A Bloomberg crypto analyst says that Bitcoin’s price chart has an “air pocket” that could send BTC higher much quicker than traders realize.

Blockchain analyst Jamie Coutts says on social media platform X that Bitcoin has sat in such a tight range for over six months that an eventual break to the upside could be unexpectedly explosive.

Coutts shares a chart showing Bitcoin’s URPD, or UTXO (unspent transaction output) realized price distribution, which keeps track of the number of existing coins that last moved within a given price range.

“For half a year, this asset’s danced between $25k-$31k. More coins have changed hands in this tight range than anywhere else in its price distribution. This is also the longest period of compressed volatility in its history. The next phase in the breakdown of the fiat monetary order is nearly upon us. Gold is also hinting at this. When Bitcoin breaks $31k, it’s an air pocket to $39k.”

An “air pocket” usually refers to a price range where relatively little volume has occurred and few positions are held, making the area volatile due to a lack of liquidity.

At time of writing, Bitcoin is trading at $30,971, just below the potential breakout level identified by Coutts.

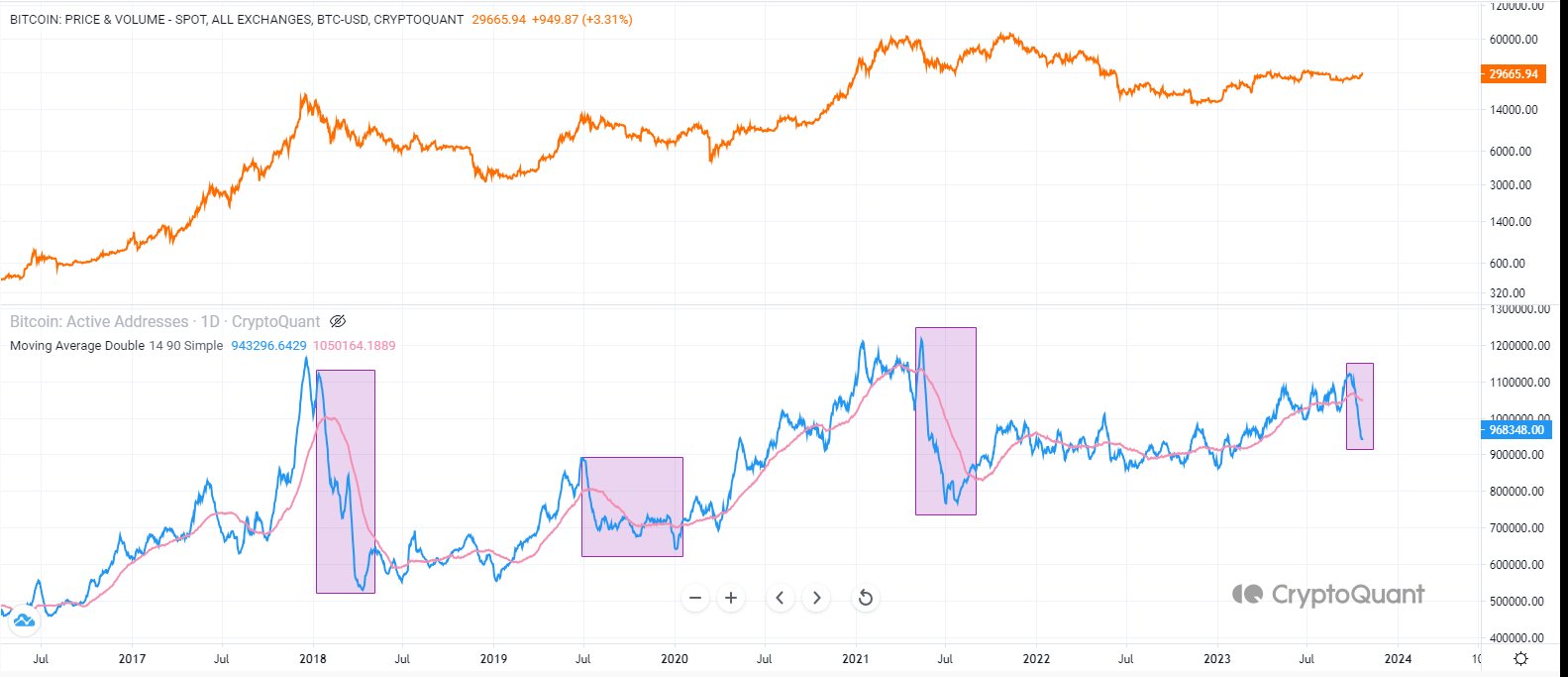

The analyst also notes that Bitcoin’s active addresses (AAs) have experienced a sharp downturn, which he notes is traditionally a bearish signal for the price of BTC. He says a break of either $31,000 or a collapse past $24,000 will clarify Bitcoin’s market structure.

“Bitcoin’s active addresses (AA) have dropped sharply- the most pronounced 1-month fall since mid-2021. While BRC/Ordinals have distorted some on-chain metrics this year, a dwindling AA typically is not price positive. The divergence between price and AA underscores building market expectations for ETF listings and a liquidity pivot.

With the mkt chopping between $25k-$30k everything is noise until we breach the $31k resistance (or $24k support).”

Generated Image: DALLE-2

Credit: Source link