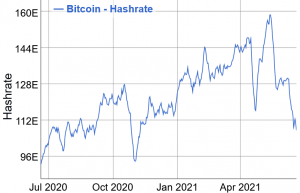

Bitcoin (BTC) saw a double-digit drop in its hashrate (the computational power of the network) in a single day following the recent regulatory crackdown in a vital mining region in China, as well as from its June peak. However, Ethereum (ETH) and several other proof-of-work (PoW) projects shared similar faiths.

As reported, Xinjiang ordered several crypto mining farms to shut down on June 9, but miners were still left with the super popular Sichuan province, especially as many of them migrate to the area during the rainy season anyway. Now, as reported, that region is ‘hit’ as well. And this immediately got reflected in Bitcoin’s average hashrate, which fell 19% between June 18 and June 20.

Looking at the 7-day simple moving average values, the hashrate fell over 4% in the same time period. However, from this month’s high, seen on June 7, it dropped almost 18%. Additionally, comparing to the network’s all-time high recorded on May 14, it’s down 32%.

Other PoW projects saw notable drops in their hashrates from their June peaks as well.

Ethereum experienced a smaller drop from the June high compared to Bitcoin, of 6%. Compared to its ATH from late May, its hashrate dropped almost 9%.

Litecoin (LTC) saw a double-digit drop in its hashrate from the peak this month, plummeting 13%. Its ATH, however, was reached back in July 2019.

Dogecoin (DOGE)’s hahsrate dropped more than 10% since the June peak, seen less than 10 days ago. As Litecoin’s, Dogecoin’s ATH remains in July 2019.

Bitcoin Cash (BCH) saw a big drop too: between June 1 and June 20, it fell over 27%. Its ATH was recorded back in November 2018.

Zcash (ZEC)’s hashrate fell 13% from its peak on June 1, continuing the drop from its ATH reached in early April – falling 35% since.

Ethereum Classic (ETC) fell 6% since the first week of June. But after jumping in early May, and then hitting its ATH on May 13, this hashrate has remained relatively steady since, dropping almost 10% in total.

Monero (XMR) saw the smallest hashrate drop on this list in June: less than 0.5% since June 2. But similarly to Ethereum Classic, Monero jumped at the very end of April, hit its ATH on May 11, and has remained relatively steady since, falling less than 1% in total.

“In the short-term, these conditions are naturally causing a negative market reaction, but in the long-term, they can be net-positive. As miners spread to other locations, they will likely choose places with secure access to cheap energy sources. As a result, hashrate will start recovering, and the network will become even more stable. Additionally, mining will become more decentralized and, likely, more based on clean, renewable energy sources,” Ulrik K.Lykke Executive Director at Crypto/Digital Assets fund ARK36, said in an emailed comment.

Meanwhile, amidst this crackdown, the prices of graphics cards, used to mine PoW coins (except BTC), from a number of companies, including Nvidia and Asus, fell by as much as two-thirds on e-commerce platforms, reported the South Morning Post.

___

Reactions:

The ongoing crackdown on mining in China seems to be freaking investors out. While this has a negative impact on BT… https://t.co/142LTswEzF

@DoveyWan profits are down despite the hashrate decrease. April-May we were seeing 0.31-0.36c/TH despite record has… https://t.co/9CDYg6Brtp

“China’s mining dominance is unlikely to last; I expect that this theoretical attack will become less and less like… https://t.co/BAVby9YSPE

@davidmarcus I disagree. Having mining in China meant that Bitcoin was more neutral. It is at risk of falling too m… https://t.co/nSoYGfyeyt

That lost hashrate will be up and running elsewhere in the world in no time… https://t.co/w6DvDR3TBY

___

Learn more:

– China Doubles Down On Crypto FUD By Recycling Old Warnings

– Sichuan ‘Joins Chinese Crypto Crackdown’ as US Woos Middle Kingdom Miners

– Bitcoin Miner Relocation Within China and Worst Case Scenario

Credit: Source link