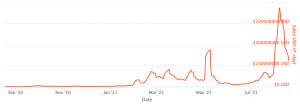

The fees required to make transactions over the Ethereum (ETH) network have surged to levels not seen since the crypto markets peaked in May this year, as a new wave of non-fungible token (NFT) trading congests the network.

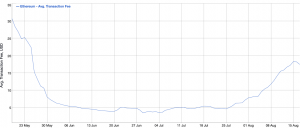

As of Tuesday this week, the average Ethereum transaction fee was at USD 17.45 (7-day simple moving average), up 123.5% from USD 7.81 at the beginning of the month. The rise brought the average fee to its highest level since May 25, when the average fee was around USD 22.

Further, Ethereum’s median transaction fee has also risen to its highest level since May 25. The median fee is up from USD 3.03 on August 1 to USD 7.17 on Tuesday this week, a 136.7% increase over the course of the month.

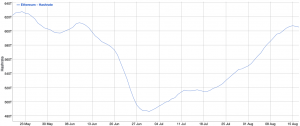

And while the transaction fees are markedly up, more hashing power has also found its way to Ethereum, with the number having reached its highest level this week since early June. The highs in hashing power come after a drop in late June, followed by a steady rise since.

The increased fees and hashing power on the Ethereum network have followed a continued rise in interest for NFT trading, driven by hot NFT collections like Pudgy Penguin and CryptoPunks.

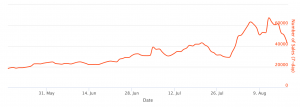

Notably, the number of weekly NFT sales recorded made a new all-time high last week, with 67,214 sales made during the week, per data from Nonfugible.com.

Similarly, the USD value of the sales also rose earlier this month, with NFTs worth some USD 375.4m changing hands at the peak in early August. Since then, however, numbers have come down, and are currently at USD 124.8m in weekly sales value.

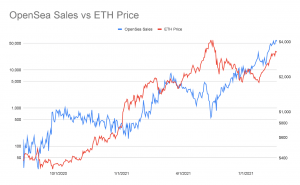

According to crypto analytics firm CoinMetrics, the increased interest in NFTs could well be a driving force behind the recent price rise for ETH, given that sales on the OpenSea platform and the ETH price appears to follow each other.

“People buy ETH to buy NFTs, sell their NFTs for more ETH, and then often reinvest that ETH back into more NFTs. High NFT sales bring new attention to ETH and help bring more users into the Ethereum ecosystem,” the firm wrote in its latest State of the Network report from Tuesday.

Meanwhile, the popular on-chain analyst and the CEO of the crypto analytics provider CryptoQuant Ki Young Ju also said today that his data suggests another run higher for the ETH price, as ETH reserves on all exchanges have reached a two-year low.

$ETH might reach its all-time high earlier than $BTC in the long term.

As of press time on Wednesday (09:28 UTC), ETH is trading at USD 3,056. It’s down 4.8% over the past 24 hours and nearly 3% over the past 7 days, after selling pressure pushed prices lower on Monday and Tuesday this week. Overall, it’s up more than 60% in a month and 611% in a year.

____

Learn more:

– Ethereum Arrives to London, Burning Begins, Price Jumps

– Ethereum’s EIP-1559 ‘Doesn’t Deliver’ As It’s ‘Not Meant to Reduce Fees’

– Ethereum Miners Can Transition to These Coins and Boost Their Values

– MEV Harms Ethereum Users And it May Be Here For Some Time

– NFT Sector Far from Dead or Even Resting, Exploding Across the Board

– Non-Fungible Penguins Are Taking Over the NFT Scene

Credit: Source link