Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum transaction costs have fallen to their lowest point in five years. The drop comes as users pull back from the network amid economic concerns, according to data from Santiment, an on-chain analytics platform.

Related Reading

Ethereum Transaction Costs Plummet To Just 17 Cents

The average fee to process a transaction on Ethereum now stands at approximately $0.168. This steep decline matches a pattern of reduced activity, with fewer people sending Ether or using smart contracts on the blockchain. Brian Quinlivan, marketing director at Santiment, explained the situation in an April 17 blog post.

Market Uncertainty Keeps Traders On Sidelines

According to Quinlivan, low network fees often appear before price rebounds. However, many traders seem to be waiting for global economic questions to clear up before they return to their normal trading patterns.

🚨💸 BREAKING: Ethereum fees are at a 5-year low, with transactions currently costing just $0.168. This is the cheapest daily cost of making $ETH transfers since May 2, 2020. We briefly break this down in our latest insight. 👇https://t.co/fg5CfRgsHn pic.twitter.com/QlLwyzdm1F

— Santiment (@santimentfeed) April 16, 2025

Hesitation continues after market worries that had started from April 2 with US President Trump announcing sweeping tariffs. Traditional markets turned out to be hit alongside cryptocurrency, where most assets languish below pre-announcement values.

Pectra Upgrade Set For Launch On May 7

Despite this market crisis, Ethereum development is on the move. Pectra is finally scheduled to go live on May 7 after some delays owing to the configuration hiccups as well as an unknown attacker causing problems during the testnet trials.

The first part of Pectra will bring numerous enhancements to the network such as an increase to layer-2 blob capacity from three to six, transaction fee reduction, alleviation of network congestion, and also allow users to pay fees with stablecoins like USDC and DAI. The upgrade will also increase the maximum staking limit from 32 ETH to a much larger 2,048 ETH.

A second phase planned for late 2025 or early 2026 will add new data structures for better storage efficiency. It will also create a system that helps nodes verify transaction data without storing the entire dataset.

Long-Term Holders Begin Selling Positions

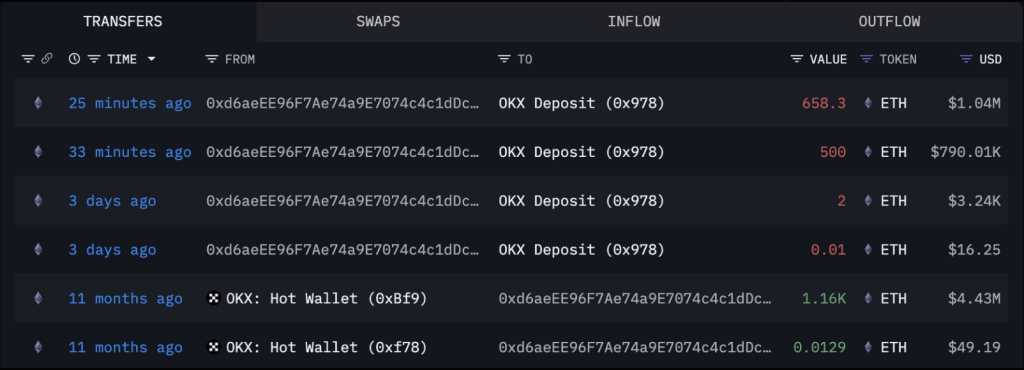

Meanwhile, data from Lookonchain shows that long-term Ethereum holders are now selling their positions, even after holding through previous market cycles. These sales are happening in the $1,500 to $1,700 price range.

After holding $ETH for 11 months, this guy capitulated and sold all 1,160 $ETH($1.83M) at a loss of $2.6M(-58.6%)!

11 months ago, he withdrew 1,160 $ETH($4.43M) from #OKX at $3,816, and deposited it to #OKX at $1,580 ~30 minutes ago, losing $2.6M(-58.6%).… pic.twitter.com/Cl0ebXie1f

— Lookonchain (@lookonchain) April 16, 2025

The selling activity has created mixed signals for market watchers. Some analysts view this as a warning sign of a potential sell-off ahead. Others believe it could lead to market stabilization.

Related Reading

This selling comes at an interesting time, with network usage at multi-year lows but major technical upgrades on the horizon. Based on Quinlivan’s assessment, reduced retail interest combined with ongoing development could create conditions for “an eventual surprise rebound with little resistance.”

Ethereum price has dipped by more than 11% over the last two weeks. Based on figures from CoinMarketCap, this cryptocurrency is now trading just below $1,600. The price has remained unchanged over the last 24 hours.

Featured image from Capital One, chart from TradingView

Credit: Source link