Over the past several days, prominent analysts have argued that more early investors are choosing to hodl bitcoin (BTC) at the moment, and that BTC is a measure of wealth, and while some say that it is a hedge against inflation, others call that narrative a myth.

According to Bitcoin analyst Willy Woo, early investors, who usually like to profit from their coins that carry more dormancy, now hodl – following Tesla‘s USD 1.5bn-heavy BTC purchase.

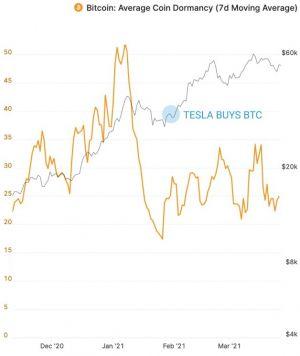

Average dormancy describes “the average number of days each coin transacted remained dormant, unmoved. The higher the dormancy, the older the coins transacted that day are on average, and the more old hands are releasing their bitcoins into circulation.”

Woo’s tweet includes an on-chain analysis firm Glassnode‘s chart of average bitcoin dormancy, 7-day average, showing the moment Tesla purchased BTC. There can be seen an abrupt drop in dormancy just before the purchase, down to November 2020 level. It’s still moving between the November and December levels.

As reported, there is quite a lot of debate in the crypto space and outside of it about possible effects Tesla’s BTC purchase and its head’s, Elon Musk’s, tweets have had on crypto and their price, specifically BTC and dogecoin (DOGE). On the same day the purchase was announced, February 8, BTC went from the USD 38,000 to the USD 46,000 level. A much smaller price rise, followed by a drop, was seen last week after Tesla had announced it would start accepting payments in BTC.

In a recent Real Vision interview, Woo noted a great number of wallets just hodling BTC without ever selling them, and these often belonging to just every-day individuals holding their coins. But recently, there’s been a larger move of coins from the exchanges and into self-custody, which is a sign of institutional players and high-net-worth individuals coming in, he said.

‘History in the making’ and myths

And as early investors hodl, another old discussion over BTC as a hedge and store of value has resurfaced recently.

In the above-mentioned Real Vision interview, a prominent analyst and CEO of trading firm Factor LLC, Peter Brandt, said that his goal as a trader used to be accumulating more USD, now finding it “a wrong goal” as USD is “the weakest […] most depreciating asset in the world,” he said, adding:

“My mindset has really changed within the last year in terms of moving from bitcoin as a trade to bitcoin as a measure of wealth.”

Brandt said that we’re witnessing “history in the making” and “everybody that’s involved in bitcoin can know they’re really taking part in history,” explaining: “This is just unbelievable. People get caught up in the daily motion and the daily moment of bitcoin without realizing we’re seeing a market advance, unlike anything we’ve really seen before. To have four parabolic advances on a log scale in the course of a ten-year period is just unheard of. I would challenge anybody to find a price chart of any asset or any commodity that has gone through this.”

Meanwhile, Northman Trader founder Sven Henrich argued that “one can make anything a store of value if enough people agree that it is, especially if there is limited supply,” giving rare post stamps and bottles of wine as examples. But is BTC a hedge against the global fiat system? His conclusion is that this is a myth.

Henrich warned that price increases, adoption and popularity don’t validate a long-term thesis, and do not guarantee a winner, and “as long as bitcoin keeps running higher everyone is convinced it is a hedge.” He stated,

“I submit the hedge argument is entirely unproven. Yes, percentage-wise bitcoin has performed tremendously on the way up since last year. But everything in our liquidity-soaked world has performed well and gone up. [F]or as long as equities keep rising on the heels of unprecedented stimulus and monetary intervention then bitcoin is just along for the ride. The real test would come if equities enter a cycle of severe selling and to see bitcoin then hold its own.”

In their latest newsletter, Glassnode also stated that bitcoin’s latest correction was a result of a general downturn in equities. But the question of what will happen to inflation is an important one to consider when looking at the future performance of the stock market and BTC, they added. Currently, markets are seemingly bracing themselves for a significant rise in inflation. Yet, with the excess printing of fiat, “BTC is already challenging gold as the investor’s choice for an ideal inflation hedge.”

“The Fed’s change in focus and policy regime is forcing investors to once again tackle inflation fears, which is great news for Bitcoin,” said Glassnode. And it remains to be seen if “the March and January cycle’s repeat, where people will invest excess income into the markets, or will this time be different.”

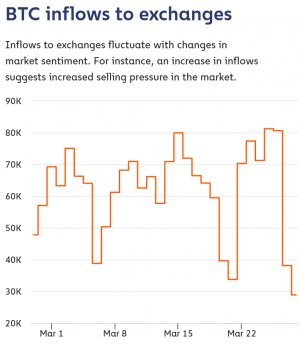

Per Chainalysis data, BTC inflows to exchanges this past Sunday reached BTC 28,860, or the lowest level in 365 days.

Meanwhile, Senior Commodity Strategist at Bloomberg Intelligence, Mike McGlone, argued that BTC is becoming a global digital reserve asset, perhaps transitioning toward a risk-off asset.

While McGlone does not rule out that BTC might peak at around USD 400,000 this year, Brandt said in the interview that BTC may eventually reach a price of more than USD 200,000. At the time of writing (14:31 UTC), BTC trades at USD 58,009 and is up by 4% in a day and less than 1% in week. It’s up by 25% in a month and 827% in a year.

____

Learn more:

– Tesla’s Bitcoin Buy Comes As Earlier Large Investors Retreat

– A Wave of Giants Rushing to Invest in Bitcoin Could Derail the Stock Market

– Inflation Is Here & Bitcoin Will Hit USD 115K ‘Ahead of Target’ – Pantera

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

– This Is Why ‘Hedge Against Inflation’, Bitcoin, Dropped On Inflation Fears

– How Education – and Envy – Turned a Billionaire Skeptic into a Bitcoin Bull

– Why Bitcoin Likes a Hard-On Environment

Credit: Source link