The market sentiment has continued to make small steps upwards since last Monday, potentially breaking a record in the number of individual coins in the positive zone. The average 7-day moving crypto market sentiment score (sentscore) for ten major coins is currently 6.36, compared to 6.27 we saw last week, per the data provided by the crypto market sentiment analysis site Omenics.

Nine out of the 10 major coins are in the positive zone – up from eight last week. While it’s another small step, this is the first time since Cryptonews.com started this weekly series back on February 2019 that such a high number of coins with a score of 6 and above has been recorded. Specifically, most have sentscores between 6 (XRP and chainlink (LINK)) and 6.6 (polkadot (DOT)).

Meanwhile, bitcoin (BTC) and ethereum (ETH) boast the scores of 7.6 and 7, respectively. Bitcoin’s minor rise was enough to push the score slightly up compared to last week, but ethereum’s was not.

Also, though all in the positive zone, the sentscores of three coins have decreased in the past week, these being DOT and LINK, as well as binance coin (BNB). DOT’s drop, though relatively small, is the highest among the three.

However, an interesting thing occurred among the green coins – while the scores of seven are up, one is undeniably the winner: tether (USDT)’s score increased 10.6%, bringing it up to the sentscore of 5.4, up from last week’s 4.9. In comparison, the second-placed uniswap (UNI) rose 5%, while cardano (ADA) and litecoin (LTC) are up around 2%.

This tether’s jump is notable as it’s been the only (occasionally one of two) coin with a score below 5 for weeks, often falling back below that level even when it had managed to reach slightly above. Additionally, it’s not uncommon for USDT to move between the biggest winner and the biggest loser title, though it is somewhat uncommon for it to lead with such a large margin.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone.

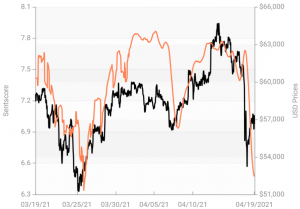

Zooming in to observe the 24-hour sentscore for these top 10 coins, we find the situation significantly different – and for the worse, reflecting the weekend sell-off. Compared to last Monday’s 6.3, the overall sentscore is down to the neutral 5.85. All coins are red, with bitcoin’s score dropping the most: 14.4%. It’s followed by ADA’s 11.9% and DOT’s 10.8%. The rest have fallen between 9.1% (BNB) and 1.9% (LINK), with ethereum’s 6.4% standing somewhere in the middle. Furthermore, BTC, ETH, and DOT are the only three remaining in the positive zone – the first two dropping from the 7 level to 6.5 each, and the latter standing at the verge of the positive zone with the score of 6.

No coin is in the negative zone, however, or even below 5. Their scores range between cardano’s 5.3 and – again, somewhat surprisingly – tether’s 5.9. This indicates that USDT had previously hit a positive 24h sentscore, up from just 4.7 seen last Monday.

Daily Bitcoin sentscore change in the past month:

Still, the week was kind to the 25 coins outside the top 10 list as well, with the scores of only 9 of them dropping – and by relatively minor percentages. The highest fall is 3.5% seen by zcash (ZEC), which wasn’t enough to push it out of the positive zone. The increases haven’t been particularly high either, with the highest one claimed by QTUM, with 5.5%. That said, 14 are in the positive zone, up from last week’s 8, with the highest among them being algorand (ALGO)’s 6.6. Furthermore, no coin has a score below 5.4.

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptocurrencies.

Credit: Source link