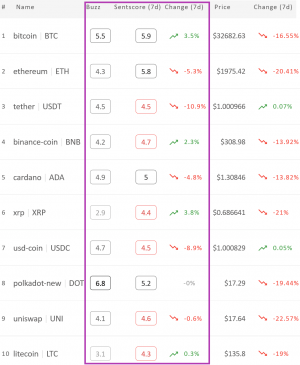

The crypto market is not doing very well, and neither is the market sentiment. The average 7-day moving crypto market sentiment score (sentscore) for ten major coins slipped yet again, this time from last week’s 5 to this week’s 4.89 – the closest it’s been to the negative zone in months, according to the market sentiment analysis service Omenics. There are no more coins in the positive zone, and the majority now has sentscores below 5.

Bitcoin (BTC) is back in the lead when it comes to the highest sentscore among the top 10 on Omenics’ list, having a score of 5.9, pushing ethereum (ETH) to the second place. Furthermore, BTC is in the second place among the week’s winners, having gone up 3.5% over the course of the past seven days. Notably, however, this improvement came before the latest round in China’s crackdown on the crypto industry, including Bitcoin miners.

Meanwhile, the number one winner is XRP, the score of which went up almost 4%. Two other green coins are binance coin (BNB), which is up 2%, while litecoin (LTC) is almost unchanged.

While polkadot (DOT) remained unchanged too, the remaining five coins have all seen a drop in their respective scores. The highest among these is tether (USDT)’s 11%. The second place is taken by USD coin (USDC)’s nearly 9%. While ethereum and cardano (ADA) dropped around 5%, uniswap (UNI)’s sentscore decreased the least among the five, 0.6%

And though XRP is the week’s winner, it has the second-lowest sentscore on this list, of 4.4, with another green coin, LTC, having the lowest, of 4.3. Four other coins have scores below 5, thus nearing the negative zone – some more than the others, while four coins have scores between ADA’s 5 and BTC’s 5.9.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone.

The last 24 hours present a clearer picture of how the crackdown may have influenced the market sentiment. The overall sentecore for the 10 coins is down again and to 4.53, compared to last Monday’s 4.79. All but three coins are red. The three are USDC, which saw a significant rise of nearly 13%, as well as LTC and UNI with rises of 2% and 1.6%, respectively. The largest drop is DOT’s 11%, followed by BTC’s almost 9%, and the lowest are ADA’s 2% and ETH’s 2%. All coins but one are below the sentscore of 5 – including BTC (4.9). ETH has the highest score of 5.4, while the lowest is BNB’s 4, putting it on the verge of the negative zone.

Daily Bitcoin sentscore change in the past month:

Besides these 10, Omenics is tracking 25 other coins, and the majority of these are red as well. Over the course of the past week, only six of them saw their sentscores increasing, the highest being 0x (ZRX)’s 8% and the lowest tezos (XTZ)’s 2%. Meanwhile, the drops range between vechain (VET)’s 12% and REN’s 1%. Zcash (ZEC) is unchanged. No coin is in the positive zone, five have sentscores above 5 with algorand (ALGO)’s 5.8 leading the list, and three (one more than the last week) are in the negative zone: QTUM, OMG, and ontology (ONT).

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.

Credit: Source link