What is cryptocurrency?

To put it simply, cryptocurrencies are viewed as a across between a digital form of money/currency and a digital asset.

Money/Currency

You can use it to pay for goods or services. (eg. US$ and AU$).

Like paying with your credit card or online banking transactions, you can use cryptocurrencies to buy a coffee or pay your taxi fare.

Digital asset

You can invest in it for capital gains including trading (eg. Stock market).

*It can be used to earn interest or yield in lending platforms to gain passive income (Read More).

What is Bitcoin and Altcoins?

Cryptocurrencies refers to all encryption (= converted into a code) digital currency like Bitcoin. Altcoins is the term referring to all cryptocurrencies other than Bitcoin. Approximately 7000 altcoins are published. Litecoin was the first altcoin created in 2011 as the “silver” to Bitcoin’s gold.

Bitcoin was launched in 2009 by the anonymous inventor/inventors, Satoshi Nakamoto.

Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It's completely decentralized with no server or central authority. Satoshi Nakamoto Bitcoin: A Peer-to-Peer Electronic Cash System, 9 January 2009. Source: https://bitcoin.org/bitcoin.pdf

Until now, the identity of Satoshi Nakamoto is uncertain and if he is an individual or a group behind a pseudonym. Bitcoin is the first successful cryptocurrency in the world and currently has the largest market capitalisation among all cryptocurrencies. People who use Bitcoin benefit from low transaction fees. Owner’s of Bitcoin also do not have to rely on third party such as banks. Custody of their assets are in their total control and ownership is recorded in a decentralised blockchain.

Why is cryptocurrency created?

It may not be apparent, but we have multiple issues in the world’s current monetary system which is primarily controlled by governments and banks.

A few issues worth mentioning that cryptocurrencies are attempting to solve are as follows:

A few issues worth mentioning that cryptocurrencies are attempting to solve are as follows:

- Having middlemen taking a cut/margin/profit from every transaction you make

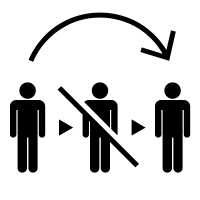

In the traditional money system, transactions are intermediated by banks and brokers, which leads to transaction cost and may take time to execute. There are no middlemen in a blockchain system. All the members in the network act as record keepers (middlemen) of the ledger (database) where transactions are recorded. So this makes transaction typically cost less and faster than the traditional system.

- Extreme money printing

A government has a central bank that controls the money supply in the country. Simply stated, a central bank can print money (increase the money supply) as part of a monetary policy during a serious economic turmoil (eg. Global financial crisis in 2007-2008 and Covid19 pandemic) to bail out debt or devalue its currency. However, this approach most often provides a temporary solution to indebted companies (which the governments typically help to keep people employed) and may cause other problems such as inflation in Greece and Zimbabwe.

- Higher risk of corruption

Having a control of money can give a great power. However, when the power goes to one person or party, the risk of abusing that power increases. Blockchain technology will solve the problem by spreading the power among the individuals of the network.

- No control of your own money

Remarkably, in traditional money system, basically the government and central banks have a high degree of access to their citizen’s funds. For example, governments can freeze individuals’ bank accounts and block the access to your own money. Eg. In US, all your assets will be taken by the government if you don’t prepare a legal will. In India, the government abolished the bank notes in 2016. In blockchain, you have control of your own money.

- Unbanked or underbanked citizens

About 3 billion people in the world have no access to financial services like banks. Surprisingly, that is roughly half of the world population! Technically, anyone who has access to an internet can make payments with cryptocurrencies.

The blockchain technology behind cryptocurrencies aims to provide solutions to the problems of traditional monetary system.

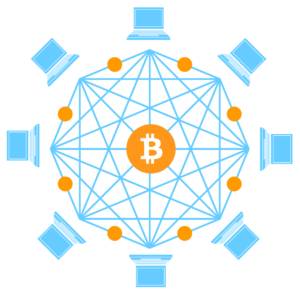

What is Blockchain technology?

Blockchain can be very complicated to understand. However, its principal is actually simple. The main concepts are:

- A Blockchain is a record-keeping technology and a specific type of database (ledger)

- Everyone can record and access to verify transactions.

- Conventionally, the data is stored in a server. Whereas, in blockchain, the data is stored in the decentralised ledger (blockchain).

- Decentralised blockchains are extremely hard to tamper. In the case of Bitcoin, all the transactions are permanently recorded and anyone can see the information.

- Blockchain is different from a cryptocurrency. A cryptocurrency runs on blockchain and other forms of digital technology. (eg. Bitcoin currency runs on the Bitcoin blockchain network).