Bitcoin miners are still not selling new BTC, according to on-chain data from Glassnode, a crypto analytics company. Since the past few days, the miner net position change has remained positive, showing that miners are HOLDing their coins, despite the fact that more mining machines recently went online on the BTC network.

Bitcoin Hash rate ATH

About a week ago, Crypto News Australia reported an increase in Bitcoin mining hash rate at 165.992 million Tera Hash per second (TH/s), which is the highest point. This simply means that more mining machines are currently active on the Bitcoin network to mine the cryptocurrency. Most of these miners, however, prefer HODLing their rewards than depositing to exchanges for selling, as seen in the BTC miner net position change.

There’s also an uptick in BTC miner unspent supply, which covers new Bitcoin that hasn’t been moved from the original mining addresses, confirming that miners are becoming strong hands.

The increasing price of Bitcoin could be one factor why miners prefer to HODL their rewards at this time. Miners reasonably need to sell some of their Bitcoin profits to cover the expenses incurred during operation, such as electricity bills. By not selling BTC, it seems to convey how confident and bullish they are on the cryptocurrency.

A Bullish Sign for BTC Market?

Noteworthily, miners are the gateway for new Bitcoin to enter the market. As they continue to stack more coins, the cryptocurrency might become more scarce, yet still in high demand. This is quite a healthy and bullish indicator for the Bitcoin market in the long-term, as scarcity often drives up the market value of an asset with huge demand.

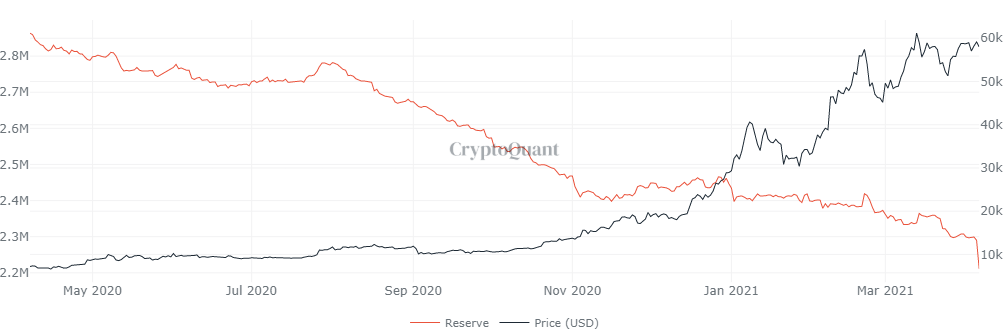

Bitcoin is already becoming scarce as many investors are continually moving out their coins from exchange for HODLing. Data from CryptoQuant shows that there is less than 2.3 million BTC in all exchanges.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link