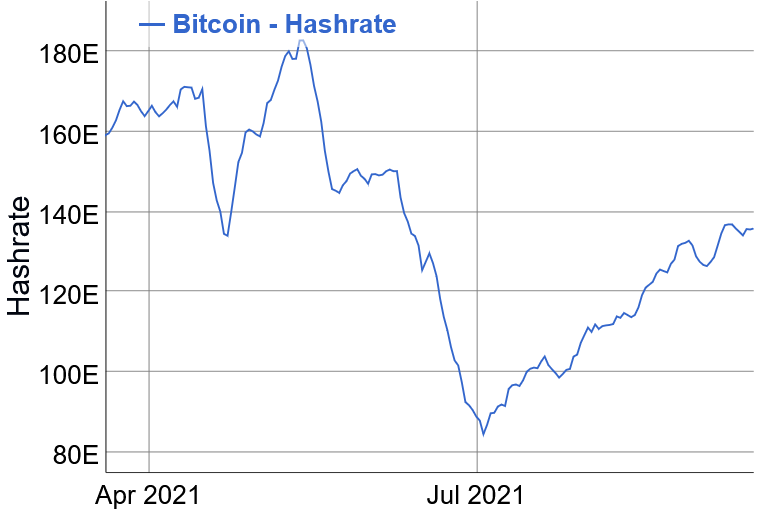

There has been a significant upward revision in expected Bitcoin (BTC) hashrate by digital asset financial technology and services platform Bitooda. At the same time, they have lowered their BTC fee revenue estimations.

Bitcoin hashrate is now expected to reach 198 EH/s by the end of this year versus the July estimate of 145 EH/s, the company said in their latest report.

This comes as the hashrate that had been lost following China’s mining ban has recovered at a faster pace than industry observers presumed it would.

Following the introduction of this now notorious ban, which resulted in a loss of about 100 EH/s, the hashrate recovery has exceeded analysts’ expectations, reaching the current level of 131.7 EH/s.

Bitooda recognizes certain risks to its hashrate estimates, where a potential upside risk would possibly be “driven by easing infrastructure constraints, coupled with surging [BTC] price.”

Per BitInfoCharts.com, the 7-day simple moving average hashrate has been on the rise since the early July lows of 84.53 EH/s. On September 16, it stood at 135.93 EH/s, slightly lower than the 3-month high of nearly 137 EH/s. The highest point it reached this year – also its all-time high – was 182.95 EH/s seen back in May.

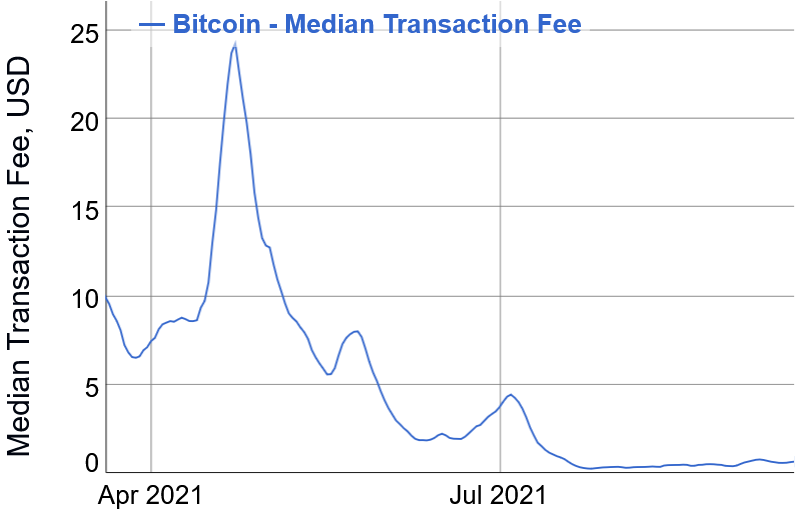

In its analysis, Bitooda also notes that Bitcoin’s transaction (Tx) fees have proved lower than recently anticipated, encouraging its analysts to suspect a shift of trading from Asia to the West, coupled with a cut in overall trading volumes.

“Over time, increased Layer 2 deployment would also lower Layer 1 congestion and thus fees,” according to the analysis. “We are lowering our long‐term estimates, with Tx fees not expected to exceed block rewards until 2028.”

Layer 1 (L1) is the base protocol (the Bitcoin blockchain), while Layer 2 (L2) is any protocol built on top of it, such as the Lightning Network, that makes BTC transactions faster and cheaper.

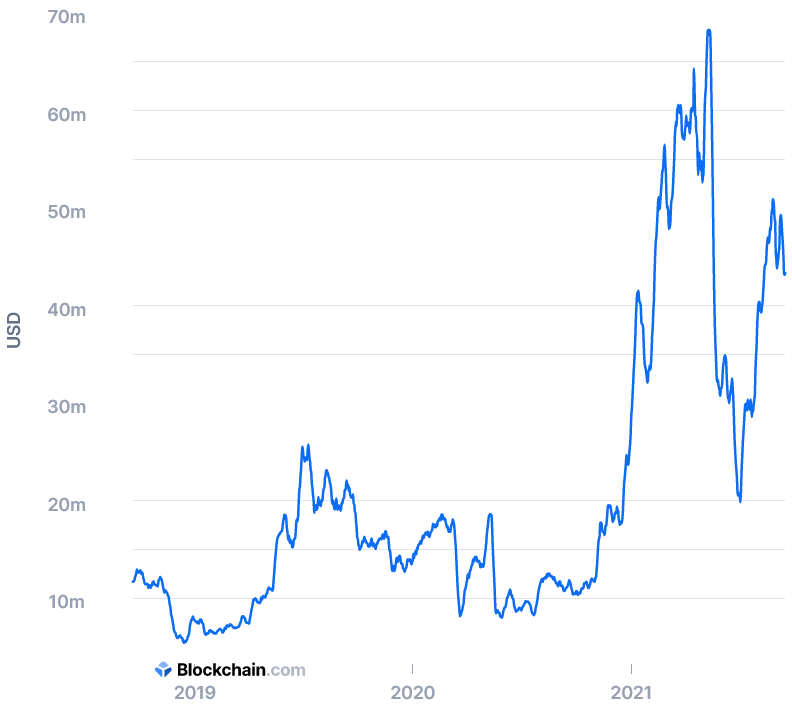

Meanwhile, at the moment, transaction fees bring less than 2% of daily miner revenue, while the block reward (currently BTC 6.25) will be again cut in half in 2024 and will reach BTC 1.56 in 2028.

Miners revenue: Total value in USD of coinbase block rewards and transaction fees paid to miners

Also, per BitInfoCharts.com, the median transaction fee is still considerably lower than at the beginning of this year.

Bitooda also said its analysts continue to expect power infrastructure to be the gating factor in further mining expansion. Taking into account its latest findings, the median power cost is now estimated at USD 40 per MWh, according to the analysis.

“We are also updating our estimated Bitcoin network power cost curve, which we assess shifted up with the loss of low‐cost Chinese power. However, it should trend back from a [USD] 40/MWh median now, to [USD] 30/MWh over the next couple of years,” the firm said.

At 14:05 UTC, BTC was trading at USD 47,421 and was unchanged in a day. The price was up by 2% in a week and almost 7% in a month. It rallied by 333% in a year.

____

Learn more:

– Bitcoin Transaction Fee Estimators: What Are They and How Do You Use Them

– Bitcoin Users Could’ve Saved Half a Billion USD in Fees – Report

– China Goes After Camouflaged Crypto Miners Ahead of Winter Season

– Bitcoin Miners, Take Notice – Biden’s Plan Would Remake the US Electricity System

– BTC Mining Migration, Challenges & Forecasts for the Post-crackdown Industry

– Unapproved Bitcoin Mining Plant Forced to Close Shop

Credit: Source link