Polygon (MATIC) is trading in an uptrend, like many other altcoins. The cryptocurrency MATIC just went up +40% in a single day by breaking a rising wedge pattern with strong buying volume and surges over +132.23% in a week.

What is MATIC?

Polygon (previously Matic Network) is one of the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

Polygon effectively transforms Ethereum into a full-fledged multi-chain system (aka Internet of Blockchains). This multi-chain system is akin to other ones such as Polkadot, Cosmos, Avalanche, etc. with the advantages of Ethereum’s security, vibrant ecosystem, and openness.

MATIC Price Analysis

At the time of writing, MATIC is ranked 35th cryptocurrency globally and the current price is $1.11 AUD. This is a +132.23% increase since 22nd April 2021 (7 days ago) as shown in the chart below.

After looking at the above 1-day candle chart, we can clearly see that Matic was trading inside the rising wedge pattern on the MATIC/USDT pair. The first resistance was on the $0.56 AUD price levels which MATIC broke with a strong bullish trend buying volume and is now heading towards the all-time high price in AUD. Seeing that many altcoins are holding strong this week, MATIC might continue to increase in the uptrend if the traders keep buying with high volume.

A rising wedge is a technical indicator, suggesting a reversal pattern frequently seen in bear markets. This pattern shows up in charts when the price moves upward with pivot highs and lows converging toward a single point known as the apex.

Larry Swing from Investopedia

A week ago, the MATIC/USDT price challenged the strength of $0.61 AUD level, where buyers showed that they were still in the game and abruptly bought back the price, having already made 2x.

That seems to suggest a chance that in the near future the price of MATIC/USD might reach the level of $1.30 AUD, and possibly even a round mark of $1.50 AUD.

What do the Technical indicators say?

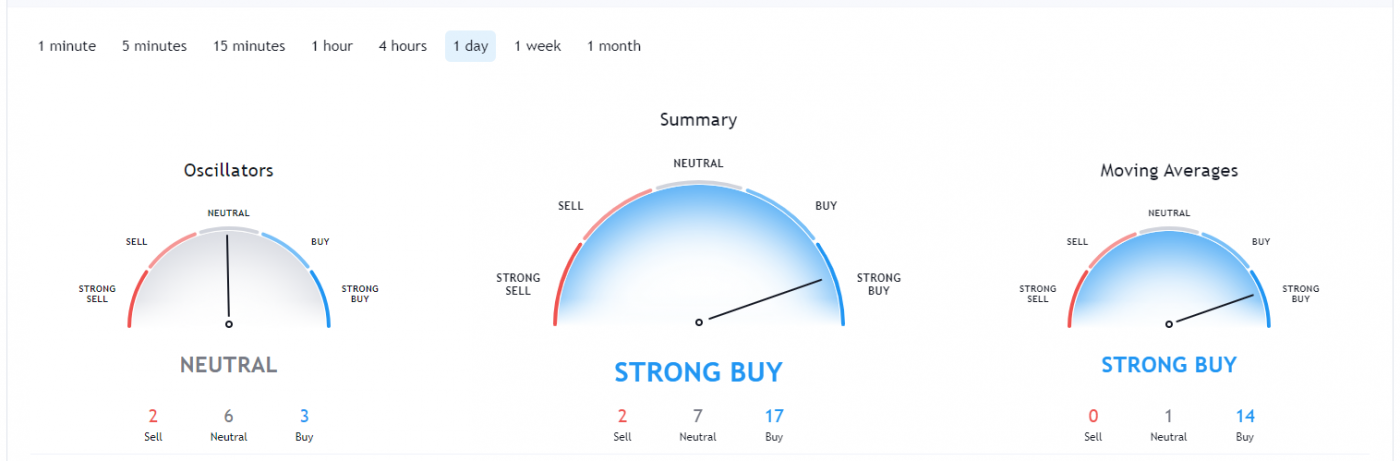

The Matic TradingView indicators (on the 1 day) mainly indicate MATIC as a strong buy, except the Oscillators which indicate MATIC as a neutral.

So Why did Matic Breakout?

General market sentiment seems to suggest cryptos are in the middle of the bull run season, which could have contributed to the recent breakout. Another reason for this sudden pump in price could be whales secretly buying MATIC for the next Altcoins rally. It could also have contributed to some of the recent news to earn staking rewards while participating in DeFi with StakeHound.

Record activity on Ethereum has led to network congestion and high transaction costs this year. The dynamic in turn has driven an increase in demand for alternative “smart-contact” blockchain networks, such as Binance Smart Chain (BSC), along with scaling projects like Polygon that provide faster and cheaper transactions using layer 2 sidechains. These are tangential networks running alongside the main Ethereum blockchain.

In recent weeks, Polygon has won increasing adoption, with top names from the world of decentralized finance (DeFi) announcing integration with the layer 2 scaling solution in a bid to bypass congestion and high fees on Ethereum’s network.

Where to Buy or Trade Matic?

MATIC has the highest liquidity on the Binance exchange so that would help for trading MATIC/BTC or MATIC/USDT pairs. However, if you’re just looking at buying some quick and HODLing then Swyftx exchange is a popular choice in Australia.

Join in the conversation on this article’s Twitter thread.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link