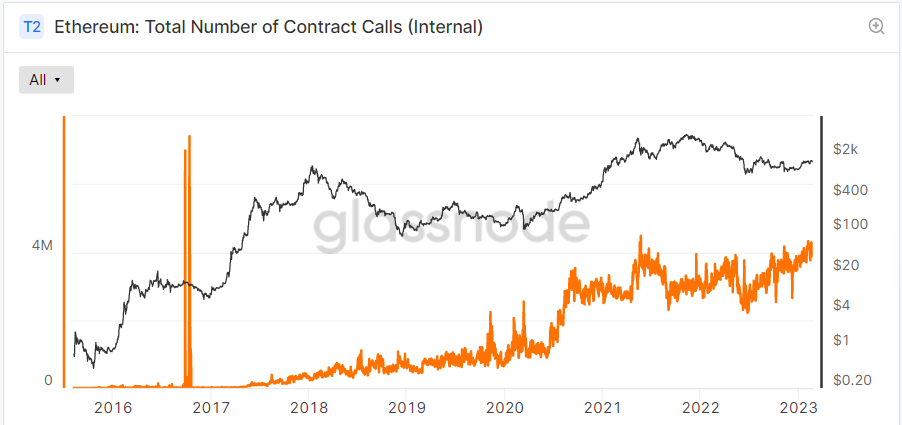

Smart-contract activity on the Ethereum blockchain remains relatively healthy, despite 2022’s ferocious bear market that has seen Ether (ETH), last in the low $1,600s, pull over 65% lower versus its November 2021 record highs in the $4,800s. According to a graphic presented by crypto data analytics firm Glassnode, so-called internal contract calls have remained close to their record highs in recent quarters at close to 4.0 million.

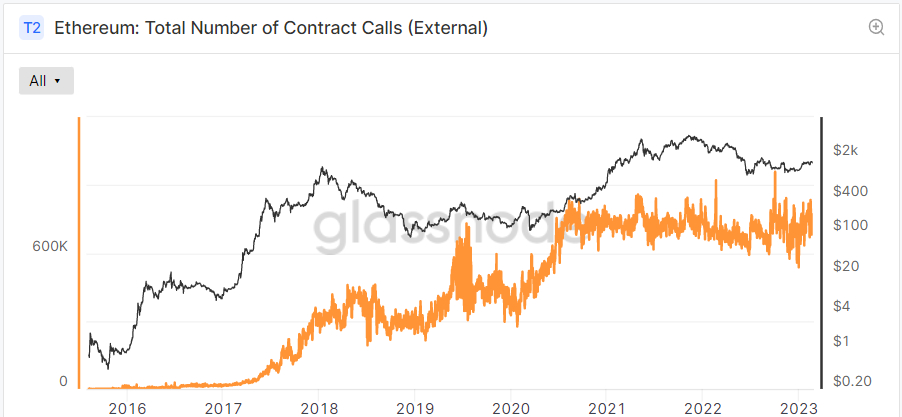

External contract calls have also remained close to or at record highs in recent quarters of between 600,000 to 800,000 per day. Glassnode explains that Ethereum transactions can include calls for the execution of a smart contract that has been deployed on the blockchain. “When a contract is initiated by an Externally Owned Addresses (EOAs), it is referred to as an External Contract Call… these typically reflect users initiating a specific smart contract, such as an ERC-20 token transfer, a DeFi transaction, or an NFT trade,” Glassnode states.

Regarding internal contract calls, Glassnode explains that “developers of smart contracts can also include contract calls which are initiated from within the executed smart contract… these are called Internal Contract Calls and enable more complex and composable systems to be built and designed by developers”.

NFT, ERC-20 and Stablecoin Activity Remains Robust

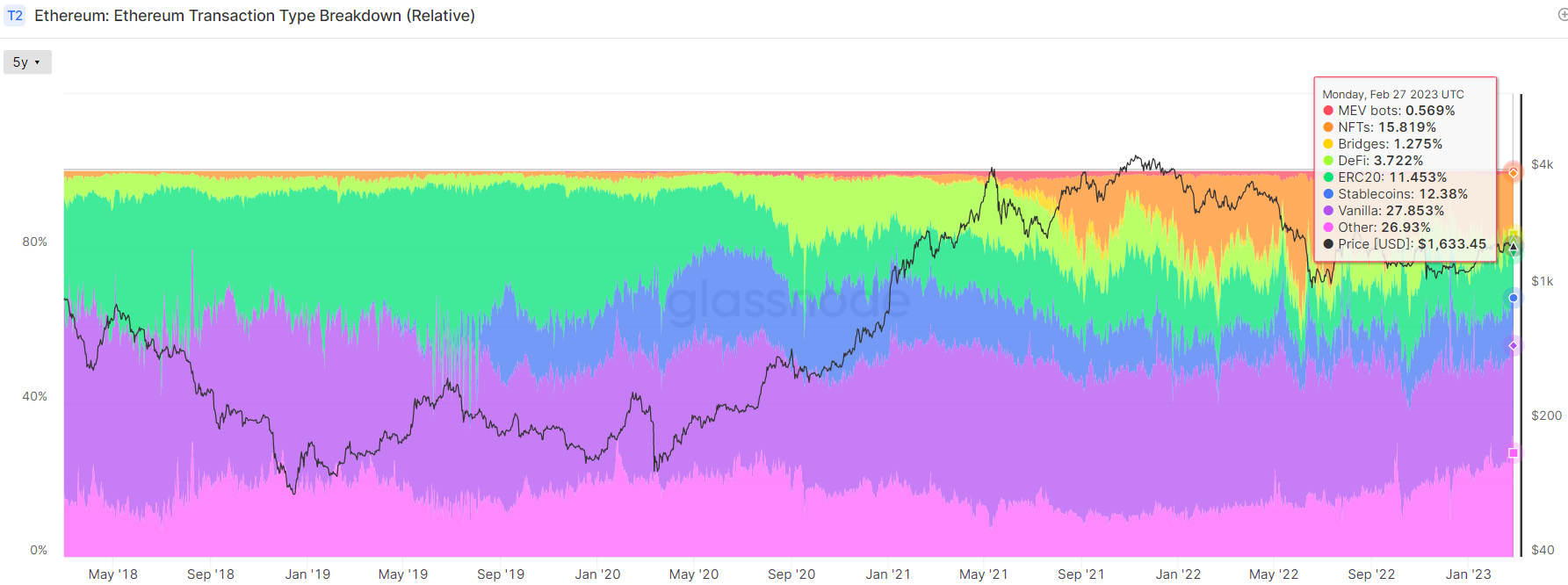

The ongoing strength of smart-contract activity taking place on the Ethereum blockchain is largely as a result of robust activity amongst the non-fungible token (NFT), ERC-20 and stablecoin transaction types. According to a separate graphic presented by Glassnode, NFT trades made up just under 16% of all transactions taking place on Ethereum on Monday the 27th of February.

ERC-20 token transfers – think the movement of tokens like Shiba Inu (SHIB) – made up just over 11% of all Ethereum transactions, while Stablecoin transactions made up a little less than 10%. So-called vanilla transactions (ETH transfers) came in at 28.5% and “other” came in at 31.5%. That compares to this time two years ago when NFTs only made up around 1.7% of transactions, while stablecoins and ERC-20 tokens made up around 16% and 12%.

One of the big areas of weakness versus this time two years ago is activity in Decentralized Finance (DeFi) related transactions. In early March 2021, DeFi transactions made up around 12% of all Ethereum transactions. As of late February 2023, they make up only around 4%.

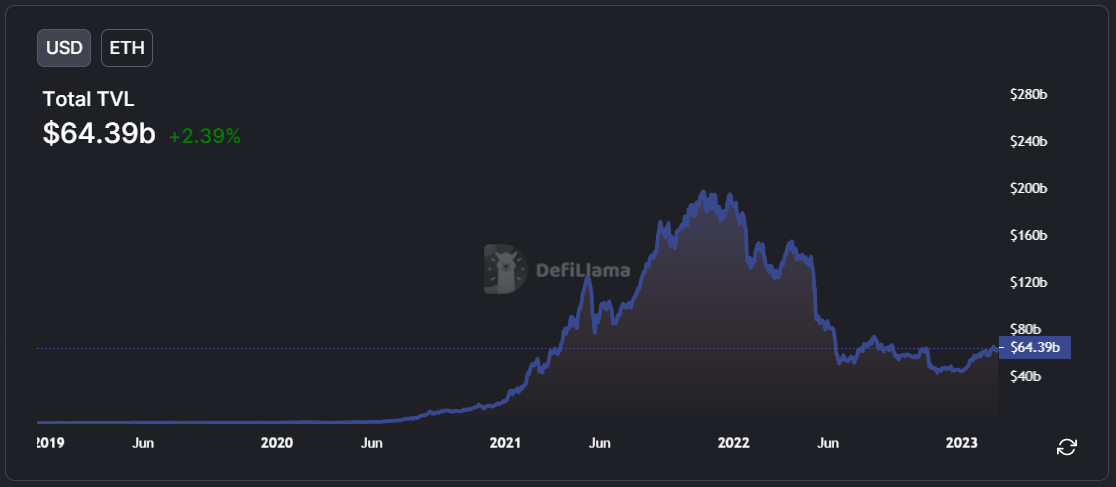

But DeFi Activity Has Taken A Big Blow

That decline isn’t so surprising in the context of the huge decline in the Ethereum DeFi ecosystem’s total value locked (TVL) in smart contracts. According to DeFi Llama, Ethereum TVL was last around $64.4 billion, down over 65% from its late 2021 record highs of above $197 billion. A huge chunk of that decline happened in tandem with the collapse of the Terra DeFi ecosystem when Terra’s UST algorithmic stablecoin collapsed, delivering a significant blow to confidence in the sector.

Less money in DeFi contracts unsurprisingly means less DeFi transactions taking place on the Ethereum blockchain.

A DeFi Resurgence Can Power the ETH Price Higher

Looking at the above-presented Glassnode graphic of ETH transaction types, one thing quickly becomes clear. The number of DeFi transactions clearly has a positive correlation to the ETH price. The so-called DeFi summer of 2020 coincided with the initial stages of a long-lasting ETH bull market, that only really ended in 2022 when DeFi activity as a proportion of total ETH transactions started to see a lasting decline.

It doesn’t take too much of a jump to conclude that, if Ethereum’s DeFi ecosystem can experience another resurgence akin to that seen during the summer of 2020, then this could help power the next ETH rally.

ETH Staking Can Power the Next DeFi Summer

Luckily for the ETH bulls, a new catalyst to trigger the next DeFi summer is fast approaching. Ethereum developers are expected to implement the so-called “Shanghai” upgrade on the mainnet within the month. And this upgrade will allow those who have staked their ETH tokens to withdraw their ETH principal and earnings for the first time.

ETH staking has been available since late 2020, but stakers have previously not been able to withdraw their tokens. The lack of staking flexibility has acted as a deterrent for ETH investors. As of the end of February, only 17.3 million ETH is staked, amounting to only around 14% of the total supply. Many other comparable layer-1 blockchains that use a proof-of-stake consensus mechanism but have flexible staking have staking participation rates in the 60-70% range.

There is clearly room for a big jump in the ratio of staked ETH to total ETH and decentralized liquid staking protocols like Lido and Rocket Pool could be big beneficiaries. Liquid staking is already the largest Ethereum DeFi sector by TVL (Lido, Coinbase Wrapped Staked ETH and Rocket Pool have a combined TVL of $12.76 billion) and looks set to continue its expansion.

This could help to power growth in other DeFi spheres as staked ETH investors look to get further yield on their staked ETH tokens. And rising DeFi TVL within the Ethereum ecosystem could help drive narratives about the blockchain’s broader adoption and significant medium to long-term price gains.

Credit: Source link