The growth of business models outside crypto exchanges demonstrates the maturation of the crypto market’s infrastructure, while a noticeable decline in pre-seed deals shows a lack of new entrepreneurial entrants to the cryptospace, according to Mike Novogratz-led crypto-focused financial services and investment management firm Galaxy Digital.

Alex Thorn, the company’s Head of Firmwide Research, said that until recently, the biggest share of the capital invested in the crypto ecosystem would end up in early-stage startups. However, in the first quarter of 2021, most venture funds were for the first time injected in later-stage startups.

“We see a maturation of the startup ecosystem when we look at median deal size and valuation. Both metrics spiked noticeably in 1Q21 to [all time highs],” Thorn said, adding that the median pre-money valuations in the first quarter of this year were up 340% year-on-year compared with the first three months of 2020.

The reported crypto industry valuations have exceeded those in the broader venture capital market, bringing forward an intensified competition among investors for most promising startups.

“Investors find themselves jockeying for position as increased demand, relatively low deal count, and a maturing crypto startup ecosystem all contribute to a founder-friendly environment,” he said. “Crypto startups are maturing. While exchanges are still the most valuable, we also see valuable companies operating in lending, custody, brokerage, [market] making, & elsewhere.”

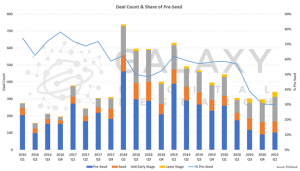

Thorn estimates that it is likely that the current bull market will pave the way for a new wave of entrepreneurs and new startups, but the collected data indicates this has not yet occurred at scale.

Meanwhile, another observed trend points to a decline in pre-seed deals which have continued to decrease since reaching highs in the first quarter of 2018, the analyst said. Due to this, in the fourth quarter of 2020, the share of pre-seed deals was lower than in any quarter since before 2016.

“The decline in pre-seed deals appears to show a slowing of new entrants into the ecosystem,” according to Thorn. “It is likely that the current bull market will bring a new wave of entrepreneurs and new startups, but the data shows it has not yet occurred at scale. Where in this cycle that influx occurs, or whether it occurs at all, remains to be seen.”

____

Learn more:

– Paxos Raises USD 300M at USD 2.4B Valuation

– Prepare Your Crypto Startups as Binance is Shopping

– Crypto and Traditional Finance To Merge Via M&As

– Ripple Goes For M&A in Asia Amid Legal Battle In US

– Mitsubishi, Banking & Telecom Giants Invest USD 62M in DeCurret

– BNY Mellon Doubles Down On Its Bitcoin Plans, Invests In Fireblocks

– Europe Gets Its New Crypto Unicorn, Bitpanda

– IPOs, M&As, and New Token Sales To Bring Fresh Capital For Crypto in 2021

Credit: Source link