The Depository Trust and Clearing Corporation (DTCC) has declared that exchange-traded funds (ETFs) linked to Bitcoin (BTC) or cryptocurrencies have no collateral value as investments.

In an announcement, the DTCC, which provides clearing and settlement services to the financial markets in the US, says digital asset-linked ETFs will be subject to a 100% “haircut.”

“No collateral value will be given for any ETF or other investment vehicle that includes Bitcoin or any other

cryptocurrency as an underlying investment, hence will be subject to a 100% haircut.”

According to the announcement, the DTCC’s new changes will be effective April 30, 2024, and will presumably affect position values on the company’s collateral monitor.

After going into effect, the changes mean that entities cannot use Bitcoin or crypto-linked ETFs as collateral when applying for credit or financing through the DTCC.

In March, digital assets manager CoinShares said institutions poured a new weekly record of $2.9 billion into crypto investment products, mostly driven by the Bitcoin ETFs.

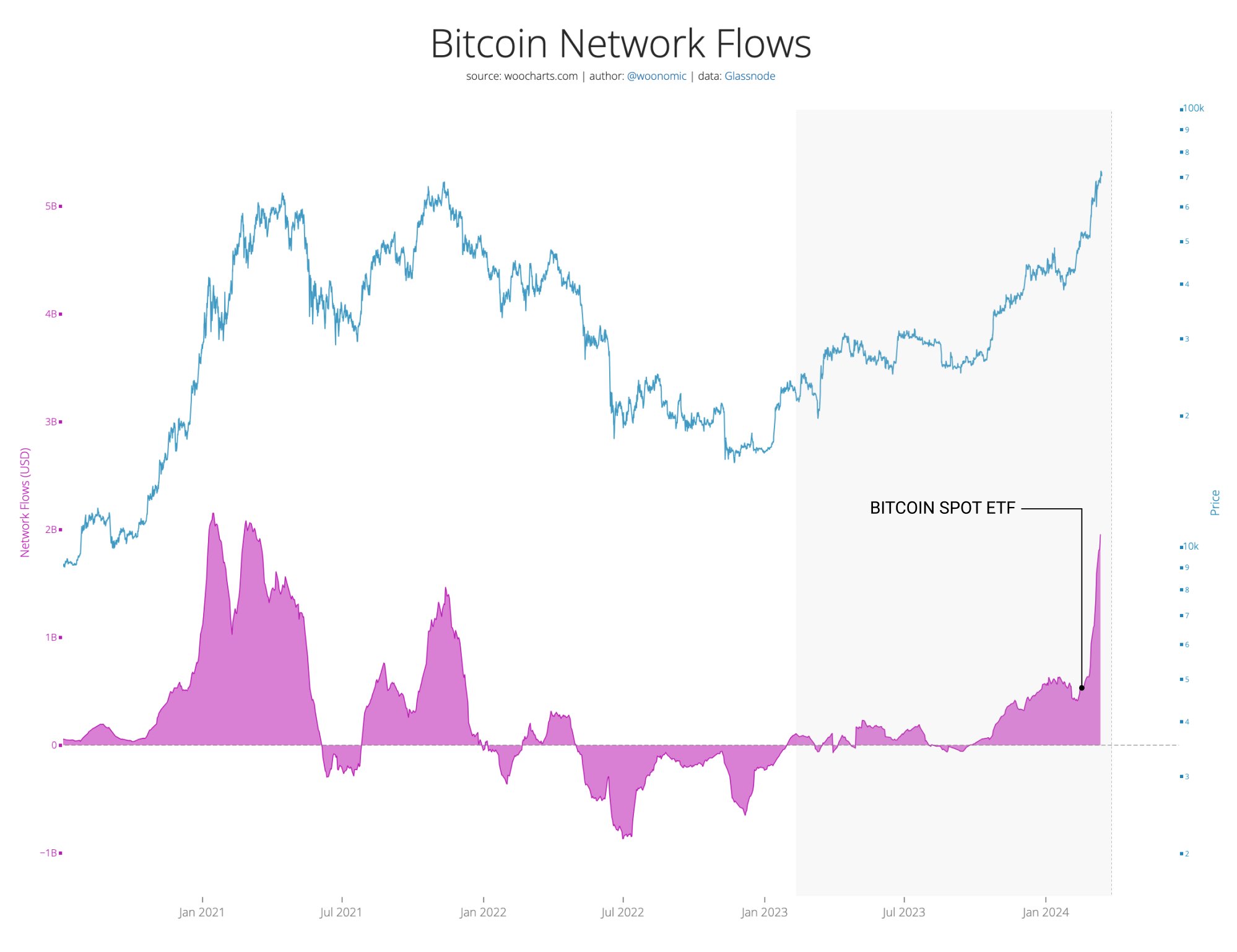

On-chain analyst Willy Woo recently told his 1 million followers on the social media platform X that daily inflows of capital being stored by the Bitcoin network – largely driven by the ETFs – recently hit $2 billion per day, equivalent to the level of the last full-blown bull market.

“This time it should climb much higher. Spot ETFs (exchange-traded funds) are opening up the inflow pipes markedly.

The inflows are measured on-chain so this includes all investors. It’s about 90% accurate. Also indicative that the ETFs are around 30% of total flows right now.

Specifically, you take the daily change in entity-adjusted realized capitalization. Entity-adjusted Real Cap tallies the price paid for every BTC when they moved to the current HODLers, this is a measure of the USD stored in the network.”

Generated Image: Midjourney

Credit: Source link