Ethereum (ETH) is moving off centralized exchanges at a record rate, according to the blockchain analytics firm IntoTheBlock.

IntoTheBlock says on Twitter that $1.2 billion worth of ETH left centralized exchanges on Wednesday. The firm also notes that the last time ETH’s exchange outflows exceeded $1 billion, Ethereum’s value skyrocketed within one month.

“[The] last time $1 billion+ left CEXs (centralized exchanges), Ethereum increased by 60% within 30 days.

The second-biggest crypto by market cap is trading at $3,437.61 at time of writing, down 3.7% in the last 24 hours. However, the leading smart contract platform is up over 13% in the past 30 days, according to CoinGecko.

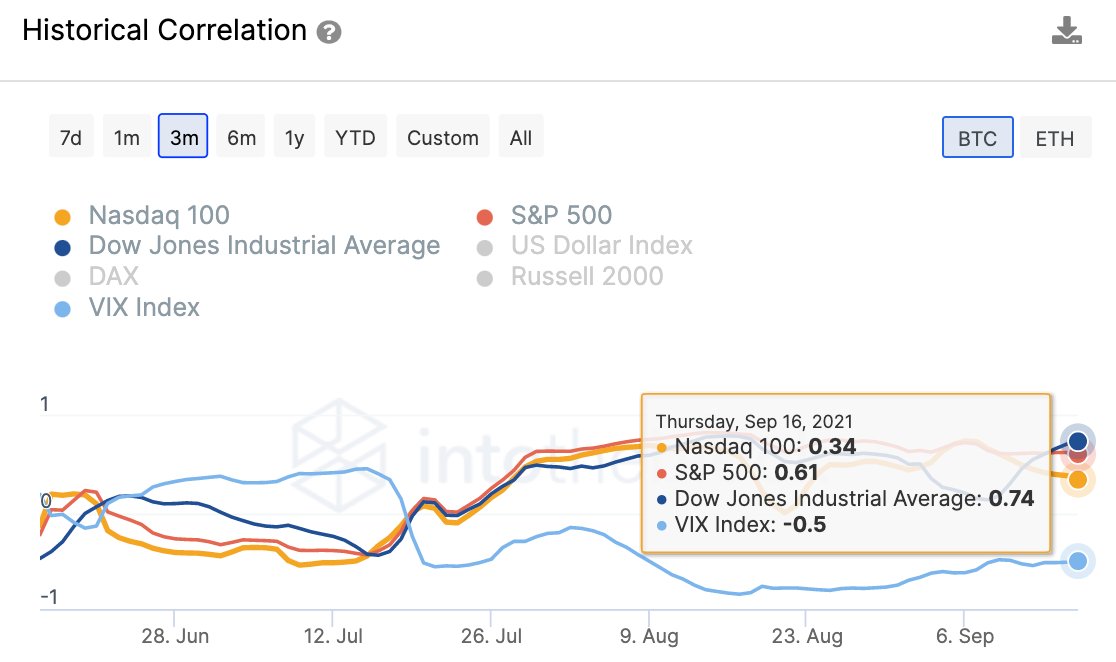

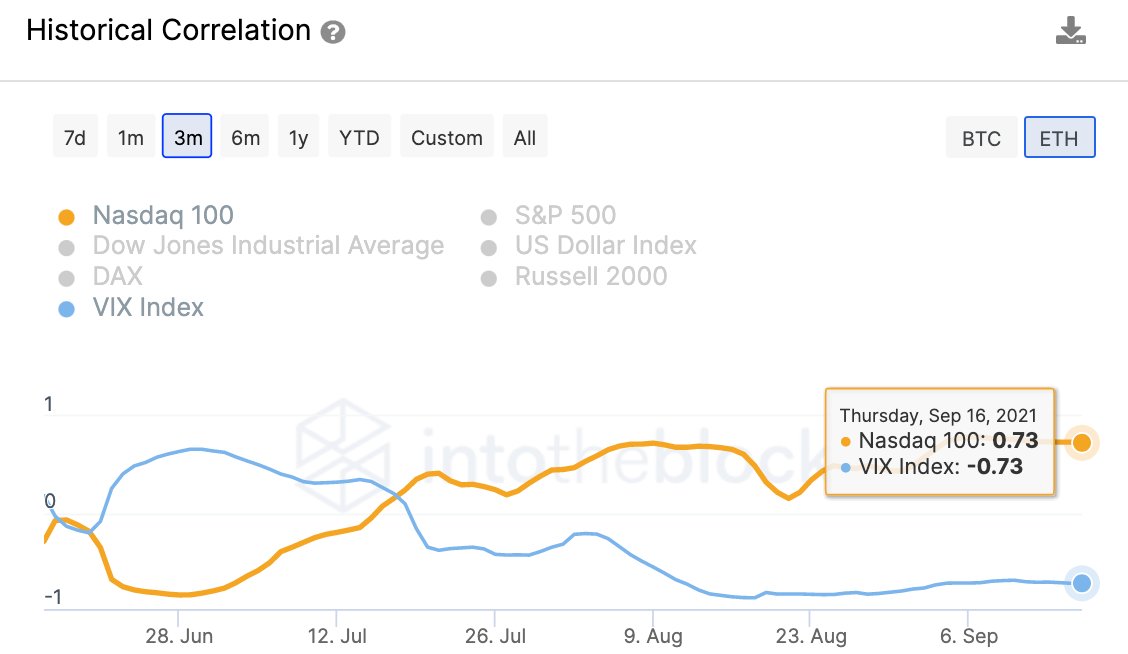

IntoTheBlock also highlights that Ethereum is demonstrating a high correlation with the Nasdaq stock market index, suggesting that ETH comes with higher risks and higher rewards.

“Ethereum appears to be priced as a risk-on bet. ETH has shown a high correlation to the Nasdaq, which tends to be linked with higher potential/risk investments.”

The blockchain analytics firm adds Bitcoin (BTC), by contrast, has a high correlation with the Dow Jones Industrial Average (DJIA) and gold. A score closer to one suggests a high correlation between two assets.

“[BTC] has moved surprisingly close to the DJIA with a correlation of 0.74 Also, worth mentioning its high 0.64 correlation to gold.”

Bitcoin is trading at $47,289.30 at time of writing and is down more than 4% in the past two weeks, though it’s up by more than 6% in the past month.

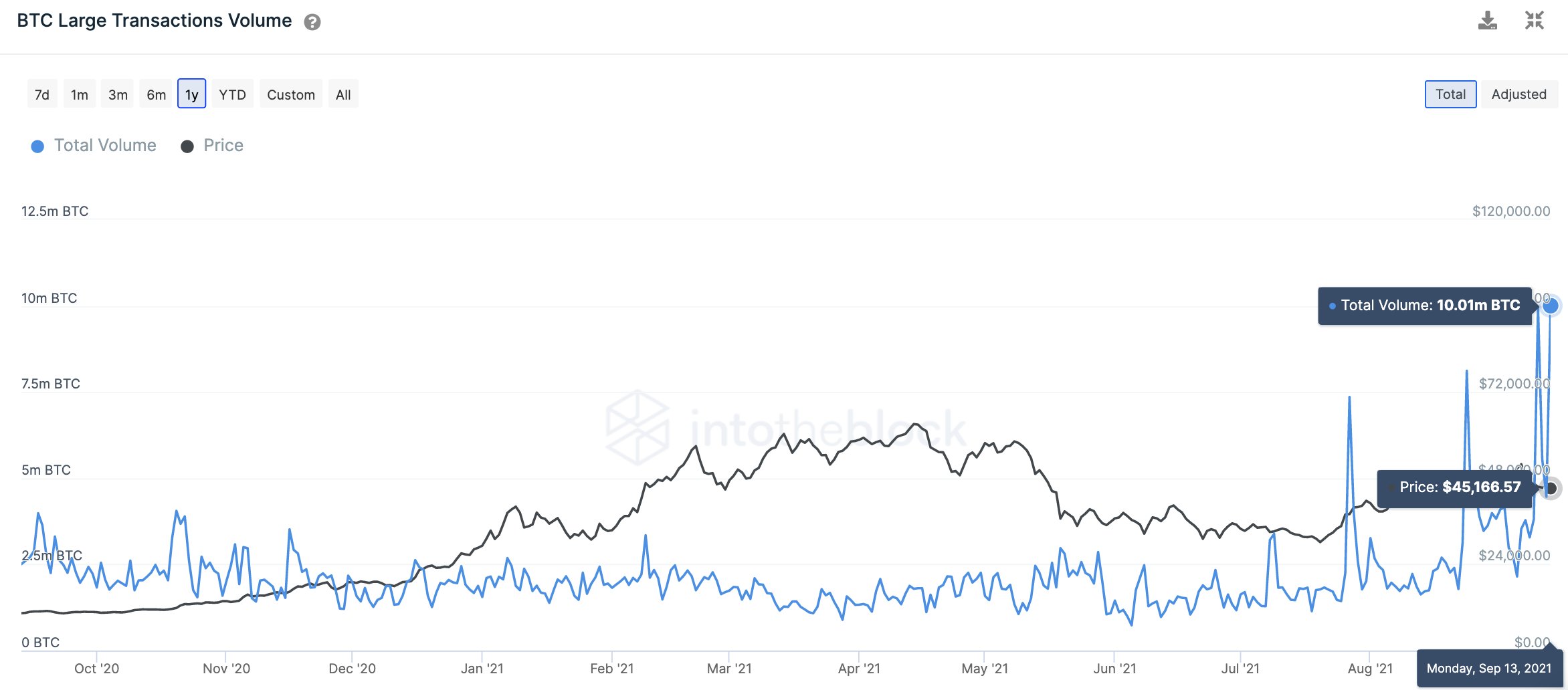

IntoTheBlock also says that the Bitcoin network has come alive after recording the largest daily BTC transaction in over 24 months, suggesting that institutional activity is on the rise.

“Large transactions on Bitcoin reached over 10 million BTC in a day for the first time in over two years.

Institutional activity appears to be in an uptrend.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/GrandeDuc

Credit: Source link