Ethereum (ETH) – the second-most valuable cryptoasset by market capitalization – has lagged behind bitcoin (BTC) in price recently. And judging from some metrics, it seems that Ethereum users are also looking elsewhere for their on-chain activities.

Over the past 30 days, the price of Ethereum’s native ETH token has risen 6% to USD 3,457 at 13:19 UTC.

The monthly gain compares to a stronger 30-day rise of 27% for BTC, which has brought the price of the number one cryptocurrency above USD 57,000, and within a relatively short distance (it’s still down by 11%) of its all-time high of just over USD 64,000.

ETH, meanwhile, is still down around 21% from its all-time high of over USD 4,300, reached in May, with significant technical resistance around the USD 4,000 mark still standing in the way.

However, ETH still outperforms BTC on a larger time frame as it’s up by more than 800% in a year, while bitcoin jumped by “only” 400%.

ETH price chart:

In either case, the relatively lower prices for ETH this month follow a warning last month from Nikolaos Panigirtzoglou, a global market strategist at investment bank JP Morgan, who said in September that ETH’s “fair value,” in his view, is only around USD 1,500 based on network fundamentals.

“We look at the hashrate and the number of unique addresses to try to understand the value for ethereum. We’re struggling to go above USD 1,500,” Panigirtzoglou was quoted by Insider as saying at the time.

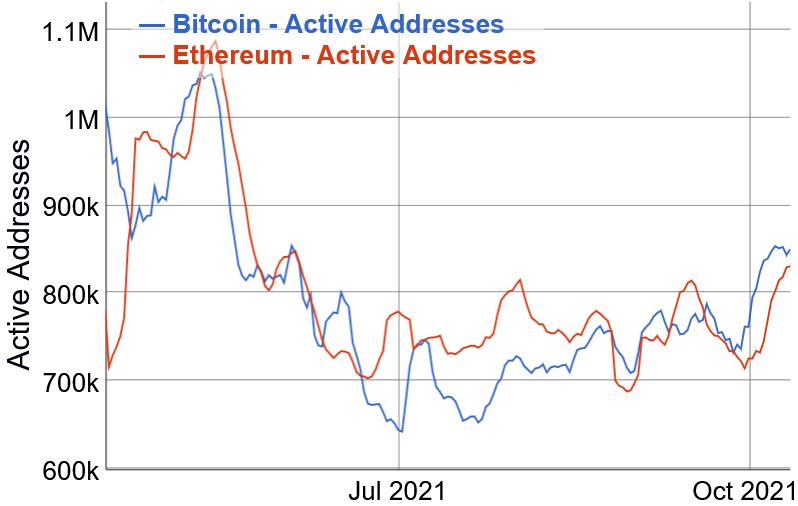

And while the price has been lagging bitcoin recently, usage of the Ethereum network also seems to have gone down. According to data from BitInfoCharts, the number of active addresses on Ethereum has dropped from more than 1.05m addresses during the market peak in May this year, to a little over 800,000 addresses as of today. Although a similar drop in activity can also be seen on the Bitcoin network, Bitcoin has seen a stronger rise since July than Ethereum.

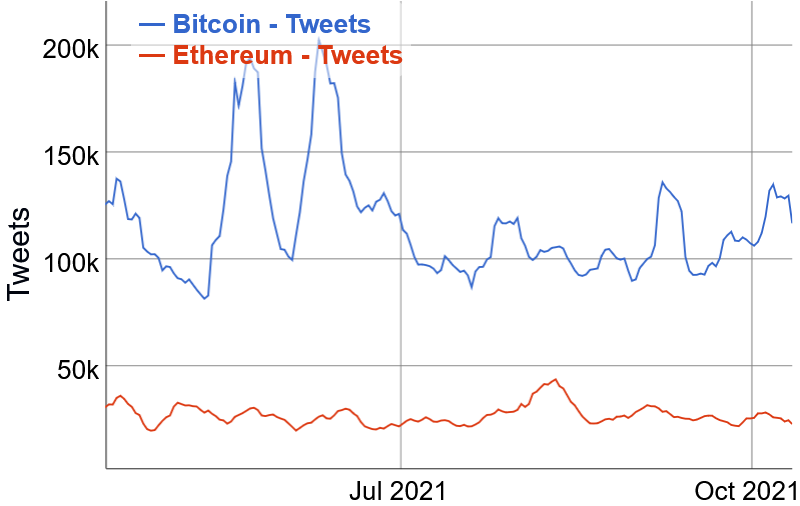

Meanwhile, the network’s “buzz” factor in social media also appears to be weakening. Looking at the number of tweets mentioning Ethereum that are published each day, data from BitInfoCharts shows that we are close to the lowest levels from the past 6 months.

Comparing this to bitcoin, a difference becomes evident over the past few weeks in particular, with the number of tweets mentioning bitcoin rising so far in October, while ethereum mentions have fallen.

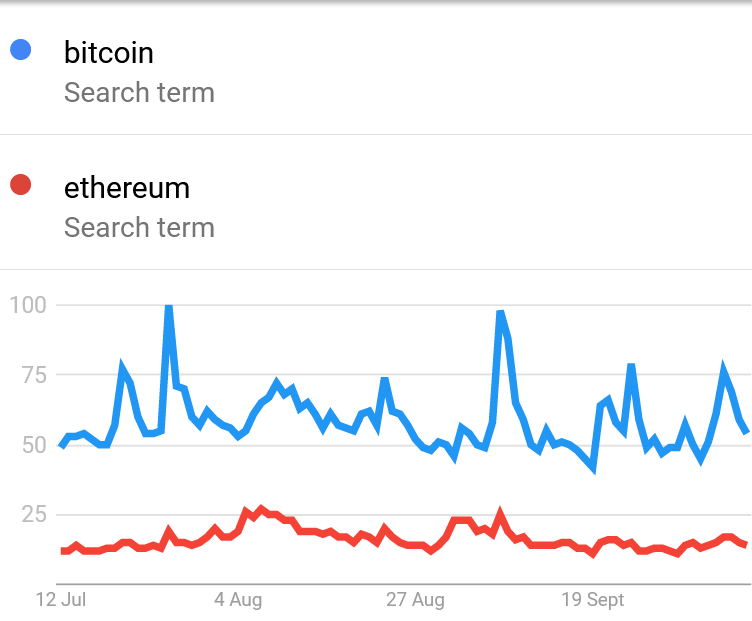

Meanwhile, the interest on Google is also seemingly trending down:

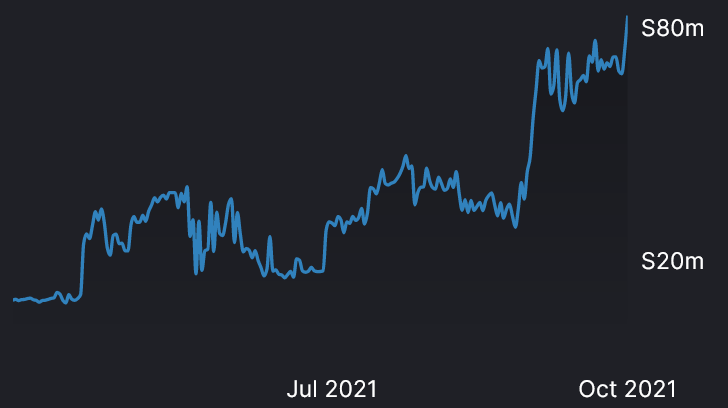

Another important metric for a smart contract platform like Ethereum, is the total value locked (TVL) on the platform. In US terms, since July, TVL jumped by more than 60%, meanwhile, in ETH terms – by only 5%.

Meanwhile, the major investors-backed, competing blockchain network, Solana (SOL), for instance, has seen an exponential rise in value locked on this platform since the summer, rising from just USD 631m on July 1 to USD 11.45bn as of today. In SOL terms, since July, TVL increased by almost 340%.

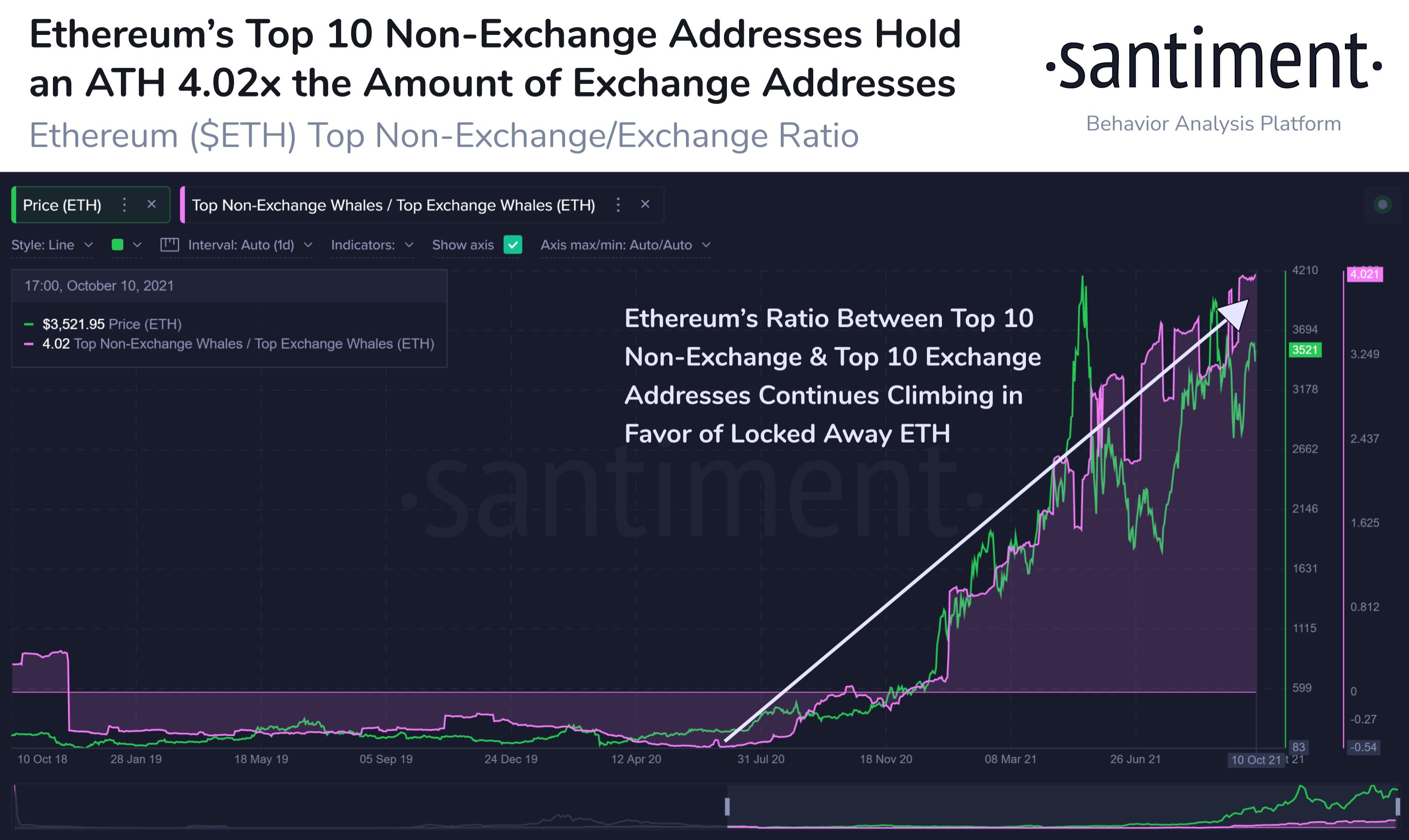

However, from a price perspective though, some signs also point in a positive direction for ETH, with for instance on-chain researcher Santiment saying today that ETH continues to move from exchanges to “non-exchange” addresses.

“The ratio between the two has shown evidence of being tied closely to price, and this rise in ratio continues to be a good sign for bulls,” the analytics firm said, sharing a screenshot that shows how tokens are moving to “non-exchange whales.”

Meanwhile, as reported yesterday, digital asset investment products saw inflows totaling USD 226m, bringing the 8 week run of inflows to USD 638m, per CoinShares data. Investments in BTC hit USD 255m, compared with USD 69m a week earlier, while ETH saw outflows totaling almost USD 14m, compared with USD 20m inflows a week earlier. At the same time, SOL saw USD 12.5m worth of inflows.

___

Learn more:

– Investments In Bitcoin Rotate From Ethereum Again as BTC Flirts With USD 50K

– Multi-Chain Future Brings Multiple Competitors to Bitcoin & Ethereum – Analysts

– Binance to Pump USD 1B Into Its Chain, Aims for Billion Users

– Ethereum, Solana, Polygon & Co Form A New Hot Market Of Blockchains

– Solana Full Service Expected Soon, SOL Recovering

Credit: Source link