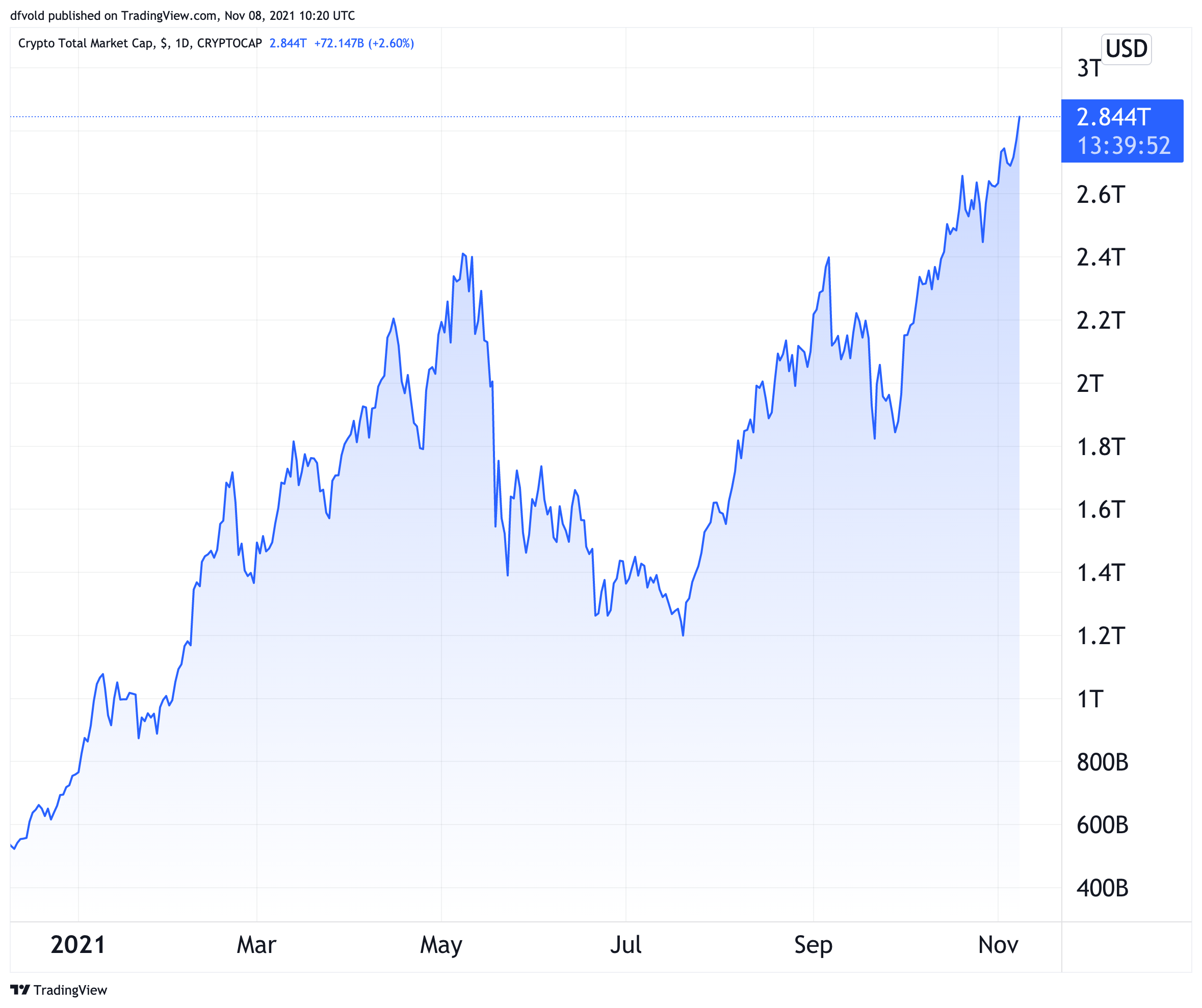

A discussion about the current crypto market capitalization has reemerged in the cryptoverse, as some data providers claim it has already surpassed a record USD 3 trillion, while others place it considerably lower.

According to the popular coin tracking site CoinGecko, the total market capitalization of the crypto market stood at USD 3.002trn as of Monday at 10:35 UTC. The figure would mark a new all-time high for crypto, and represent the first time the valuation of the nascent asset class has reached above the USD 3 trillion mark. Meanwhile, bitcoin (BTC) dominance, or the percentage of the total market capitalization, now stands at almost 42%, also per CoinGecko.

The news was shared online by members of the crypto community, while also being reported on by several mainstream outlets Monday morning.

However, data from CoinMarketCap tells a different story. Here, the market capitalization is at just USD 2.87trn, a difference of USD 130bn. Meanwhile, the market capitalization data tracked by TradingView values the crypto market at USD 2.85trn, the lowest among the three.

Interestingly, the difference between the two popular tracking sites CoinMarketCap and CoinGecko is there despite the fact that the former covers more than 3,000 more cryptoassets than the latter does, with CoinMarketCap’s 13,762 coins versus CoinGecko’s 10,447.

In other words, the only thing we can be sure of is that the market capitalization is growing. What exactly it is, however, depends on who you ask. Moreover, the market is flooded with multiple extremely volatile tokens that are trying to capitalize on the success of dogecoin (DOGE).

Still, even CoinMarketCap’s USD 2.87trn market capitalization is a respectable number by any measure.

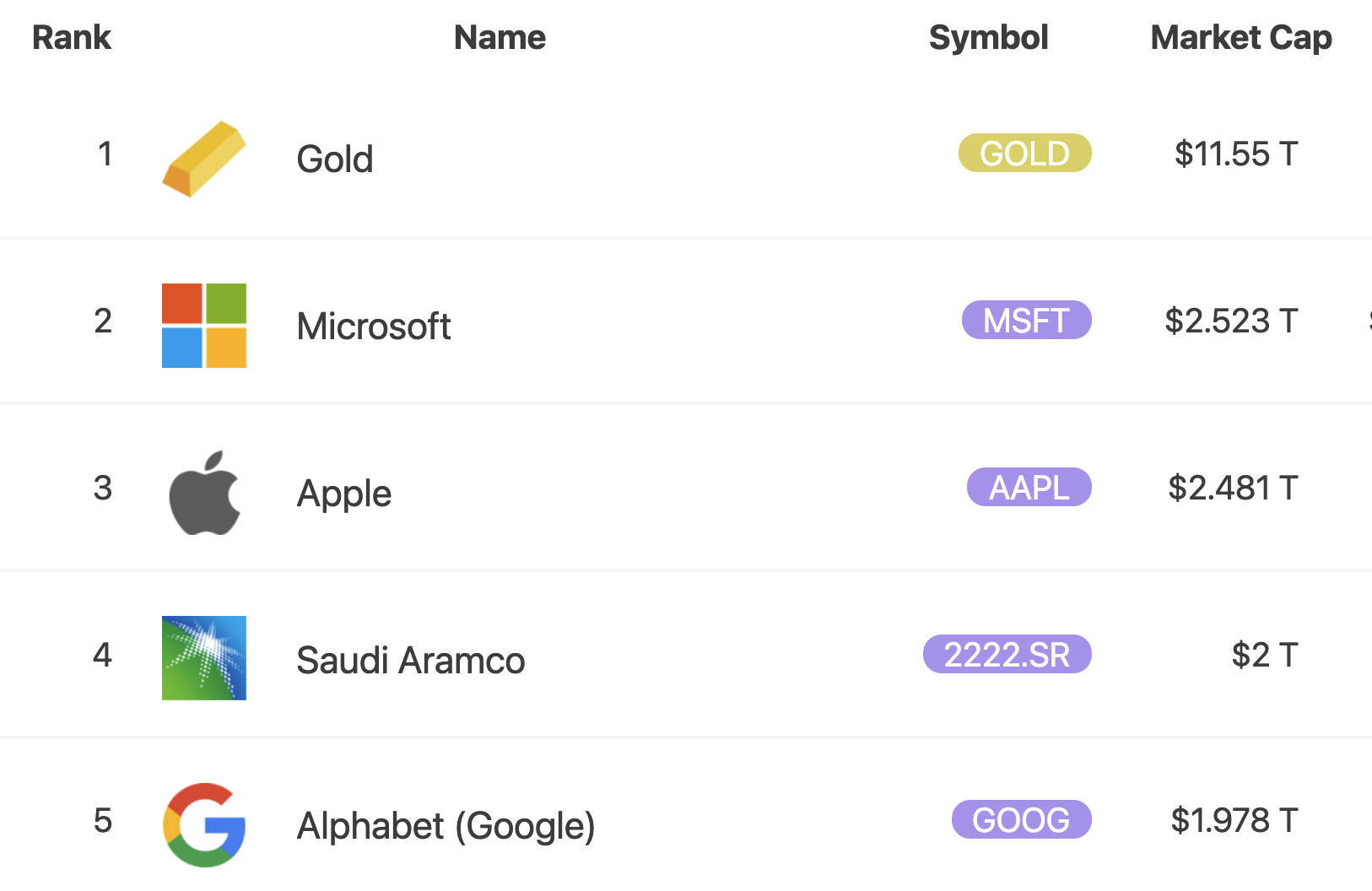

For comparison, the total market capitalization of all above-ground gold is estimated at USD 11.54trn, according to 8MarketCap.com. This means that crypto might be now worth more than a quarter of the gold market, with many BTC proponents, in particular, claiming that the ‘digital gold’ will eventually surpass the physical metal’s market capitalization.

Comparing it with the stock market, however, the crypto market has already surpassed the value of Microsoft, currently ranked as the world’s most valuable publicly-traded company, at USD 2.52trn.

Meanwhile, the entire silver market is valued at USD 1.37trn, just ahead of bitcoin’s USD 1.25trn, but well below the value of the entire crypto market.

The most valuable assets by market capitalization:

The discussion about market capitalization today comes after the total crypto market cap first reached USD 1trn back in January of this year, before going on to hit USD 2trn in April.

Meanwhile, the crypto intelligence firm Coin Metrics has previously stated that they believe bitcoin’s market capitalization for a long time has been exaggerated.

Taking into account bitcoins that are “lost and not available to the market anymore,” Coin Metrics said that “a more realistic representation” of bitcoin’s supply would be 14.5m coins, rather than the 18.6m coins that were officially circulating at the time of the report.

The report further said that the same methodology could be used to adjust the market capitalizations of bitcoin forks such as bitcoin cash (BCH), bitcoin SV (BSV) and bitcoin gold (BTG), making an even bigger impact on the total crypto market valuation.

_____

Learn more:

– Why Market Capitalization is Not the Best Metric To Evaluate Crypto?

– How to Make Market Capitalization Measure Great Again

Credit: Source link