Is the price of bitcoin (BTC) once again nearing its all-time high, or has it already exceeded it? The question is not as easy to answer as it seems, and, frankly, the answer depends on whom you ask.

As a truly global digital currency, bitcoin is traded by people on exchanges, over-the-counter (OTC), peer-to-peer (P2P) and in person all around the world, and against a whole range of fiat currencies.

And although the US dollar price of bitcoin on leading exchanges is perhaps the one most readers are familiar with, the bitcoin price is also often expressed in terms of other fiat currencies, including the euro (EUR), Japanese yen (JPY), and British pound (GBP), to name just a few.

In fact, the price of bitcoin is already flirting with its all-time high in euro terms. At its daily high on Tuesday, bitcoin traded at EUR 54,249, versus an all-time high from April 14 of EUR 54,297 on crypto exchange Binance.

If we look at price data from the competing exchange Bitfinex, however, we find that BTC/EUR had already reached a new all-time high last Friday, on October 15, when it traded at EUR 54,207, versus the old high from April of EUR 54,172.

The detail was also pointed out by The Investor’s Podcast Network host Preston Pysh recently, saying that the number one cryptocurrency is “right at the all-time high in euros”:

Similarly, traders in Japan who calculate their returns in terms of Japanese yen also have a reason to celebrate, with the BTC/JPY pair on Bitfinex moving well above its old all-time high last Friday, and still remaining above that level today.

As of 9:36 UTC on Tuesday, bitcoin traded at JPY 7,060,200 on Bitfinex, slightly above its April 14 high of JPY 7,057,300.

The new highs in the bitcoin price in terms of some fiat currencies follow a bullish period for the coin, helped in large part by an expected listing later on Tuesday of the first bitcoin futures-backed exchange-traded fund (ETF) in the US.

The ETF, launched by ETF issuer ProShares with the ticker BITO, will have an annual fee of 0.95%, less than half of the 2% fee charged by Grayscale Bitcoin Trust, the only other major US-regulated bitcoin investment vehicle.

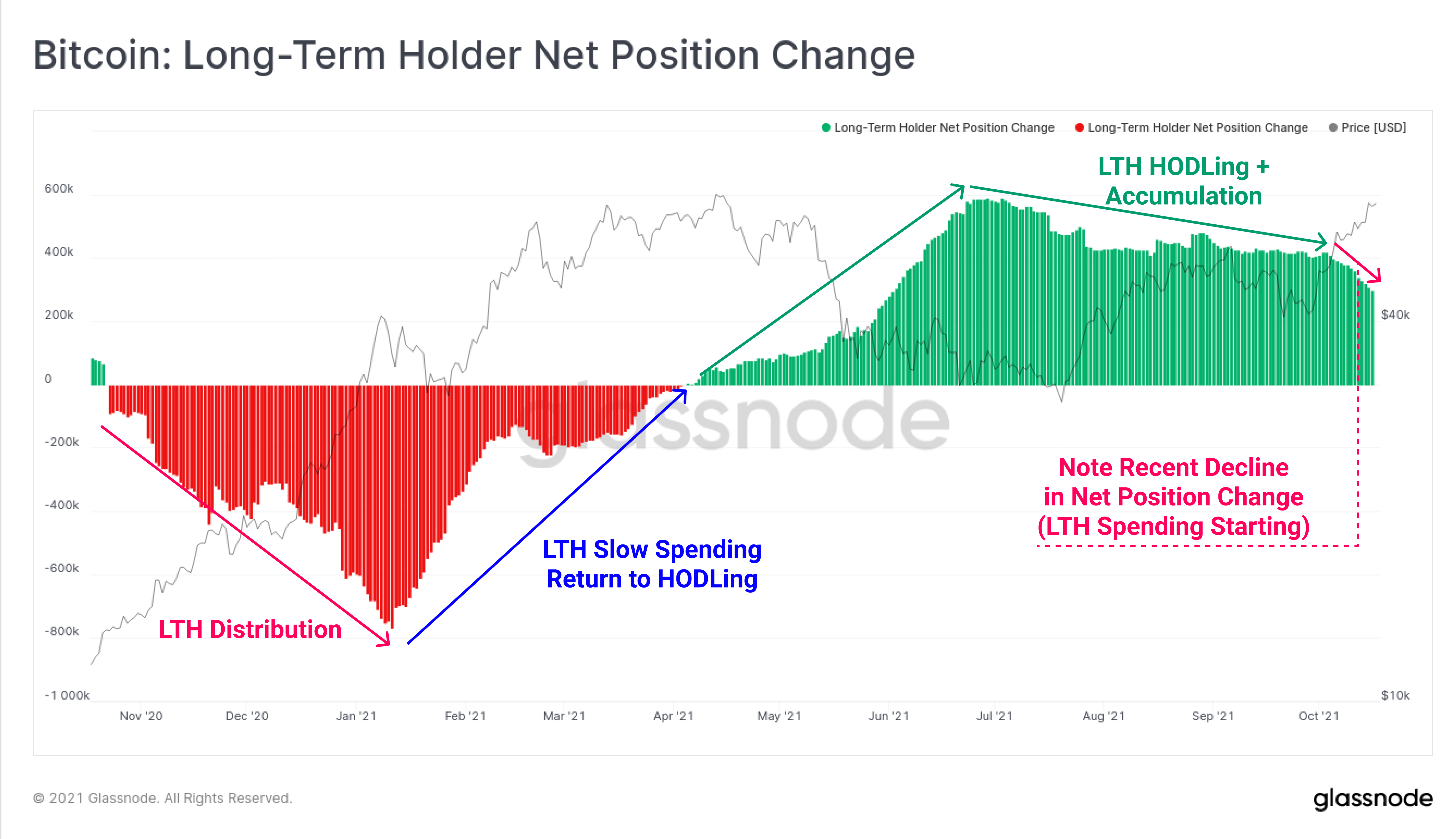

Meanwhile, on-chain analytics firm Glassnode said in its latest weekly report on Monday that some long-term holders (LTH) have begun to take “modest profits” as bitcoin again nears its all-time high.

“Over the past week, we can see a slight softening of the LTH net position change metric. This suggests a degree of LTH spending is occurring as prices rally above USD 60,000,” Glassnode wrote.

The firm also shared a chart that showed how accumulation – although still in positive territory – has started to slow:

On a more bullish note, Santiment, another on-chain analytics firm, said yesterday that bitcoin traders are showing “a surprisingly low level of excitement” about the current high prices. The lack of euphoria is generally seen as bullish, as it means many buyers are still sitting on the sidelines, and are likely to buy in at even higher prices.

In US dollar terms, at 12:20 PM UTC, BTC trades at around USD 62,167 and is up by almost 2% in a day. It’s still down by 4% from its all-time high of USD 64,805 (per Coingecko), reached on April 14. Meanwhile, according to Coinmarketcap, on that day, BTC reached USD 64,863, while Messari claims it was USD 64,654. Therefore, it looks like the market might have multiple instances to celebrate.

____

Learn more:

– Bitcoin All-Time High: What Is Peak Bitcoin Anyway?

– Total Crypto Market Cap Nears All-Time High, Bitcoin Dominance Slips

– El Salvador Bitcoin ‘Scalpers’ Force App Turnaround as Chivo Criticism Continues

– 88% of Investments Flow Into Bitcoin

– RBC Proposes Options Bet on Bitcoin-Linked Tesla and MicroStrategy

– Bitcoin Futures ETF to Start Testing Market on Tuesday Amid Pullback Talks

Credit: Source link