Crypto Tax in Australia 2021

What do you need to expect and prepare for the tax on your crypto?

What is the Best Crypto Tax Software in Australia?

Latest update on 1 June 2021

The ATO knows about your crypto activities?

Yes, the ATO (Australian Tax Office) can collect the data from Australian crypto exchanges with the purpose of knowing who the holders are and if they are liable to paying tax on their crypto transactions. These are all possible through the KYC (*Know you client) policy of crypto exchanges in Australia, which you agree to when you make your account.

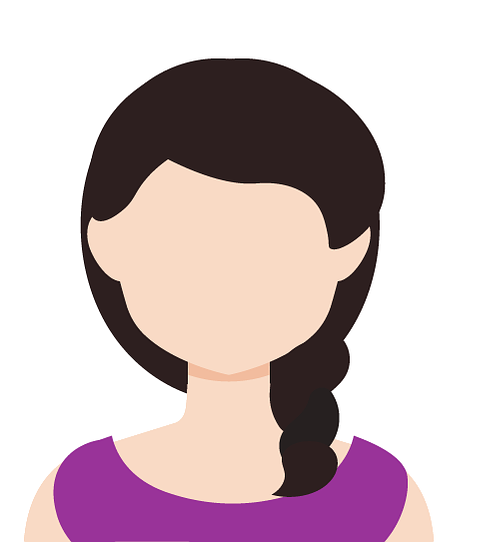

In 2020, the ATO sent this letter to 350,000 Australian crypto investors (source):

The letter acts as a reminder for crypto investors to declare any capital gains from their crypto transactions.

Cryptocurrency is still a relatively new asset and taxes on cryptocurrency could be quite complicated. This article aims to provide basic knowledge of crypto tax to help you understand what to prepare in your tax return.

Table of contents

- Business or Personal?

- Can I be a professional trader and an investor?

- Pros and Cons as a Professional Trader

- Cryptocurrency is a Property??

- Exchanging a crypto to another crypto (Case study 1)

- Long-term Capital Gains Discount (Case study 2)

- Gifting Crypto (Case study 3)

- Staking and Airdrops (Case study 4)

- Chain Split / Hard Forks (Case Study 5)

- Transferring crypto between your wallets (Case Study 6)

- Personal Use Assets

- Donation

- Lost/Stolen Coins

- Koinly

- CoinTracking

1. Business or Personal?

The short answer for the common question, “Do I need to pay tax on my crypto?” is yes, in most of the cases. However, there are 2 different ways to be taxed depending on your situation: if the crypto you hold business/professional use or personal use?

Business = Income Tax

If you made crypto profits or losses from your business activities, those profits or losses are subject to income tax. For instance, the following activities can be considered business activities:

- Professional crypto trading

- Professional crypto mining

- Crypto exchange businesses (including ATMs).

The difference between personal and professional trading and mining is a gray area as there are no strict criteria to be professional traders or miners. However, your activity may be considered as a professional or business if you usually:

- Carry on your activity for commercial reasons and in a commercially viable way

- Undertake activities in a business-like manner – this would typically include preparing a business plan and acquiring capital assets or inventory in line with the business plan

- Prepare accounting records and market a business name or product

- Intend to make a profit or genuinely believe you will make a profit, even if you are unlikely to do so in the short term. (Source ATO)

Personal = Capital Gain Tax (CGT)

If your crypto activities do not fit the above criteria, your crypto profits or losses are considered as a personal investment and subject to CGT, if you are:

- Buying crypto for yourself

- Mining crypto as a hobby

- Casual, low-volume crypto trading

The details of CGT on crypto will be explain later in this article.

2. Can I be both a professional trader and an investor?

Yes as a short answer. However, you need to make sure that your trading account and investing account separately and you have different wallets for each purpose. So that you can have clear records of each activities.

3. Pros and Cons as a Professional Trader

Here are the pros and cons of being taxed as a professional trader or small crypto business.

Pros

- Small business tax incentives: these incentives change frequently, however, one of the incentives is $1,000 tax offset for certain classes of small businesses.

- Loss rules: Professional traders, who generate over $20,000 in trades but have a net capital loss, can often claim this loss against the rest of their taxable income, allowing traders to claim their trading losses against their regular salary.

- Expenses: Professional traders can instantly write off $30,000 of their expenses. This includes expenses related to trading and business such as hardware, software, trading fees and subscriptions.

Cons

- No CGT discount : The crypto profits that you make as a professional trader/small business is not applicable to have 50% CGT discount even though it is held over 12 months. (CGT discount)

- Higher chance of getting more attention from the ATO: Special tax concessions for crypto traders may come with an extra attention from the ATO as they will be more interested in scrutinisng your activities.

- Extra admin: Tax record-keeping and requirements for professional traders are more complex and complicated. For example, you may need to submit detailed trading records, a log of work time, clearly defined strategy documents, detailed research notes, and accurate business records. These can be costly and time consuming.

4. Cryptocurrency is a Property?

The ATO stated that cryptocurrencies are not considered as money or Australian or foreign currency but treated as property as an asset for CGT purposes. CGT event occurs if you:

- Sell and gift crypto

- Trade or exchanging cryptos (including crypto to crypto)

- Convert crypto to fiat currency (eg. AU$ and US$)

- Use crypto to obtain goods and or services

Let’s check out the following 6 case studies to understand how tax would apply to your crypto assets.

Exchanging a crypto to another crypto

Exchanging a crypto to another crypto is a capital gains event including Stablecoins. Stablecoins like USDC is treated exactly the same as other cryotocurrencies.

*Stablecoins = a type of coin whose value is backed with an outside asset, like US$ or gold to stabilise the price.

Case Study 1

Amy bought 100 ABC coins for $20,000 on 15 January 2021 (= $200 per ABC coin). On 10 May 2021, Amy exchanged 20 ABC coins for 100 XYZ coins, whose market value was $7,000 at the time of the transaction (= $350 per ABC coin). Thus, $200 x 20 = $4,000 is the initial capital and $350 x 20 = $7,000 is the proceeds from exchanging from ABC coin to XYZ coin. Amy’s taxable capital gain from this transaction is $7,000 - $4,000 = $3,000.

Long-term CGT discount

If you bought a cryptocurrency as an investment, you will need to pay tax on any capital gain when you sell the cryptocurrency.

It is important to remember that you will not be entitled to the personal use asset exemption if you hold the crypto as an investment.

However, you may be entitled to the CGT discount to reduce a capital gain when you sell the crypto if you hold it as an investment for over a year just like shares.

If you have a net capital loss, you can use it to offset any capital gains you make in the future. You cannot deduct a net capital loss from your other income.

Case Study 2

Steve bought Coin BB in 2018 as part of his portfolio and holds it until now. If he sells some of Coin BB, the profit (or loss) will be subject to CGT and also entitled to the 50% of CGT discount as he’s been holding Coin BB more than 12 months.

Gifting crypto

If you send your crypto to somebody as a gift, this is considered as a capital gains event, and you will need to pay CGT. Gifting a crypto is considered the same as selling a crypto.

If you’re receiving a crypto as a gift, you don’t need to pay CGT when you receive it. However, you’ll need to pay CGT when you sell the crypto. In this case, you need to calculate the difference between the value of the crypto when you received it and when you sell it.

Case Study 3

Mike sent Lauren 10 Coin DD, the market value was $150 at the time of the transaction on 5 March 2021. Mike needs to pay CGT of $150, but no CGT on Lauren. Lauren sold 10 Coin DD for $500 on 6 April 2021. She needs to pay CGT on the capital gain of $350 (= $500 - $150).

Staking rewards and airdrops

Staking means that you’re holding a particular crypto in your wallet or platform, for the purpose of receiving rewards in the form of cryptocurrencies for supporting the functionality of a blockchain system. You lock your crypto in your wallet or platform (= staking), and you will receive a reward by the network as a return.

Airdrops pertain to the distribution of a new cryptocurrency to the holders of specific cryptocurrencies. If you have a certain crypto in your wallet, you’ll be distributed a particular coins at no cost depending on the amount of the crypto in your wallet.

Both staking and airdrops are treated as capital gains events. You will need to calculate the capital gains or losses from the value of the crypto when you receive the coins and when you sell it.

Case Study 4

Mary holds 10,000 Coin FF and stakes all of them to the Coin FF Staking Pool. Mary receives more Coin FF as a reward when her pool participates in consensus. The value of the additional Coin FF at the time the coins are distributed to her will be used when calculating her capital gains.

Chain Split / Hardforks

A chain split/hardfork is a permanent upgrade to an existing blockchain that results in branching the chain into 2 paths. For example, Bitcoin underwent a hardfork on 1 August 2017 and created Bitcoin Cash. If you held 10 Bitcoin on 1 August 2017, you received 10 Bitcoin Cash at no cost as the result of Bitcoin hardfork. As you obtained 10 Bitcoin Cash for $0, you will need to pay CGT on the total sale value of Bitcoin Cash when you sell.

Case Study 5

Sarah, who is an investor, held 5 Bitcoins on 1 August 2017 and received 5 Bitcoin Cash after the Bitcoin hardfork. The 5 Bitcoin Cash that Sarah received is not considered as a capital gain or ordinary income at the time of receiving them. Sarah sold the 5 Bitcoin Cash for $2,000 on 1 May 2018. CGT is applied to the $2,000 proceed of the sale as it did not cost Sarah any capital to acquire 5 Bitcoin Cash.

Transferring crypto between your account or wallets

Transferring crypto between your account or wallets is not considered as a capital gains event.

Case Study 6

Nick transferred his Coin E from his crypto exchange account to his hardware wallet to keep his asset in a safe place. In this case, he is not disposing any crypto, so it is not considered as a capital gains event.

5. Capital Gains Exemptions

Personal Use Assets

If you have less than $10,000 in cryptocurrencies, and you bought the crypto and used it solely to purchase items or services, the capital gains or losses occurred by the event may be not subject to CGT .

However, crypto is NOT considered as a personal use asset if it is held and used mainly:

- As an investment

- In a profit-making schemes, or

- In the course of carrying on a business

- And under these following situations (except in rare cases):

- When you need to exchange your crypto to AU$ or a different crypto in order to purchase goods or services, or

- If you need to use a payment gateway or third party payment methods to purchase goods or services on your behalf as opposed to purchasing them directly with your cryptocurrency.

If you do not use your crypto for a long period of time to purchase goods or services, it will be hard to consider it for personal use.

Donation

A donation with your crypto to registered charity organisations or funds is not treated as a capital gains event. You can also claim the amount of crypto that you donated as a deduction on your tax return. It is important to understand that the orginisation or fund that you’re donating to needs to be registered as a for this purpose.

Click here to check if the charity is registered as a DGR with the ABN, ACN or Name of the charity in the ATO website.

Lost/Stolen Coins

In the event you lose your private key for your wallet or your cryptos were stolen, you may be able to claim a capital loss. In order to claim, you need to provide evidence on how your crypto or access to your wallet was lost. This includes:

- when you set up and when you lost the private key

- the address of your wallet related to the lost private key relates

- the capital spent to buy the lost or stolen crypto

- the amount of crypto in your wallet at the time they were lost

- ownership of the lost crypto wallet

- transactions between the wallet and the crypto exchange platform where you have verified account.

6. What you need to record for your tax return?

It is very important to keep a good record to prepare your tax return regardless if you hold cryptos for personal use or professional/business use.

Your crypto record should include:

- the date of the transaction

- the value of the crypto in AU$ at the time of the transaction (you should be able to get the information from your crypto exchange)

- the purpose of the transaction, and who the senders/receivers were.

You also need to keep the records including

- receipts when you buy or transfer crypto

- exchange records

- receipts if you use an agent, accountant and legal services

- digital wallet records and keys

- receipts if you use any tax management software

7. The Best Crypto Tax Software in Australia

Preparing for crypto tax may take you hours or days to go over all your transactions and check the prices of each crypto you bought, sold or exchanged manually. Luckily , there are softwares available that are designed to help record and manage crypto tax. These software enable the process of preparing crypto tax as easy as possible. Koinly and Cointracking are 2 reputable crypto tax softwares and both offer free and paid subscriptions.

One of the best crypto tax softwares, which is available in over 20 countries including Australia. It is recommended for both beginners and sophisticated users as it is very simple to set up and the layout of the website is clean. Also, the free plan is already loaded with features that include 10,000 transactions record with unlimited wallets and exchange accounts.

Plans include Free ($0/year), Newbie ($49/year), Holder ($99/year) and Trader ($179/year). Full Price Chart

Pros

- Free plan 10,000 transactions record with multiple services with no limited timeframe (*no tax report for Free plan)

- Simple and clean website.

- Beginner friendly

- Supports 350+ exchanges, 50+ wallets, 6k+ Blockchains, 10+ crypto services

- Tax forms are auto generated

- Portfolio analysis tool provides ROIs on each crypto investment, invested fiat, income, profit-loss and capital gains

- Smart transfer matching uses AI to detect transactions made between your personal wallets. This allows for more accurate computation of your tax by taking into account transactions such as sending your crypto to your account and wallet.

Cons

- Bitcoin markets, which is one of the leading crypto exchanges in Australia, is not supported at the time of writing…

CoinTracking was founded in 2012 and launched their online service in April 2013. The software is considered as the world’s first crypto tax reporting tool and portfolio manager. It is a popular software with over 873,000 active users and 1250+ corporate clients in the world.

Plans include Free ($0), Pro (US$10.99/month), Expert (US$16.99/month), Unlimited (US$54.99/momth) and Corporate (US$499+ /year), Full Price Chart

Pros

- Free plan with 200 transaction records and a tax report with no limited timeframe

- Provides detailed trading data including Provides personal portfolio analysis reports and charts for things like coins, audit reports for profits and losses as well as an overview for realized and unrealized gains.

- Many advantages for professional traders and businesses

- Supports 110+ exchanges

- Mobile app available (only for iOS)

- 160 tax advisors and tax lawyersto assist with international tax filing

Cons

- Paid plans are expensive. *if you only made limited numbers of trades a year, you might consider the cost of the paid plan.