Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Dogecoin (DOGE)

Dogecoin DOGE is based on the popular “Doge” Internet meme and features a Shiba Inu as its logo. The open-source digital currency was created by Billy Markus from Portland, Oregon, and Jackson Palmer from Sydney, Australia, and was forked from Litecoin in December 2013. Dogecoin’s creators envisaged it as a fun, light-hearted cryptocurrency that would have greater appeal beyond the core Bitcoin audience since it was based on a dog meme.

DOGE Price Analysis

At the time of writing, DOGE is ranked the 10th cryptocurrency globally and the current price is US$0.2221. Let’s take a look at the chart below for price analysis:

DOGE marines continue holding the price, printing nearly 35% gains during November.

The consolidation near $0.2435 is likely to provide support as the price continues exploring new highs. However, a set of relatively equal lows near $0.2159 provides a tempting target for a stop run into probable support near $0.2050.

A decidedly bearish shift in the market could reach probable support near $0.1980, near October’s monthly open.

Almost no resistance lies overhead, although low-timeframe traders can use the resistance below recent highs near $0.2847 as a first target. Beyond this level, extensions near $0.3067, $0.3252, and $0.3566 give reasonable higher-timeframe targets.

2. Decentraland (MANA)

Decentraland MANA defines itself as a virtual reality platform powered by the Ethereum blockchain that allows users to create, experience, and monetise content and applications. In this virtual world, users purchase plots of land that they can later navigate, build upon and monetise. Decentraland uses two tokens: MANA and LAND. MANA is an ERC-20 token that must be burned to acquire non-fungible ERC-721 LAND tokens. MANA tokens can also be used to pay for a range of avatars, wearables, names, and more on the Decentraland marketplace.

MANA Price Analysis

At the time of writing, MANA is ranked the 23rd cryptocurrency globally and the current price is US$5.09. Let’s take a look at the chart below for price analysis:

Like many other altcoins, MANA set a new all-time high during mid-November before retracing 35% to the low at $4.35 last week.

Price broke through resistance near $4.86, which may mark an area of possible support on a retracement. If this support fails, bulls might also step in near $4.73. However, a drop this far increases the chances of a stop run to $4.60 and possibly into support near $4.55. For now, continuing bullish market conditions could help $4.90 become support.

The swing high around $5.15 gives bulls a reasonable first target, with $5.20 also likely to draw the price upward. Higher-timeframe resistance beginning near $5.25 or $5.30 could cap the move or trigger consolidations. If bullish market conditions continue, bulls might test probable resistance near new all-time highs near $5.40.

3. Mithril (MITH)

Mithril MITH is a decentralised social media platform on the Ethereum Blockchain that rewards users for creating content. The team plans to partner with existing social platforms to drive the adoption of its ERC-20 MITH token, which can reportedly be integrated with any social media platform. In addition to storing funds, the Mithril Vault wallet can be used for staking and swapping into other currencies.

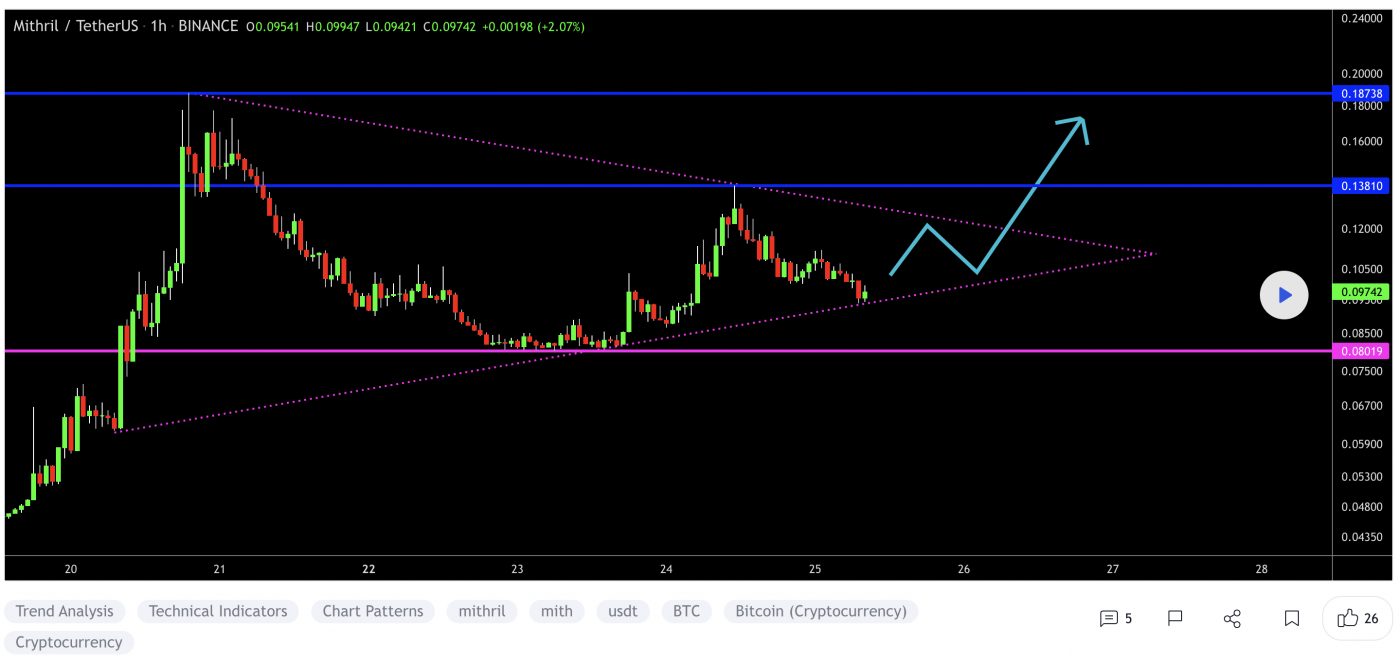

MITH Price Analysis

At the time of writing, MITH is ranked the 494th cryptocurrency globally and the current price is US$0.09727. Let’s take a look at the chart below for price analysis:

During November high, MITH’s 58% drop marks the current range as a reasonable area to expect accumulation.

The recent bearish flip of the 9, 18, and 40 EMAs might cause bulls to be less aggressive in bidding. However, possible support near $0.08522 and $0.08255 – between the 61.8% and 78.6% retracements – could see at least a short-term bounce.

Long-term consolidation suggests that the areas near $0.1137 and $0.1354 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $0.1523, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $0.1640, the start of the bearish move.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link