Ethereum (ETH) has seen more growth in market value than Bitcoin (BTC) over the past month.

Recent market data confirmed that Ether’s monthly return for April surpassed that of Bitcoin by almost 50 percent. On a year-to-date (YTD) chart, Ethereum has gained over 350 percent in market value. Below we take a look at the reasons why ETH has performed so well in the past month or so.

This might not be a surprise following the increasing demand for ETH, which pushed the coin to a new all-time high above $3,000 USD.

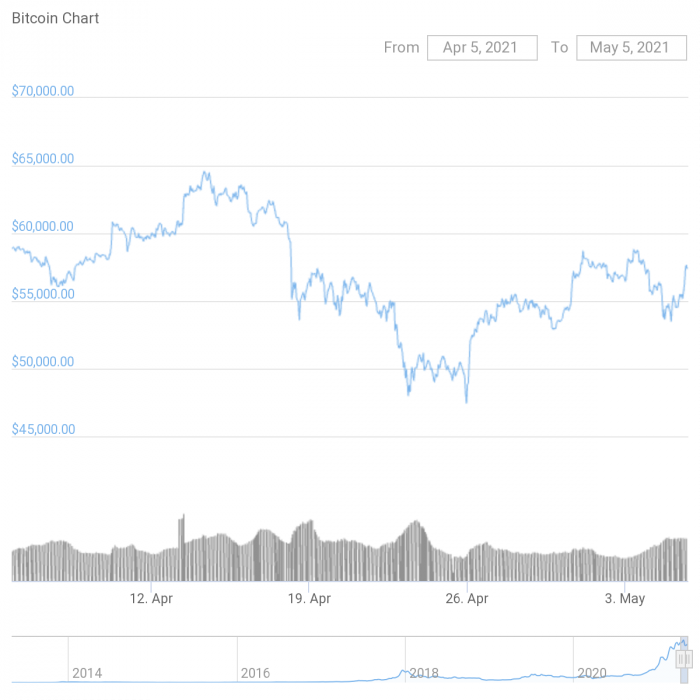

Although some cryptocurrencies including Ethereum soared in April, the past month was obviously not that favourable for Bitcoin (BTC). For the first time since 2021, Bitcoin posted a negative return of -2.7 percent. BTC declined from $58,889 USD on April 1 to $57,261 on May 1.

Notably, the price suddenly dropped to about $55,000 USD on April 18, and even further to $49,754 USD on April 23rd, as per data from Coingecko. Since the drop, BTC has struggled to return back to $60,000 USD level.

What’s Behind ETH’s Rise?

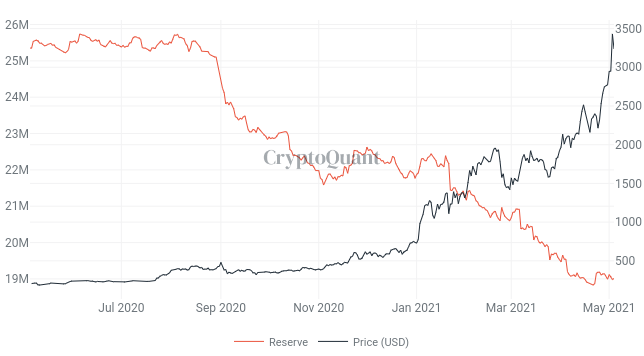

One possible reason for the growing price of Ethereum is the fact that the cryptocurrency is becoming more scarce. More ETH are being staked on the Ethereum 2.0 deposit contract than mined.

Currently, over 4.14 million ETH has been staked, according to the network explorer beaconcha.in. This represents more than 3.5 percent of the current circulating supply of ETH.

CryptoQuant, a crypto on-chain analytics platform, also confirms the scarcity of ETH. At the moment, there is less than 20 million ETH available on all crypto exchanges. ETH exchange reserve has been declining since Q3 2020, as the price of the coin began increasing.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link