Injective, a Layer 1 (L1) protocol, emerged as one of the standout performers in the crypto market on Thursday, with its native token INJ experiencing a substantial 7% surge within the past 24 hours.

Accompanying this surge, the protocol’s market capitalization is inching closer to the significant milestone of $3 billion. The price movement coincides with notable announcements by the Injective protocol regarding its token and ecosystem.

Injective Users To Burn 6 Million INJ

One of the key announcements unveiled by the protocol is the release of a comprehensive paper on the Injective Token, INJ. The paper delves into the token’s core utilities and mechanisms that power a programmable token economy, specifically focusing on deflationary acceleration.

Related Reading

Additionally, Injective disclosed that INJ token burn auctions are “steadily increasing in size,” with 12,266 tokens being burned indefinitely on the announcement day. Injective users are set to burn a cumulative total of 6 million INJ by next week.

This burning mechanism plays a key role in reducing the total supply of tokens in circulation, thereby increasing scarcity and potentially driving up the value of the remaining tokens. Ultimately, this benefits token holders by establishing a deflationary mechanism and controlling inflation within the protocol.

Injera And USDi Launch

Injective also revealed that the anticipated launch of the Injera protocol is scheduled for the end of June, marking the beginning of “a new era for Injective,” according to the protocol.

As announced, in collaboration with DojoSwap, a decentralized exchange (DEX) on Injective, the community will build Injera and USDi, the Injective Synthetic Dollar aimed at powering the Web3 ecosystem. The objective is to create a decentralized synthetic dollar token fully backed by Injective’s finance infrastructure.

The Injera money market is at the core of the Injera protocol and USDi, designed as a collaterized debt position (CDP) market. This market optimizes capital efficiency for the USDi synthetic dollar by enabling sensible leveraging of USDi to borrow “market-making assets.”

USDi, the native synthetic dollar, will be governed by the Injera token (ERA). It is a stable synthetic USD generated through delta-neutral positions, ensuring stable yields ranging from 10% to 90% for USDi holders.

For DojoSwap, this development ensures a continuous increase in TVL and trading volume, generating fee amounts for ecosystem participants.

Bullish Sentiment Returns

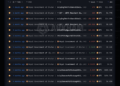

As these announcements were made, the INJ token successfully reclaimed the $28.68 price level, reigniting its bullish momentum after experiencing a price correction to the $20 mark in April.

This correction occurred following the token’s remarkable achievement of reaching a new all-time high (ATH) of $52 in March.

Related Reading

In the immediate term, the $29 level may act as a hurdle for the token, representing a significant resistance point that has persisted for the past two months.

However, if the bullish momentum continues, the token could surpass this resistance and retest the $31 and $35 resistance levels on the INJ/USD daily chart.

Ultimately, the ongoing advancements within the Injective ecosystem have generated anticipation regarding the token’s future trajectory. Market participants are keen to see whether these developments can fuel a sustained upward trend and potentially surpass the previously achieved record levels.

Featured image from DALL-E, chart from TradingView.com

Credit: Source link