Cboe Global Markets, a Chicago-based exchange that provides trading and investment solutions, is ready to get back into the crypto space after previous failed attempts.

Not giving up

According to Cboe CEO Ed Tilly:

“We’re still interested in the space; we haven’t given up on it. We’re keen on building out the entire platform. There’s a lot of demand from retail and institutions, and we need to be there.”

The American company stopped offering Bitcoin Futures some years back, and its attempts to list a BTC exchange-traded product has been unsuccessful.

As the demand for crypto products skyrocket, Cboe Global Markets does not want to miss this bandwagon based on its unrelenting efforts to avail crypto offerings.

An overwhelming appetite by institutional investors in the crypto market has made the demand go through the roof. For instance, Elon Musk, the CEO of American electric vehicle manufacturer Tesla, has disclosed that clients will have the liberty to purchase vehicles using Bitcoin.

Bitcoin has joined the big leagues

Cboe Global Markets has, therefore, set its eyes on the crypto space because this market is entering the early stages of mainstream adoption, as acknowledged by Kraken CEO Jesse Powell.

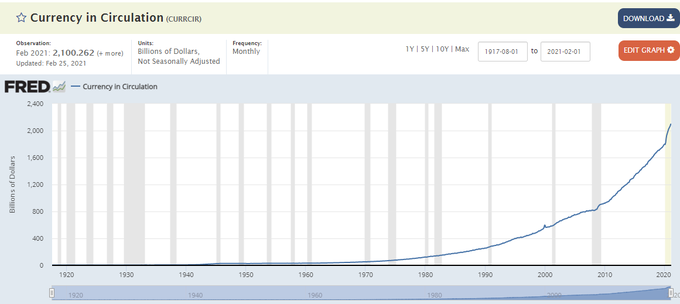

For instance, veteran trader Peter Brandt recently disclosed that Bitcoin has joined the big leagues as its market capitalization stands at $1 trillion, whereas the US dollars in circulation are estimated to be nearly $2.1 trillion and gold reserves are at $2.2 trillion.

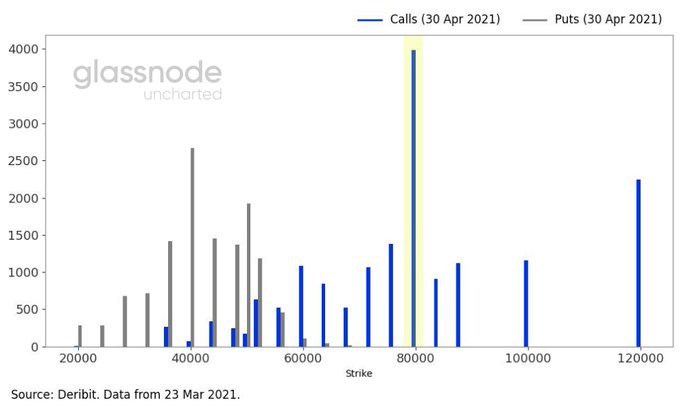

With BTC options worth $6 billion expected to expire tomorrow, Bitcoin price expectations for April are high as most investors are placing their new bets on $80k, as alluded to by Glassnode co-founders Jan & Yann.

The crypto market is, therefore emerging and gaining mainstream attention in the financial sector based on its rising popularity – as its market capitalization inches closer to the $2 trillion mark.

Image source: Shutterstock

Credit: Source link