On-chain data shows that Bitcoin whales have just had their most active hour in around three months as the asset has broken past $30,000.

Bitcoin Whale Transaction Count Has Observed A Spike Recently

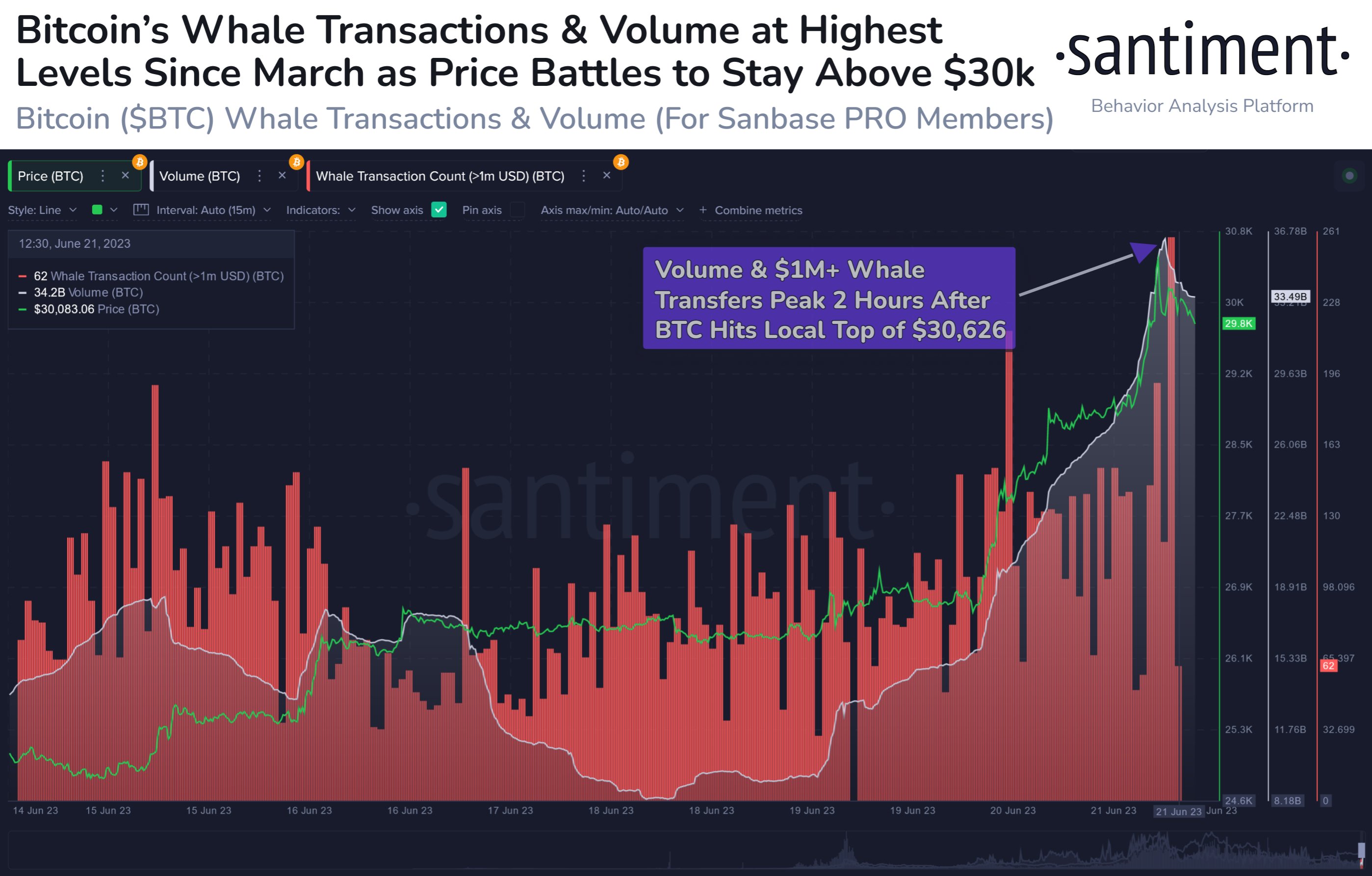

According to data from the on-chain analytics firm Santiment, 259 whale transactions occurred two hours after the local top that the cryptocurrency has observed during the past day so far.

The relevant indicator here is the “whale transaction count,” which measures the total number of Bitcoin transactions taking place on the blockchain that is worth at least $1 million in value.

As generally, only the whales are capable of moving such large amounts with a single transfer, these transactions can provide us a hint about the degree of activity that the whales are displaying right now

When the value of the whale transaction count is high, it means that there are a high amount of large transactions taking place on the network currently. Naturally, such a trend would imply the whales are highly active at the moment.

Since the amounts involved in these transfers are so high, a large number of them taking place at once can cause noticeable fluctuations in the asset’s price. Thus, when the whale transaction count is elevated, the cryptocurrency may become more probable to show high volatility.

Now, here is a chart that shows the trend in the Bitcoin whale transaction count over the past week:

Looks like the value of the metric has been quite high in recent days | Source: Santiment on Twitter

As displayed in the above graph, the Bitcoin whale transaction count has registered a huge spike during the past day. This extraordinary surge in the indicator occurred around two hours after the asset hit its local top and lasted for around an hour.

In this hour, whales made 259 transactions, which is the most amount in over three months. As for the implication of this spike on the price of the asset, as mentioned before, high values of the indicator can lead to more volatility for the cryptocurrency.

Such volatility can go either way, however, as the metric merely counts the pure number of whale transactions happening on the blockchain; it contains no information about whether the transfers have been made for buying or selling purposes.

Nonetheless, additional context like the prevailing price trend can perhaps help us guess better about what these whales intended to achieve with these large transactions.

As the spike in the indicator came just after the BTC top, it’s possible that the whales were looking to sell before the asset saw a further decline. The price continued to go downhill following these transfers, hinting that at least some selling did take place.

This drawdown has so far been short-lived, however, as Bitcoin has already recovered back above the $30,000 level. This can be a sign that although some selling may have taken place, it was still at levels low enough that the market was able to absorb it just fine.

BTC Price

At the time of writing, Bitcoin is trading around $30,100, up 21% in the last week.

BTC has surged during the last couple of days | Source: BTCUSD on TradingView

Featured image from Todd Cravens on Unsplash.com, charts from TradingView.com, Santiment.net

Credit: Source link