ETH, the cryptocurrency that holds the second-largest market cap, has remained steady by finding support at $1,500. Despite this, experts predict that a rebound is unlikely before the upcoming Shanghai hard fork.

At present, the price of Ethereum is hovering around $1,555, having experienced a decrease of 1% in the last 24 hours.

Investors who locked their ETH in the Beacon Chain smart contract to help the network transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus algorithm are expected to withdraw the tokens when the Shanghai hard fork comes in early April.

Analysts appear conflicted over the impact of the much-awaited upgrade with some saying it would send Ethereum price above $2,000 while others foresee a further drop in price as stakers gain access to their ETH locked in the smart contract and start to sell.

Ethereum Price Wobbles Above $1,500 as Recession Fears Mount

The cryptocurrency market has remained in a precarious position for several weeks, even as Federal Reserve Chair Jerome Powell testified before the Senate Banking Committee on Tuesday.

Powell did not mince his words when he said that interest rates were most likely to rise and by a larger margin than expected by market watchers, citing extremely unfavorable economic data since the previous review in early February.

The crypto market is expected to feel the pinch, with bearish forces likely to be in control, as investors choose fixed-income products and the strengthening US dollar over other assets. Powell’s remarks have been interpreted as a warning of a recession beckoning – if it is not already here.

Ethereum’s price and the crypto market must also brave the tough stance from US regulatory agencies, which have vowed to increase oversight of the industry following the sudden collapse of FTX exchange in November.

US-based crypto firms are feeling the pressure – made worse by the recent revelation that crypto-friendly bank, Silvergate is evaluating its ability to stay in business.

Dissecting the Ethereum Price Short-Term Technical Outlook

In addition to the Ethereum price staying stable above $1,500, ETH holds onto support provided by the 200-day Exponential Moving Average (EMA) at $1,546 on the daily chart.

The price of ETH is facing challenges due to low liquidity and strong selling pressure at $1,569, which is reinforced by an upward trendline. The market is currently controlled by sellers, and it remains to be seen when this changes.

Ethereum’s price could drop further before a trend reversal ensues. Traders looking forward to booking long positions in ETH may want to wait until ETH consolidates at support and prepares for a leg up.

Furthermore, the MACD’s recent slide beneath the mean line at 0.00 hints at bears having the upper hand. In that case, support at the 200-day EMA must be protected at all costs. Otherwise, we could see Ethereum’s price dropping to $1,400.

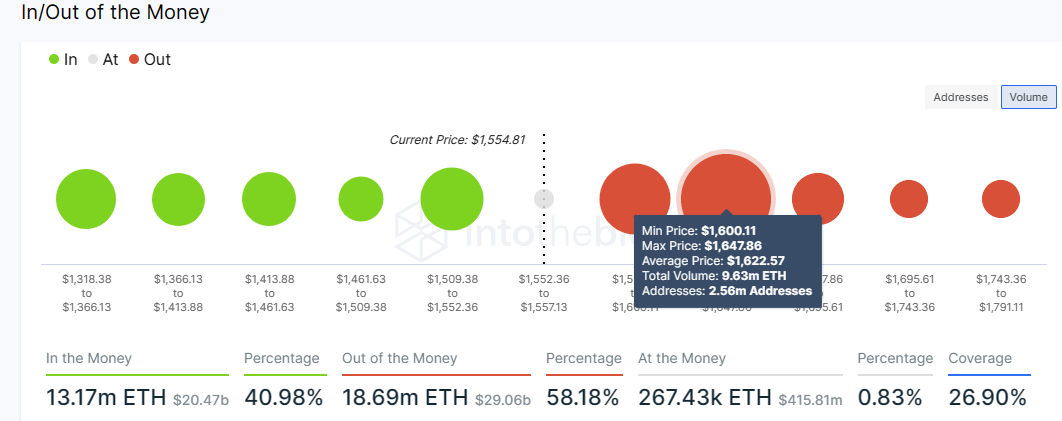

As per blockchain data presented by IntoTheBlock, around 18.69 million ETH addresses are currently at a loss.

Retail investors may opt to sell their crypto assets and instead go for better-performing assets, even if it means taking a loss.

Addresses in the money with unrealized profits are represented by small green circles on the chart, and if selling pressure increases, Ethereum price may fall to retest downstream levels at $1,400 and $1,338, respectively.

The large circle between $1,600 and $1,647 is where sellers are most concentrated and where bulls may face resistance as they push for an uptrend. If this area is overcome, ETH price could quickly rally up to $1,800 and $2,000.

Buy Ethereum Now

Related Articles:

Credit: Source link