Today, April 14, US-based major crypto exchange Coinbase goes public on the Nasdaq stock exchange via a direct listing of its shares under the symbol ‘COIN’, with a great number of narratives surrounding the event.

The company will let current shareholders directly sell their shares on the stock exchange. Nearly 115m Coinbase shares will be put on the market to start.

In light of this event, let’s look into the main narratives surrounding Coinbase going public, and the effects industry insiders find it may have – all of which are firmly intertwined, with one effect leading to or fuelling another. Importantly, most insiders can’t say without a doubt that the listing will be a massive success or that all predictions would come true, but they see the event as largely positive for the exchange and the industry as a whole.

Helps legitimize the industry

The Coinbase listing – which the New York Times described as “crypto’s coming-out party” – sends crypto on a fast track into the mainstream, and it could serve as a massive test for the industry’s legitimacy.

Eric Kapfhammer, COO and Head of Polyient Capital at Polyient, said in an emailed commentary that the listing will be seen as an element that lends credibility to the space, and as many crypto supporters and investors are invested in its success, the listing effects will be felt across the sector.

“Will it be a success? In a sense, merely getting to this stage – a public listing stock – is an incredible achievement in itself,” argued Kapfhammer.

Jun Li, Founder of public blockchain Ontology (ONT), went a step further and said that this listing “will reset the entire blockchain market.” Investors will be able to “point to Coinbase as a properly vetted, and publicly-traded company as a starting point when reaching out to new market entrants whether those are limited partners, new investors, or other firms. This is a very exciting time.”

Helps regulate the industry

Following the listing, Jun Li argued, there will be a “welcomed increased pressure” on states to bring policy and regulation to the blockchain and crypto industries and without regulation the industry will not be officially recognized.

Investors who may be wary of buying crypto directly, now gain the ability to own stock in business approved by the US Securities and Exchange Commission (SEC) that facilitates the transactions.

Helps reassure the industry

Over the recent months, even years, there were constant whispers of potential bans. However, Coinbase listing in the US is a big deal for many investors because “it somehow sends a signal that the US lawmakers aren’t going to ban bitcoin (BTC), and the crypto king is here to stay now,” argued Naeem Aslam, chief market analyst at AvaTrade, as reported by MarketWatch.

Furthermore, any industry that can launch a listing of this size “is without a doubt a real thing, and it’s proven by the market,” Bradley Tusk, a venture capital investor whose firm Tusk Venture Partners backed Coinbase, told the NYT.

Provides another way to get exposure to a wide range of digital assets

This is another major narrative surrounding the listing, which also fuels a number of bullish statements. Manuel Rensink, Strategy Director at Securrency, described the listing as “a huge shot in the arm for the credibility of digital assets,” and especially those listed on Coinbase, including stablecoins, decentralized finance (DeFi) coins, and utility coins, but not yet digital securities. A next step will certainly be listing COIN on Coinbase, said Rensink. (Meanwhile, a competing major exchange, Binance, already said it will list Coinbase Stock Token (COIN) today.)

Fuels capital flows

Rensink made another relevant point, and that is that, as more blockchain companies join COIN on Nasdaq, alongside a string of Bitcoin exchange-traded funds (ETFs), “we will see that the digital markets will start driving the traditional equity markets, triggering trillions in capital flows.”

In Eric Kapfhammer’s opinion, once established, there will be more flow of capital into crypto-focused companies and cryptocurrencies themselves.

Bridges crypto and traditional finance

“The Coinbase Nasdaq listing is essentially the first legitimate bridge between the traditional capital markets and the crypto markets,” argued Kapfhammer. Added to this the mentioned boost in capital flows, “this could be viewed as the end of the beginning, or introductory phase of the evolution of the industry. Que mass adoption!”, he said.

Jun Li also sees the acceptance of crypto business in traditional finance, resulting in more funding and investment from a range of different institutional investors on the one hand, and attracting new talent to the industry with broader skill sets on the other. “I expect that this will be warmly welcomed by Wall Street as many of the institutions there already recognize the potential that blockchain has,” Li said.

Meanwhile, per Bloomberg, Barry Schuler, a co-founder of Coinbase investor DFJ Growth, said that Coinbase is “going to build out a full financial services company. […] Like a crypto version of a Goldman Sachs or a Morgan Stanley.”

It’s bullish for the entire crypto industry

Thanks to the offered exposure to COIN, Rensink said, many other centralized and decentralized exchanges will benefit from a successful Coinbase listing.

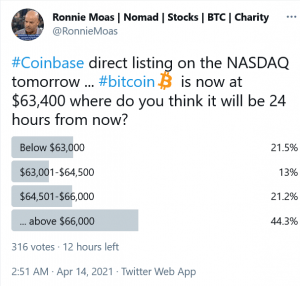

It’s also presumed that the listing may lead to a further increase in institutional interest in crypto, which will then fuel crypto prices. Whether the listing will be beneficial for the prices of crypto is yet unknown as some doubt it, but on April 14, both bitcoin and ethereum (ETH) hit their new all-time highs of USD 64,769 and USD 2,385, respectively.

Eric Kapfhammer argued that “after years of crypto picking away at the edges of the financial markets landscape, the Coinbase listing should serve as the example that there are legitimate and mainstream-ready crypto businesses ready to integrate into the broader capital markets.” Increased access to traditional markets should spur a growth phase in the industry as a whole, and there’s likely to be maturation in the space in terms of investment flows, as well as the expansion and development of new services with the accompanying infrastructure.

Greg Carson, Head of Corporate Development and Venture Capital at Stablehouse, said that if Coinbase does well, it’s a bullish indicator, but “the listing itself will draw a lot of attention to the opportunities that bitcoin and crypto are bringing to the world,” leading to larger global acceptance of the concepts and innovations that have been introduced.

Triggers existential risk to legacy institutions

Seamus Donoghue, VP of Strategic Alliances at METACO, commented that the listing is “a definite statement of the coming of age of a pure play crypto business available for mainstream investment,” and that its growth metrics and market capitalization will place it in the top tier of all global financial institutions. This will make it visible to the mainstream, while a successful listing would see more capital further drive the sector’s exponential growth. He said,

“Coinbase will put paid to the notion that there is no sustainable business model in crypto, and more importantly, will put fear into incumbents that crypto will indeed “eat the banks and financial firms” if they don’t get involved. […] Legacy financial firms are already seeing their most profitable services being disrupted by fintech, with fintech firms forcing banks to compete with a new business model. However, the rapid growth and success of Coinbase building a crypto bank provide a far more existential risk to legacy institutions. The full range of services provided by Coinbase potentially provides a permanent exit out of the legacy banking system to a completely new global digital-crypto banking model. “

It’s reminiscent of historical events

Amber Ghaddar, co-founder of AllianceBlock, noted that the frenzy surrounding this listing is reminiscent of gold miners trade as a proxy investment to gold – certain equity investors couldn’t access gold a few decades back as they didn’t have a commodity and/or derivative mandate and were instead investing in gold miners. “Many retail and institutional investors eying the Coinbase listing are doing the same: they have neither the knowledge nor the infrastructure to invest in Bitcoin and crypto and are using Coinbase as a proxy investment in the sector,” said Ghaddar.

Affects the entire society

Connected to the previous point, the listing may affect the society as a whole, far beyond the Cryptosphere alone. “When people are considering whether to invest in Coinbase, zoom out and think about what Crypto means for society from here,” Garry Tan, founder and managing partner at Initialized Capital and an early-stage Coinbase investor, told Bloomberg, adding that Coinbase is this decade’s Microsoft, Netscape, Google, or Facebook.

Similarly, Greg Carson argued that going public is a validator for any emerging industry and a trend clearly seen throughout the history of emerging technology — computers (Apple), mobile phone companies (Sprint), software companies (Microsoft), and internet companies (Amazon, Google), which all had periods where the financial community and public were sceptical. He added that,

“Going public in the face of this skepticism is a bellwether event, leading to acceptance from traditional spaces and transformation of their industries over time. In the case of Coinbase’s IPO, there is a promise for reshaping of both the technology and financial spaces — meaning we may see twice the validation.”

Reignites the DPO vs IPO debate

This was the conclusion by Alex Coffey, Senior Specialist at TD Ameritrade‘s Trader Group. His article noted a number of differences between initial public offerings (IPOs), which use a broker, and direct public offerings (DPOs), that use a direct approach. The latter may give companies more control over the terms of their offerings because they aren’t working with an investment bank, resulting in all investors having equal access to the shares.

Let the buyer beware

Per this saying, the buyer alone is responsible for checking the quality of goods before a purchase. Jason Blick, CEO of EQIBank, argued that, while Coinbase’s listing will provide “long needed” transparency to its finances, its underlying business model is subject to “extraordinary pressure.” He explained that in the ‘race to the bottom’ pricing models of leading exchanges, investor expectations of dramatic long-term returns may be quickly vanquished as lower prices result in profit margins being permanently squeezed. “Whether this can be offset by access to the public markets has yet to be seen, but unless Coinbase rapidly expands its product sets to embrace higher-margin financial services, Caveat emptor has never been more appropriate,” said Blick.

MoffettNathanson’s Lisa Ellis, who is bullish on the stock, warned that investing in Coinbase is not for the faint of heart, as the business and the stock “will likely see dramatic, potentially protracted, swings,” reported Axios.

The early birds in COIN will likely be hedge funds and retail, who may be buying into them “pretty heavily,” said Olivier Marciot, a portfolio manager at Unigestion, but this “shouldn’t be a clear indication of how they will be in the longer term.”

We’re now certainly in the latest boom, said for the NYT Nick Tomaino, 1confirmation Founder and former Coinbase employee. He couldn’t say if that’s going to turn tomorrow or two years from now, but “the busts and booms are always higher than the last.”

Proves the fragility of valuation system

Per Amber Ghaddar, in terms of euphoric valuations, Coinbase is right up there with Tesla, while, “based on valuations in European private markets,” it was trading at a USD 150bn valuation on April 13, higher than the LSEG, ICE and CME market capitalizations combined, as well as close to 60 price to sales ratio, while other exchanges trade between 3 (Nasdaq) to 15 (CME). “This is further proof that the framework of traditional valuations is broken and the current euphoria, driven in part by helicopter money, is nothing but unsustainable,” said Ghaddar.

‘OK, Boomer’?

The listing follows the exchange reporting USD 1.8bn in revenue in the first quarter of 2021, compared to USD 1.3bn for the entire 2020.

As reported, the listing could value the company at upwards of USD 100bn. Hugh Tallents, a financial services consultant at CG42, told Axios that the valuation will likely “raise tremendous eyebrows, but it’ll be one of those kind of ‘OK, Boomer’ moments where if you don’t believe in the cult, then the valuation will be mind-boggling for you.”

But to justify that number, Coinbase would need to mushroom into the biggest financial exchange in the world, Fortune said. “It’s part of the overall frenzy creating bubbles everywhere,” they quoted David Trainer, an analyst at research firm New Constructs. “When you do the numbers, there’s no way to make an argument for owning this stock with a straight face.” Getting to this number looks like “a mathematical impossibility.”

An earlier MarketWatch article stated that “the company has little to no chance of meeting the future profit expectations that are baked into its ridiculously high expected valuation of USD 100 billion,” and that the valuation should be closer to USD 18.9 bn.

Meanwhile, Nasdaq announced on Tuesday that the exchange was given a reference price of USD 250 a share, which values it at around USD 65.3bn. The reference price is based on past transactions of Coinbase shares on private exchanges and input from the investment bankers, but it doesn’t indicate where the stock will open.

_____

Other reactions

@CryptoMichNL Whenever youtubers talk about the rise of bitcoin then comes the big drops. Same thing happened lastw… https://t.co/qg6IORhIXL

— 01001101 01110010 00101110 01001110 01101111 🗸 (@dvrmc1975)

@MatiGreenspan True. Obvo it’s #bitcoin . But also right now it’s more like a truck full of gasoline into the ragin… https://t.co/xCxDmfMED8

The big lesson for me here has been: don’t over-think what’s obvious. Crypto is still evolving and part of that is… https://t.co/fvNurDj0na

____

Learn more:

– Considering Coinbase’s COIN? You Might Be Better Buying Bitcoin Instead

– Coinbase Employees Get Extra Millions That Might Be Spent on BTC and Alts

– Coinbase Goes Public This Week – What To Expect?

– Coinbase Listing Won’t Help Bitcoin Price – Analyst

– BTC Slips As Coinbase Sees 15% User Growth At Best, Focuses on Altcoins

– The Dark Side Of Coinbase Listing

– Bitcoin, Ethereum Hit New ATHs One Day Before Coinbase Listing

__

(Updated at 11:19 UTC with additional reactions.)

Credit: Source link