Global financial chiefs have suggested that they may look to more aggressive tax collecting measures in advanced economies as a means to dig the world economy out of a “disturbing” impending coronavirus pandemic-induced debt hole.

The comments were made at a virtual summit of the International Monetary Fund (IMF), streamed online, during a seminar named “Averting a COVID-19 Debt Trap” today. Attendees addressed possible ways “to contain debt risks through better debt architecture and transparency” and asked how “global cooperation” might help alleviate the problem.

The IMF’s Managing Director, the Bulgarian economist and the former CEO of the World Bank Kristalina Georgieva, claimed that the world had “entered the pandemic with high levels of debt,” with 56% of low-income countries at risk of or already in the grips of “debt distress.”

She added that the risk for developing countries was twofold: With a slower rollout of vaccines than richer economies, lower-income areas would likely “lag in years behind advanced-economy countries without support.” And, she opined, good economic news “for some” could “turn into bad news for others.” A faster United States recovery, she added, “may push up interest rates, increasing the debt burden for developing world.”

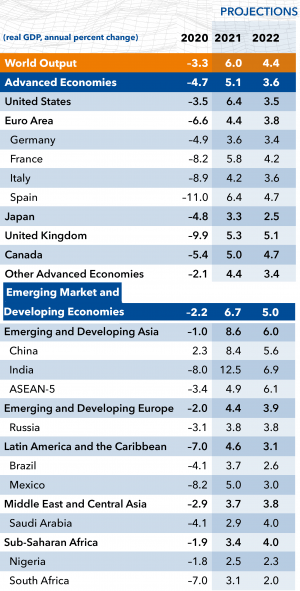

Indeed, the IMF’s latest projections saw global GDP forecasted to rise by over 6% this year, dropping down to just under 4.4% in 2022 – after global output dropped by 3.3% in 2020. America, though, is expected to outstrip the global average with 6.4% growth, while the pace of growth will be the lowest in Sub-Saharan Africa, at just 3.1%.

But Georgieva indicated that IMF’s “path forward” involved “more grants and increased support” to “bring down [poorer countries’] debt levels.” And with the 30-or-so poorest nations temporarily not currently paying back IMF loans due to the economic fallout of the pandemic, she called on advanced countries to ensure “all hands” were “on deck.” And this, she claimed, involved governments to “collect taxes more effectively.”

Her comments came hot on the heels of calls for international tax reform from Janet Yellen, the American Treasury Secretary. Yellen has recently spoken of her desire to see a “global corporate tax” system put into place.

AP quoted the Treasury chief as stating she wanted to “make sure that governments have stable tax systems that raise sufficient revenue to invest in essential public goods.”

Many governments have already sought to bolster the public coffers by clamping down on crypto tax evasion – and imposing capital gains and income tax levies on crypto-related profits.

Experts recently told Cryptonews.com that bitcoin (BTC) could become a “safe haven” if the debt crisis escalates – with even a possible selloff likely followed by people returning to BTC at a later date.

Georgieva added that transparency would be key in its approach to global debt. She said that the IMF “must press very hard to make it so that mountains of debt that are often hidden” were made public, and “expose” debt contracts and some of their often “ridiculous conditions.”

She also talked about building a common framework for creditors and “making it stick” for traditional lenders as well as a new breed, including possible private-sector creditors, and parties from countries like “China and Turkey.”

She warned,

“We cannot afford complacency. If countries are not committed to moving with us, nations will start falling into the debt trap.”

Martin Wolf, the chief economics commentator at the Financial Times, drew attention to polls run by the IMF on LinkedIn where 48% of respondents said they were “extremely worried” by the escalating debt crisis and 23% said that “low, stable inflation” would be key to alleviating the situation.

He noted that the attendees had painted “a disturbing picture” of the likely outcome.

Mohamed El-Erian, the President of Queens’ College, Cambridge, and Allianz’s Chief Economic Advisor, claimed that higher growth and the “timely restructuring of debt” could help avoid the kind of debt crisis the world faced in the early 1980s and again in 2008, but opined that a “lost decade” could be looming. “More market volatility” could follow if the correct measures were not followed, El-Erian added.

He warned that part of the debt restructuring solution “will involve using the stick” in the system, “not the carrot.” He added that there was “too much complacency right now” and warned that many markets were “flooded with liquidity” that had “made debt problems worse.”

The crisis, he added, could be worse than that of the 1980s, particularly in Africa and parts of Asia.

But the Under-Secretary-General of the United Nations, Vera Songwe, who is also the Executive Secretary of the Economic Commission for Africa, noted that debt-to-GDP levels are currently at 65% in Africa, and opined that a “lack of private sector participation” could compound the problem.

She said, “Vulnerable middle-income countries, such as Morocco […] are suffering from a lack of tourism.” And this, Songwe said, could propel lower-income countries into negative spirals.

And while others were more guarded about the role of the private sector and Chinese players in alleviating developing-nation debt, Songwe stated that liquidity was badly needed. “Emerging economies have not seen enough liquidity,” she said, adding:

“[These countries] need new liquidity yesterday. […] The private sector needs to come to the markets – and do so at the right cost. We can reduce the cost of market access. […If not,] 170 million people may fall into poverty. Can we really afford to let so many people fall into poverty?”

____

Learn more:

– Crypto and Tax in 2021: Be Ready to Pay More

– IMF Says Higher Rates Might Reduce Appetite for Risk. And Bitcoin?

– Bitcoin Faces Hedge Test Amid Rising Inflation Concerns

– Why The Return Of High Inflation Can No Longer Be Excluded

– Joe Biden’s USD 1.9T Stimulus Won’t Reignite World Economy

– A Debt-Fuelled Economic Crisis & Bitcoin: What to Expect?

Credit: Source link