Ki Young Ju, the CEO of blockchain analytics platform CryptoQuant, says he’s expecting the current Bitcoin (BTC) bull run to last until the first few months of 2025.

Ju tells his 351,000 followers on the social media platform X that while he sees the potential for more downside for Bitcoin, perhaps near the $47,000 level, he is still anticipating a continuation of the bull market up until early next year.

“I believe the Bitcoin bull cycle will continue until early next year.

For those trading in spot, it would be wise to DCA (dollar cost average) while keeping in mind that it could drop to $47,000 from here.

If you are not an experienced futures trader, do not open high-leverage long or short positions based on my tweets.

Over the past month, I have indirectly warned against excessive risk, but it seems some people are still opening high-leverage long positions based on my tweets about the long-term cycle.

My tweets are from a spot trading and long-term cycle perspective. Warnings about corrections are mentions of risk. Always DYOR (do your own research).”

When asked for a potential price target for the bull market top, Ju reveals a forecast based on a realized cap indicator – an on-chain metric that looks at the price at which each Bitcoin in a given cohort was last moved as opposed to the current market value.

“$112,000 at the peak of the cycle.”

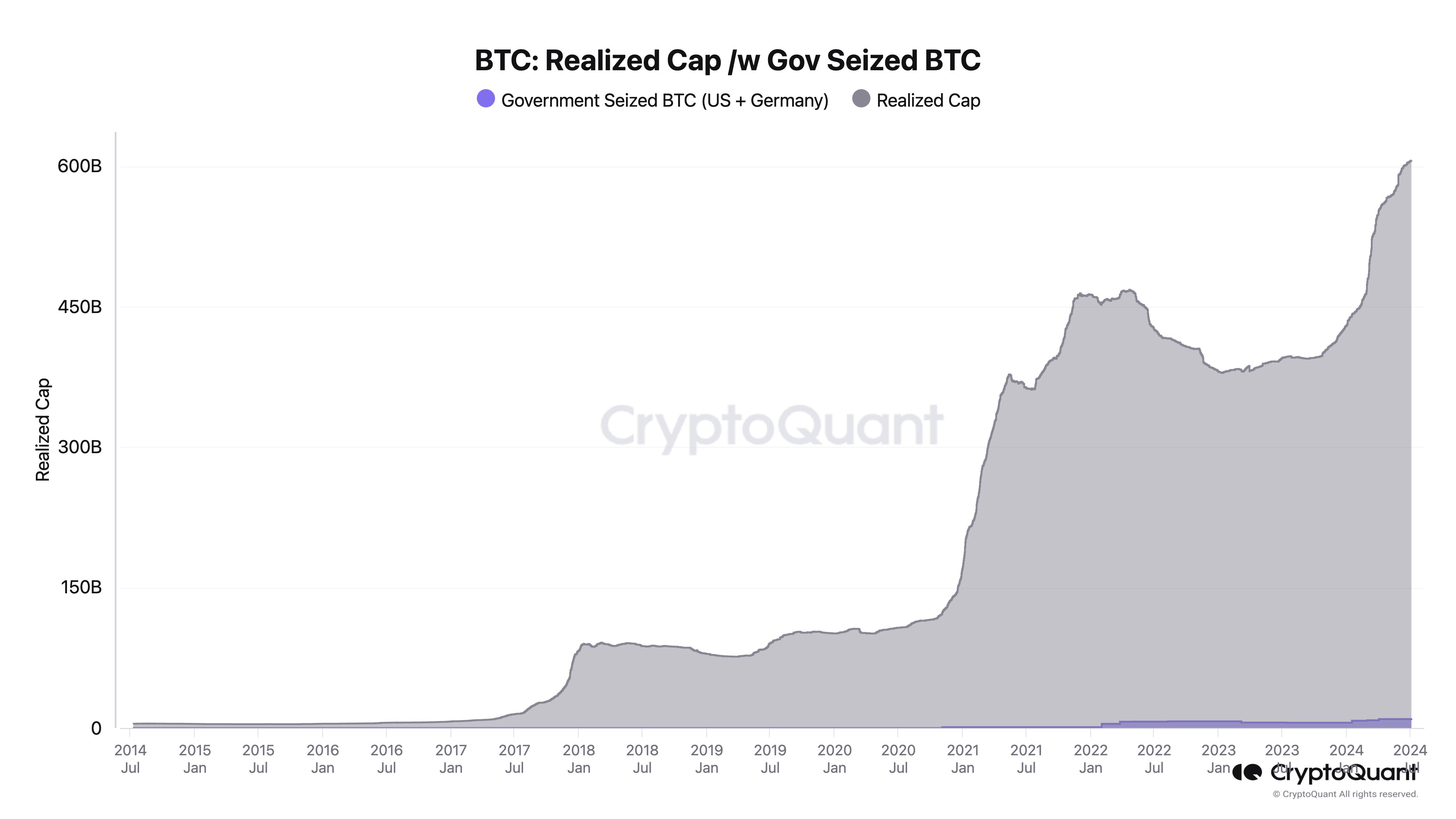

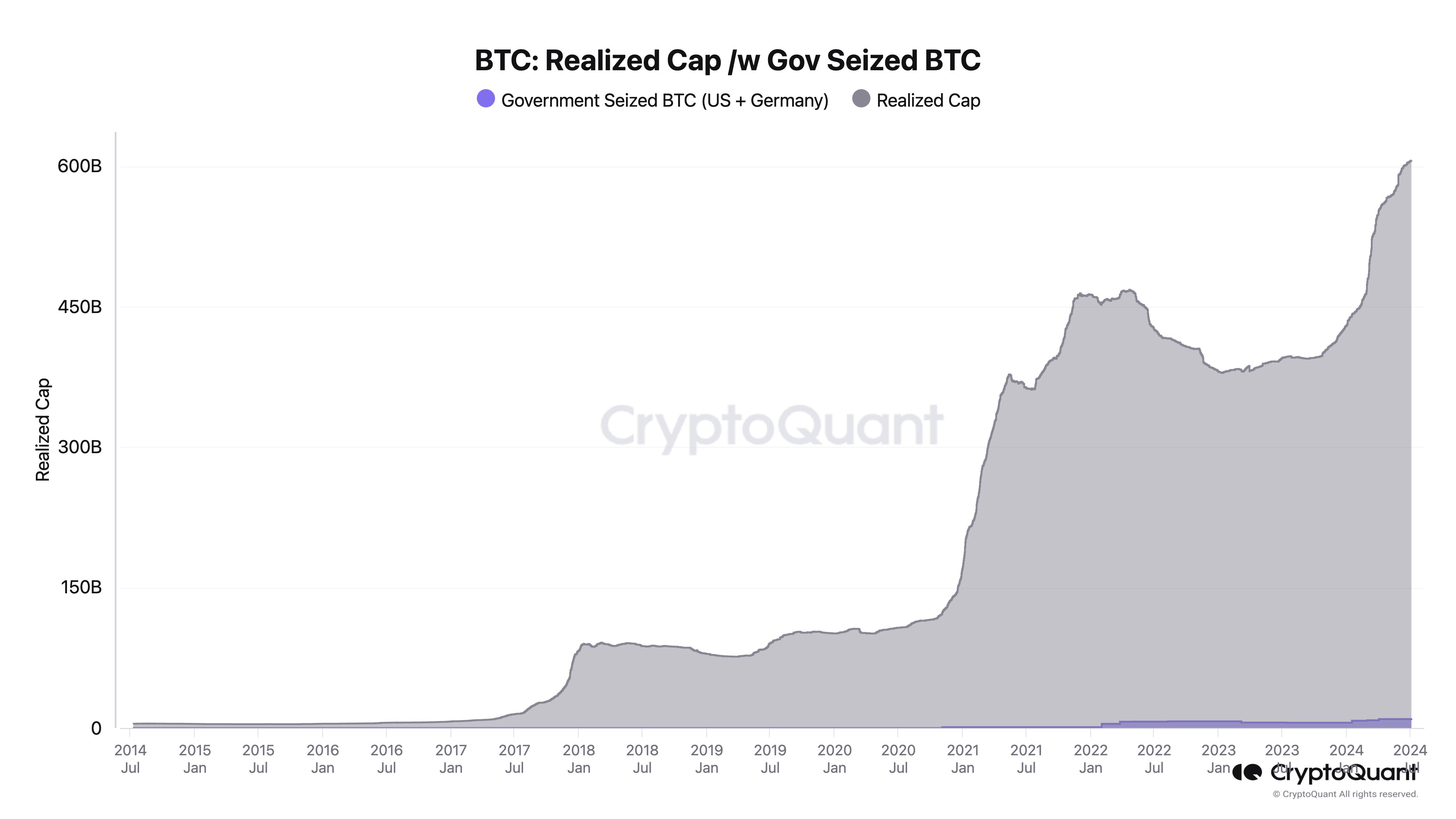

Ju also says that the current uncertainty about Western governments selling their seized Bitcoin is likely overblown due to the relatively small market share of coins that they hold.

“Government Bitcoin selling is overestimated.

$224 billion has flowed into this market since 2023. Government-seized BTC contributes about $9 billion to the realized cap.

It’s only 4% of the total cumulative realized value since 2023. Don’t let government selling FUD (fear, uncertainty and doubt) ruin your trades.”

At time of writing, Bitcoin is trading at $57,879.

Generated Image: DALLE3

Credit: Source link