Goldman Sachs Group Inc (GS), a multinational US$136 billion investment bank, has released a note to its investors saying that a US$100,000 price tag for Bitcoin in 2022 is possible if it continues to erode gold’s utility as a store of value.

Goldman Sachs and Bitcoin

Even though GS isn’t bullish on Bitcoin per se, Wall Street bankers inevitably follow the money, as reflected in the investment bank’s recent actions.

In June last year, it began trading Bitcoin futures, even though its investors were unsure whether Bitcoin was an investable asset. Later, an internal survey revealed that 60 percent of its wealth management clients were interested in purchasing Bitcoin.

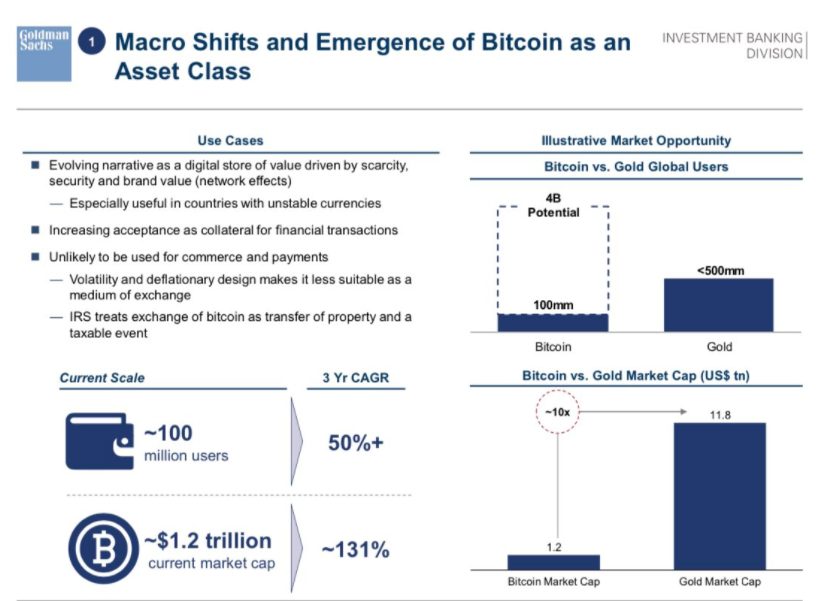

Despite the natural tension between fiat-loving bankers and Bitcoiners, GS’s recent paper was met with delight by Bitcoiners who felt that, finally, a major investment bank saw Bitcoin for the “digital store of value” that it is. The report went on to add that Bitcoin’s userbase may well increase from 100 million to 4 billion within the next five years.

Goldman Sachs and the ‘Store of Value’ Thesis

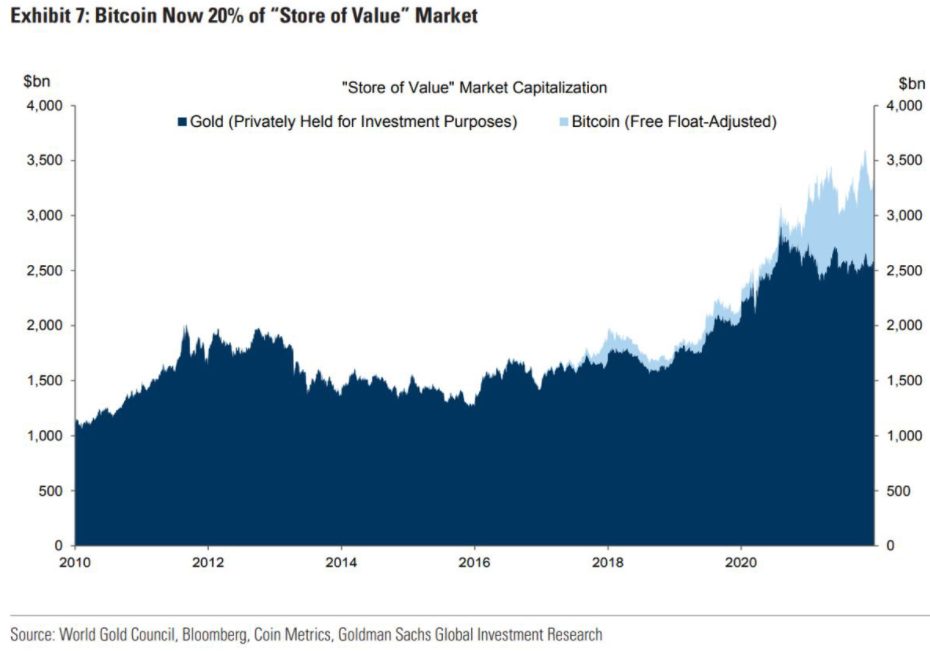

In its report, GS commented that Bitcoin would continue to take market share from gold as part of a broader adoption of digital assets. By GS’s own estimates, Bitcoin accounted for 20 percent of the “store of value” market which it said comprised Bitcoin and gold. The value of gold that’s available for investment, in their opinion, is estimated at US$2.6 trillion.

The note went on to say:

If Bitcoin’s share of the store of value market were ‘hypothetically’ to rise to 50 percent over the next five years, its price would increase to just over US$100,000, for a compound annualised return of 17 or 18 percent.

Zach Pandl, co-head of global FX and EM strategy, Goldman Sachs

While one could debate whether GS’s figures are accurate, as well as its specific understanding of Bitcoin (for example, it doesn’t appear to know about the Lightning Network), it is clear it has become something it is taking seriously.

Whereas most financial products are created at the top and distributed downwards to retail (like mortgage-backed securities), Bitcoin is a retail-inspired monetary revolution that is slowly bringing in institutional capital. Raoul Pal spoke of an impending “wall of institutional money” in 2021. Perhaps 2022 will be the year.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link