Bitcoin exchange outflows, a key market indicator, have reached a one-year high providing an additional signal that bodes well for the apex predator of digital assets.

Exchange Outflows

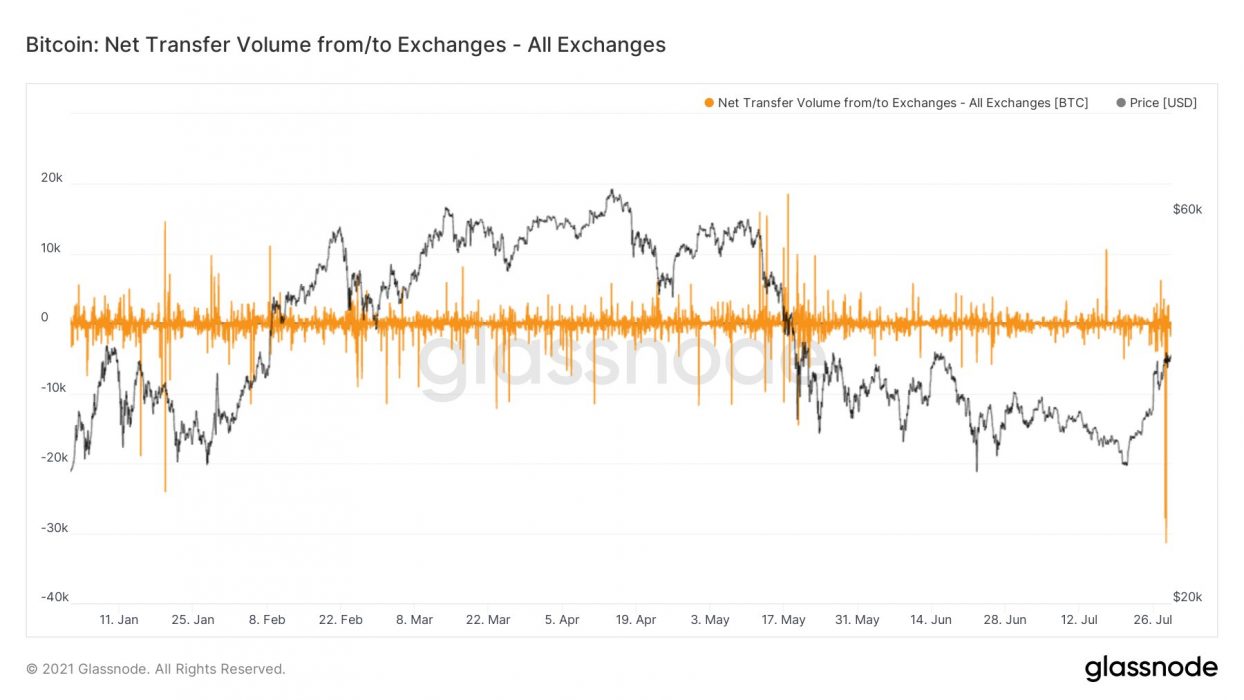

Bybt and CryptoQuant shared data that showed the highest one-day outflow in at least a year. In 24 hours, 57,000 BTC – worth over US$2 billion – left exchanges.

Bitcoin Archive was quick to chime in on the bullish news:

While no single market indicator should be considered as definitive evidence of a trend, the latest data reflecting massive Bitcoin outflows from exchanges has provided much cause for optimism.

Generally, large exchange outflows are indicative of investors taking their bitcoins “off market” and into cold storage. The reverse is true when exchange inflows are high. Note the precipitous drop in net transfer volume in Glassnode’s dataset below:

Bull Market Continues?

Bitcoin went sideways for months on end, leaving many investors questioning whether the bull run was over. Of late, however, the market sentiment appears to have shifted, at least as measured by the Bitcoin Fear and Greed Index:

There have been a number of promising market indicators in the past month suggesting that a sharp rise may be around the corner. From the reduction in leveraged shorts to growing evidence of a supply squeeze, Bitcoin bears appear to be on the back foot, at least for now.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link