Ethereum (ETH) continues showing its potential by scaling new heights. The second-largest cryptocurrency has soared to a new all-time high of $2,159.30, as acknowledged by market analyst Holger Zschaepitz.

The previous record was $2,151.63, set on April 6. Nevertheless, a correction occurred almost immediately, and Ether plummeted to $1,930 on April 7.

Ethereum’s rally has been backed by various bullish fundamentals. For instance, late last month, payment giant Visa Inc. announced that it has settled for the Ethereum blockchain to undertake USDC transactions.

According to crypto data firm IntoTheBlock:

“As the price of ETH continues to climb up, the fundamentals behind it are getting stronger. Supply in exchanges continues to decrease (-4.6m YTD), open interest is above $6b, 10.65 million ETH locked in DeFi, and steady growth in daily active addresses.”

The decentralized finance (DeFi ) area has played a pivotal role in Ethereum’s bull run as some of its products like smart contracts are in high demand in this sector.

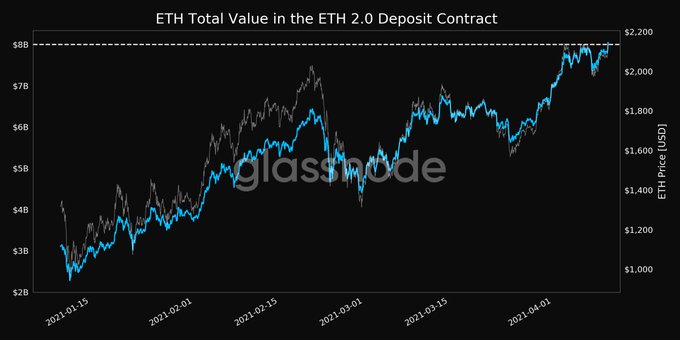

Total Value Locked in ETH 2.0 Surpasses $8 Billion

More participants are joining the Ethereum bandwagon, as alluded to by Glassnode. The on-chain metrics provider explained:

“The number of Ethereum addresses holding 0.01+ coins just reached an ATH of 13,872,315.”

Glassnode also revealed that the total value in the ETH 2.0 deposit contract surged past the $8 billion mark, which is an indication that investors are betting big.

Ethereum 2.0 went live in December 2020, and it seeks to transit the current proof-of-work consensus mechanism to a proof-of-stake framework, which is touted to be more environmental friendly and cost-effective.

The proof-of-stake algorithm allows for the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle.

Additionally, Ethereum’s transition to proof-of-stake will allow the blockchain to see upgrades, including sharding, which would improve scalability.

Image source: Shutterstock

Credit: Source link