Ethereum (ETH), the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain and the second most valuable cryptocurrency in the world by market capitalization, is in consolidation mode ahead of what has been touted as one of the most important Fed policy announcements in years.

Ether was last changing hands just above $1,800, having seen a decent bounce from earlier weekly lows in the $1,720s on Tuesday.

The cryptocurrency was last up around 6% in the last seven days.

Price Prediction – How the Fed’s Balancing Act Could Impact Ethereum (ETH)

The US central bank is expected to lift interest rates by another 25 bps, taking the federal funds target range to 4.75-5.0%.

However, following the collapse of a series of regional US banks earlier this month and amid signs that contagion continues to threaten dozens more, the bank is expected to soften its tone on the outlook for further tightening.

However, the Fed faces a balancing act, as, with US inflation still well above their 2.0% target, they won’t want to allow financial conditions to ease too much.

Ether could easily drop to fresh weekly lows under $1,700 if the Fed’s message is interpreted as more hawkish than markets had been expecting (i.e. they play down financial stability risks and emphasize the inflation fight isn’t over).

But should this create further troubles for struggling banks, that could come to crypto’s aid once again, as investors move funds to assets deemed as “hedges” to weakness in the traditional financial sector (i.e. gold and blue chip cryptos like Bitcoin and Ether).

Alternatively, if the Fed comes across as more dovish than markets had been expected, that could trigger broad risk-on, which would likely lift Ether.

ETH/USD bulls would be eyeing a test of last August’s pre-“Merge” highs in the $2,030s, a further 12% rally from current levels.

How High Can Ether (ETH) Go in 2023?

The emergence of troubles in the US (and global) banking sectors seems to have marked a key shift in the macro narratives driving traditional asset classes and cryptocurrencies that could have a big impact on Ether’s outlook for 2023.

Firstly, if current money market pricing is to be believed, a dovish pivot from the Fed now looks to be just around the corner.

That means the outlook is tilted towards much easier rather than tighter financial conditions for the remainder of 2023, which has historically been bullish for cryptocurrencies like ETH.

Crypto, led by Bitcoin, also appears to be benefitting from safe-haven flows, with investors seemingly finally starting to view blue-chip cryptos as a viable alternative to the mainstream, fiat-based financial system.

If contagion in the US banking space continues to spread, that will likely benefit Ether rather than hamper it.

ETH/USD strong recent bounce from its 200-Day Moving Average and recent golden cross (ETH’s 50DMA moved above its 200DMA in early February) are both long-term bullish technical signals.

The pair could well continue to grind higher in the weeks and months ahead, with a push into the upper/mid-$2,000s per token a distinct possibility.

ETH Supply Deflation Could Make Up for Weak On-chain Activity

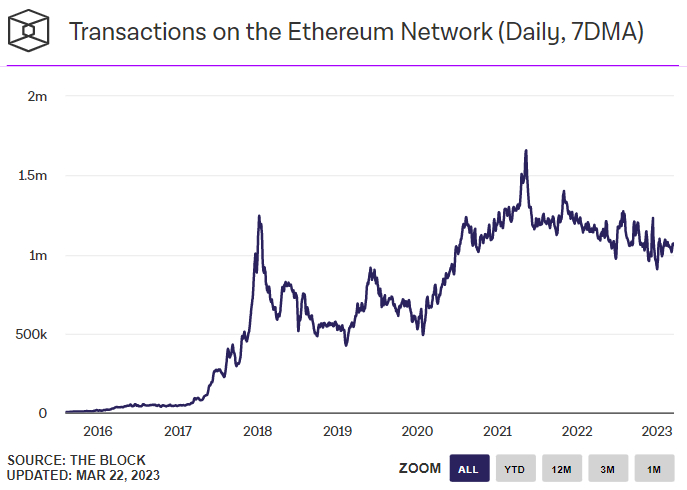

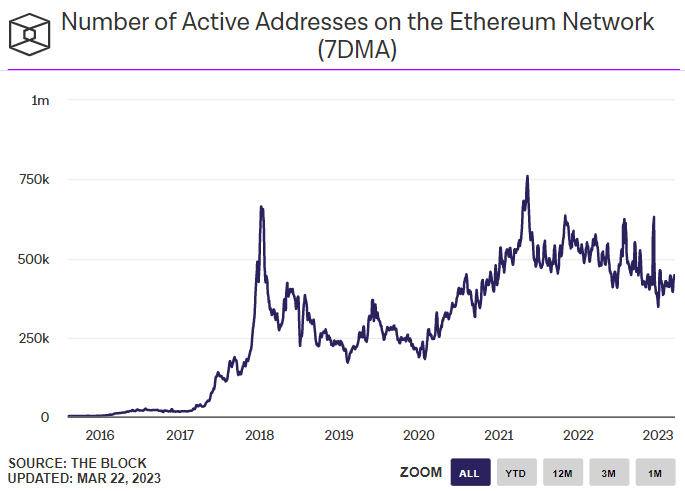

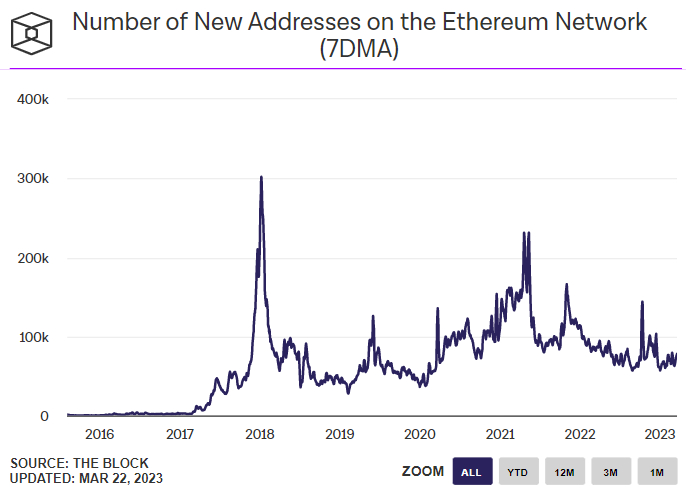

Activity on the Ethereum blockchain, as per on-chain data presented by The Block, is yet to show the kind of pickup that has historically been needed for an ETH bull market to really get going.

The number of daily active and new addresses and the number of daily transfers continue to languish within bear market ranges.

If Ether is to hit new all-time highs, these will likely need to see substantial improvement.

But ETH could still get a lift from its rising deflation rate, which briefly surpassed 5.0% on an annualized basis a few weeks ago (though it was last around 0.6%).

The upcoming “Shapella” upgrade to the Ethereum network in mid-April is also being touted as a big potential bullish catalyst for ETH.

The upgrade will allow staked ETH withdrawals for the first time, with greater flexibility expected (in the long run) to attract more investors toward staking their ETH tokens.

This could reduce the circulating supply of ETH (assuming ETH stakers want to leave their tokens to accrue interest for a prolonged period of time), increasing its scarcity on exchanges and pushing prices higher.

Credit: Source link