Virtually all digital assets are in the red following sharp declines that began last Thursday and continued into the weekend. An estimated US$1.3 billion in leveraged long positions was liquidated amid a correction that saw the crypto market capitalisation (market cap) drop close to 50 percent from its November high.

Blood in the Crypto Streets

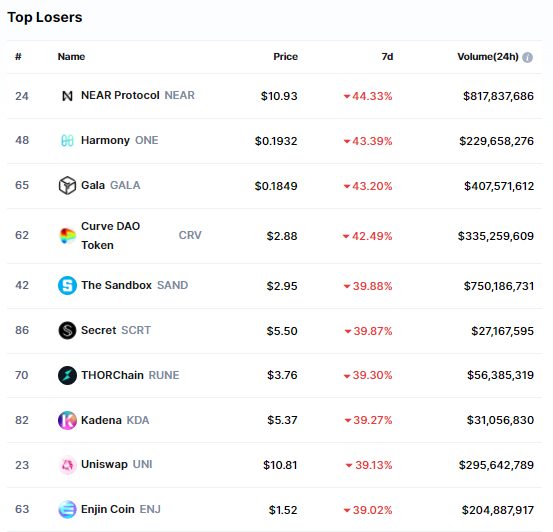

Over the course of a few days, billions were wiped out across the board, with few exceptions. Of the top 100 cryptocurrencies by market cap, DeFi tokens were hit hardest:

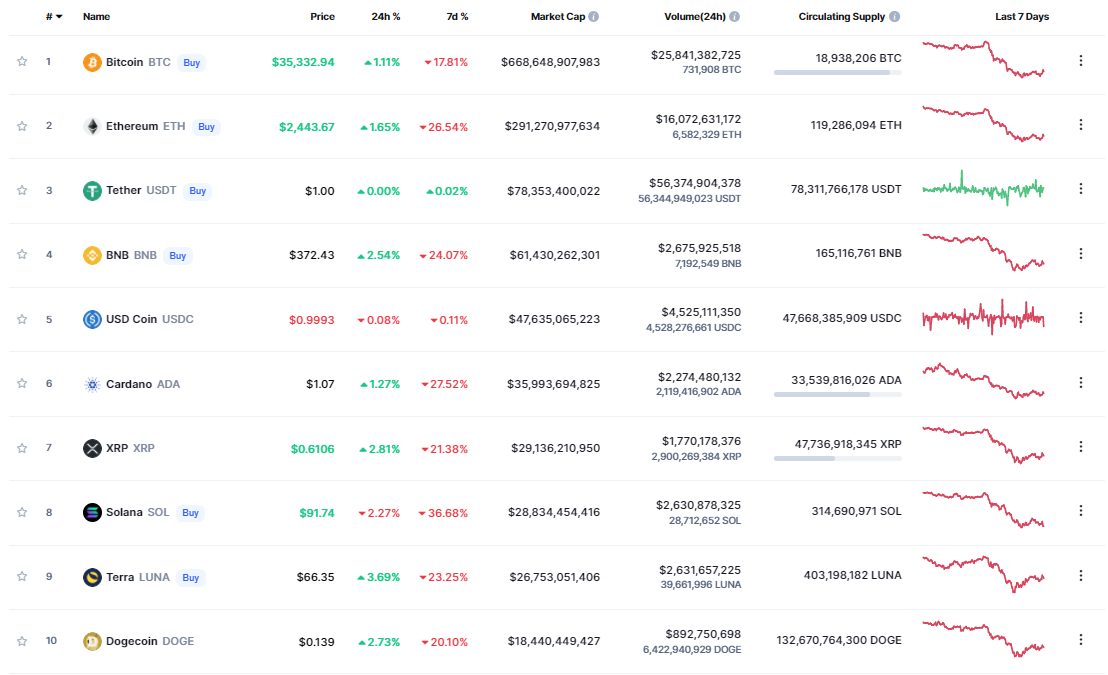

The top 10 cryptos by market cap fared somewhat better, although Solana’s 36 percent decline over the week is also partially due to it suffering another, yes another, DDoS (distributed denial-of-service) attack.

What Happened?

As the US Federal Reserve recently signalled its intent to tighten monetary policy in 2022, market sentiment shifted from risk-on to risk-off.

Risk-on assets are those with higher volatility, to the upside as well as the downside. These include assets like equities and crypto. Generally speaking, value stocks tend to be less risky than tech stocks. And Bitcoin is widely considered less risky than other digital assets.

Risk-off assets, by contrast, are assets with low volatility and therefore perceived as less risky. These are things like government bonds and cash, which don’t tend to fluctuate sharply in value.

With the broader market going risk-off, a Wall Street-induced equity sell-off saw close to US$500 billion in market cap erased over the course of five days. This move was amplified by a cascade of leveraged long liquidations, an all-too-familiar sight in the crypto markets:

As Bitcoin increasingly is viewed as risk-on in the short term, a fascinating positive correlation has emerged between the NASDAQ (a technology-focused index) and Bitcoin.

If you compare the NASDAQ to Bitcoin and then compare Bitcoin to the DeFi tokens, it’s evident that the further you go out on the risk curve, the harder you get hit when market sentiment goes risk-off:

While some may be feeling the Monday blues from the past few days’ crypto carnage, others will look at it similarly to the May 2021 sell-off, which in hindsight represented a great buying opportunity. Of course, hindsight is 20/20.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link