Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is trading just below the $2,500 mark, struggling to reclaim higher ground as bearish momentum picks up across the broader crypto market. After repeated failed attempts to break past resistance, ETH now sits under heavy selling pressure, raising concerns about a deeper correction. Bulls appear to be losing control as overall market sentiment weakens amid global economic uncertainty and the persistent weight of rising US Treasury yields. Some market participants are now bracing for a significant downturn if Ethereum fails to hold above key demand zones.

Related Reading

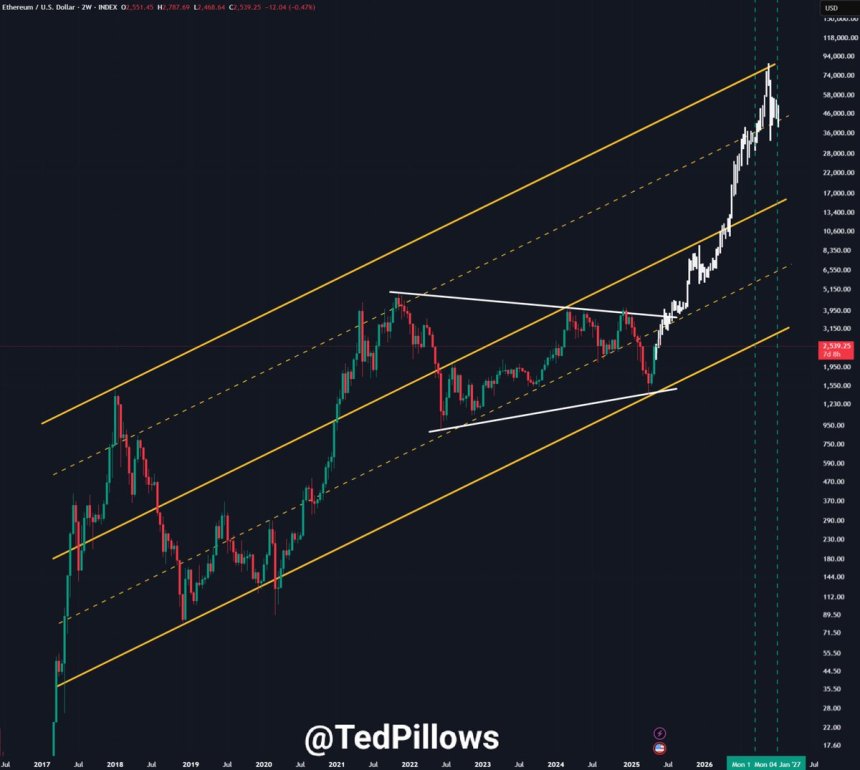

However, not everyone is turning bearish. Some prominent analysts maintain a highly bullish long-term view, arguing that Ethereum still has significant upside this cycle. According to Ted Pillows, Ethereum could reach $10,000 before the cycle ends. From his perspective, current price action represents a temporary dip rather than a trend reversal, and accumulating during weakness is the smarter move for long-term investors.

While short-term uncertainty dominates headlines, long-term conviction remains strong among Ethereum supporters who point to rising institutional interest, declining exchange supply, and the overall maturing of the Ethereum ecosystem as reasons to stay optimistic. For now, ETH’s position just under $2,500 sets the stage for a critical test in the days ahead.

Ethereum Analysts Eye Breakout Potential

Ethereum is currently testing a crucial support level at $2,500 after repeatedly reaching the $2,700 resistance over the past few weeks. This zone has proven difficult to break, but bulls are still holding the line. If ETH manages to reclaim the upper range and close above it, analysts believe it could ignite the altseason the market has been waiting for.

Despite Ethereum’s underperformance over the past year, marked by a lack of sustained momentum and significant selling pressure, the recent price action suggests a shift. Over the past few weeks, ETH has entered a more bullish phase, supported by increasing on-chain activity and stronger demand.

Some analysts remain firmly bullish. Ted Pillows, for example, has projected that Ethereum is headed above $10,000 this cycle. While short-term volatility may cause concern, long-term conviction remains strong. For many investors, the message is clear: embrace the dips, accumulate strategically, and avoid panic selling.

Technical sentiment across the board is turning cautiously optimistic. Market watchers point to Ethereum’s resilience at the $2,500 level as a sign of building strength. If this support holds and bulls step in with volume, the breakout above $2,700 could be swift and aggressive.

Related Reading

ETH Tests Key Support As Bulls Defend $2,500

Ethereum is currently trading around $2,488 after a 2% daily drop, showing continued weakness below the crucial $2,700 resistance zone. The chart highlights a clear consolidation range forming since early May, with ETH repeatedly failing to close above the 200-day SMA, currently around $2,680. This long-term moving average is acting as a significant barrier, preventing any breakout momentum from gaining traction.

Support remains at the lower boundary of the range near $2,470–$2,500, where buyers have consistently stepped in to absorb selling pressure. This area coincides with the 34-day EMA at $2,386 and the 100-day SMA just below current levels, forming a dense cluster of technical support.

However, volume has been declining, suggesting that neither bulls nor bears have clear control. If Ethereum loses the $2,470 level decisively, the next key area to watch lies near $2,300, where the 50-day SMA could act as a cushion.

Related Reading

Conversely, reclaiming $2,700 with strength could signal the beginning of a larger move to the upside. Until then, ETH remains stuck in a range, and traders will be watching closely for a decisive break—up or down to define Ethereum’s next major trend.

Featured image from Dall-E, chart from TradingView

Credit: Source link