In recent weeks, Ethereum has displayed subtle signs of recovery amidst a generally bearish crypto market, with the altcoin mimicking Bitcoin’s modest uptrend.

Despite Ethereum’s price increasing slightly by 0.2% over the last 24 hours, a parallel trend that might significantly affect Ethereum’s economic model has been unfolding beneath the surface.

Decline In Network Activity Reduces ETH Burn

April witnessed Ethereum’s ETH burn rate hitting an annual low, primarily due to a significant decrease in network transaction fees.

These fees have typically fluctuated just below 10 gwei this year, but recent weeks have seen them dip to some of the lowest levels, directly influencing the rate at which ETH is burned.

This reduced burn rate is evidenced by the stark drop in daily burned ETH, which reached a low of 671 ETH in the past day a notable decrease from the daily figures of 2,500–3,000 ETH seen earlier in the year.

Such a decline in burn rate is not merely a statistical anomaly but a reflection of broader shifts within the Ethereum network.

A significant factor contributing to the lowered gas fees is the increased migration of network activities to Layer 2 solutions, which enhance transaction speeds while lowering costs.

Moreover, innovations like blob transactions, introduced in Ethereum’s recent Dencun upgrade, have further optimized costs on these secondary layers.

Notably, Blobs are a feature introduced to enhance Ethereum’s compatibility with Layer 2 solutions like zkSync, Optimism, and Arbitrum by efficiently managing data storage needs. This functionality is part of the Dencun upgrade, which integrates proto-danksharding via EIP-4844.

While beneficial in reducing transaction fees, these technological strides pose challenges to Ethereum’s deflationary mechanisms.

This upgrade introduced a new fee structure in which a part of every transaction fee, the base fee, is burned, potentially reducing the overall ETH supply. However, with decreased transaction fees, the anticipated deflationary pressure via burning has softened, signaling a shift to a more inflationary trend in the short term.

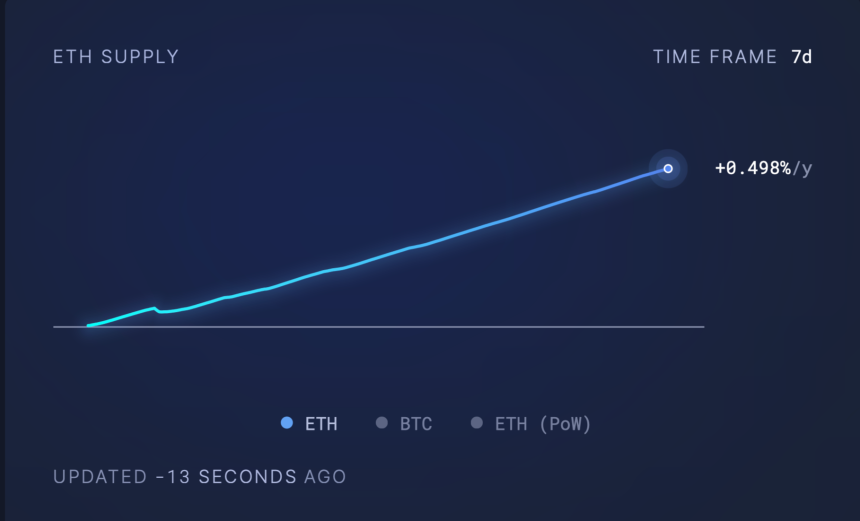

According to Ultrasoundmoney, Ethereum’s supply dynamics have swung to a mildly inflationary mode with a growth rate of 0.498%. This shift could realign if network activity intensifies, leading to increased transaction fees and, consequently, higher burn rates.

Ethereum Market Response

Despite these underlying network dynamics, Ethereum’s market price has struggled to regain its former highs above $3,500. The asset trades around $3,085, reflecting a slight downturn over recent weeks.

This price behavior underscores the broader market’s reaction to internal network changes and external economic factors, such as regulatory struggles from the US Securities and Exchange Commission (SEC) and macroeconomic uncertainties.

Looking ahead, the trajectory of Ethereum’s gas fees and subsequent ETH burn rate will be crucial in determining the sustainability of its economic model.

Featured image from Unsplash, Chart from TradingView

Credit: Source link