Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Polkadot (DOT)

Polkadot’s native DOT token serves three clear purposes: providing network governance and operations, and creating parachains by bonding. Polkadot is an open-source sharding multichain protocol that facilitates the cross-chain transfer of any data or asset types, not just tokens, thereby making a wide range of blockchains interoperable with each other. This interoperability seeks to establish a fully decentralized and private web, controlled by its users, and simplify the creation of new applications, institutions, and services.

DOT Price Analysis

At the time of writing, DOT is ranked the 9th cryptocurrency globally and the current price is A$20.38. Let’s take a look at the chart below for price analysis:

DOT exploded upwards from its long-term accumulation range during Q1 as it swept 2021’s high. The recent 40% drop found support near A$13.24 before opening last week near A$12.58

Support formed over the weekly open near A$13.15 This week is likely to test new support around A$16.34. However, the relatively equal lows below provide an attractive downwards draw for the price. If this test of possible support near A$15.47 and A$14.89 occurs, it could give longer-term bulls a better opportunity for entry.

Multiple resistances rest overhead, with the level at A$20.95 currently pinning the price down. A reclaim of this level will have to contend with resistance at A$23.17 and A$25.52.

However, a decisive break of this level likely means that the recent high at A$30.69 is a target. A more extended move may reach resistance and an old high near A$35.77, which has confluence with the 1.0 extension.

2. Curve DAO Token (CRV)

Curve CRV is a decentralized exchange for stablecoins that uses an automated market maker (AMM) to manage liquidity. Curve is now synonymous with the decentralized finance (DeFi) phenomenon and has seen significant growth in 2021.

CRV Price Analysis

At the time of writing, CRV is ranked the 97th cryptocurrency globally and the current price is A$2.16 Let’s take a look at the chart below for price analysis:

During the last week of June CRV provided nearly 105% gains before the price ran into resistance near A$2.95 Currently, the price is accumulating under the July last week open near A$2.23, just over relatively equal daily lows around A$2.13.

A sweep of these lows into probable support beginning at A$1.88 may provide traders with at least a short-term bounce to capitalize on. If this zone breaks, support could be found at A$1.72, although a move this far down may sweep the next set of the relatively equal lows near A$1.59 and fill the daily gap down to A$1.50.

A break of resistance beginning near A$2.35 could run highs near A$2.54 into resistance at A$2.83 which marks the beginning of the upper half of the June 12th daily gap. A more sustained upward move could target the last major swing high at A$2.96 with resistance beginning at A$3.22.

3. Horizen (ZEN)

Horizen ZEN is an interoperable blockchain system, supported by a decentralized node infrastructure. Its sidechain platform focuses on scalable data privacy, and as such enables businesses as well as developers to build private or public blockchains using the unique sidechain technology known as Zendoo. Horizen claims to be completely decentralized, fully customizable with privacy features and supports low costs associated with building blockchains with configurable revenue models and an unlimited number of tokens and digital assets.

ZEN Price Analysis

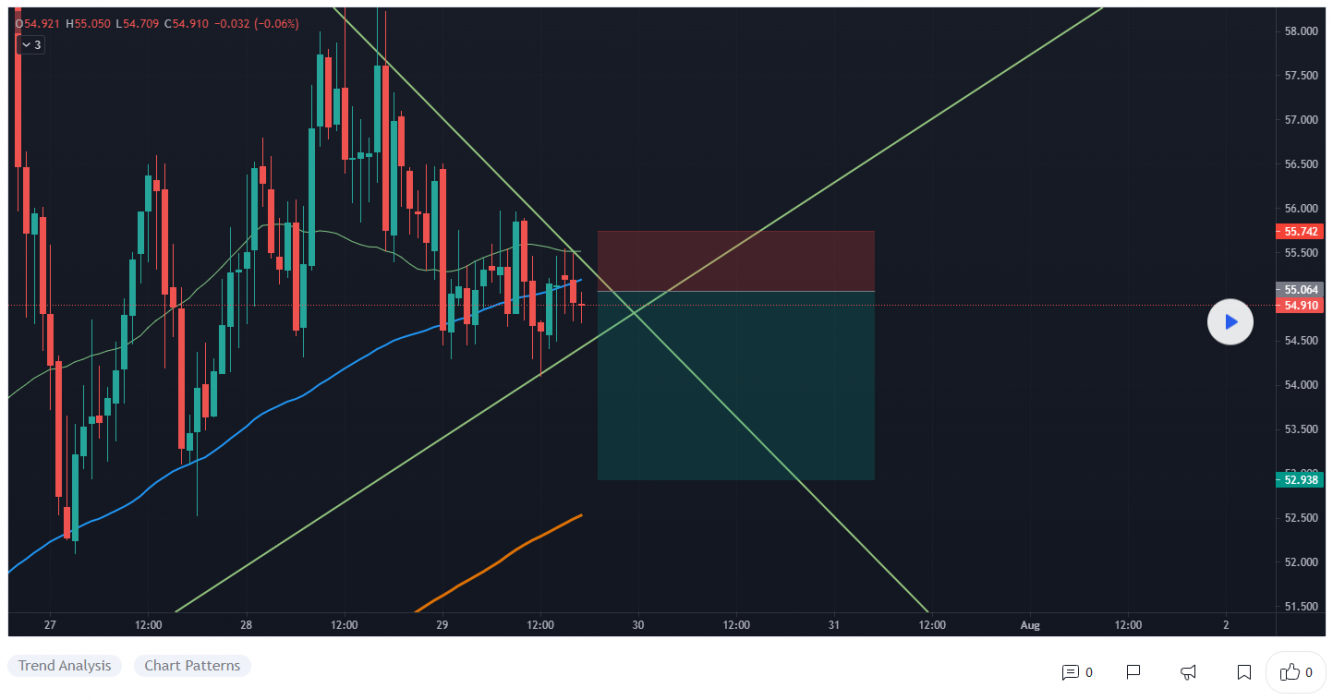

At the time of writing, ZEN is ranked the 95th cryptocurrency globally and the current price is A$74.65. Let’s take a look at the chart below for price analysis:

ZEN saw an energetic run from April to May, climbing approximately 160% before cooling off into support near A$65.36 Resistance beginning near A$62.85 pinned down last week’s attempt to rally, which is likely to retest possible support near A$60.14.

A deeper marketwide retracement could take out the relatively equal lows below the weekly open and support near A$58.69. This move might offer entries near probable support near A$56.47 and A$54.78.

However, more bullish market conditions may prompt a rally to the relatively equal highs near A$83.67 into resistance beginning at A$85.46. If the price reaches this level, the last high at A$93.58 gives the next likely target before price discovery begins.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link