Based on the idea that human nature is pro-cyclical, investors should go against the urge and buy bitcoin (BTC) when the market is below trend, thus benefiting from the fact that the cryptocurrency has been at this price level or below for only one-fifth of the past eleven years, according to Pantera Capital CEO Dan Morehead.

Also, data by on-chain market intelligence provider Glassnode provided further evidence that long-term holders are not spending their coins despite the market volatility, and opting to accumulate instead of selling.

“Resist the urge to close down positions. If you have the emotional and financial resources, go the other way,” Morehead said in his latest letter to investors.

The CEO stressed that bitcoin generally goes “way up,” and has averaged more than tripling annually for ten years. He added that “anyone that has held bitcoin for 3.25 years has made money. Bitcoin has only printed one calendar year with a lower low. So, most of those investors are up big-time.”

Checking whether bitcoin was overvalued, the fund’s analysts observe the cryptocurrency is currently trading around 36% below its 11-year exponential trend, finding that bitcoin has only spent 20% of its history to date under trend valuation.

“The year-on-year return never went literally off-the-chart like in past peaks. It’s currently trading at 281% year-on-year — which seems entirely plausible given the money printing that has occurred in that period,” Morehead said, adding that “bitcoin’s four-year-on-year return is at the lower end of its historical return,” but that their analysts believed “we’ve seen the most of this panic”.

Last month Morehead also encouraged investors to buy the dip and said that the price of bitcoin could double this year despite the energy concerns.

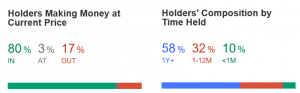

Meanwhile, Glassnode observed in its analysis that bitcoin’s high volatility “makes it a magnet for traders who are able to monetize price swings in both directions.”

Analyzing the latest data on the coin days destroyed (CDD) metric (a measure of economic activity that gives more weight to coins that haven’t been spent for a long time), the firm stated that long-term holders are keeping their crypto, indicating the dip has not encouraged selloffs by the most experienced investors.

“The Binary CDD metric has reached an extremely low value throughout June, coincident with the early 2020 start of the bullish trend. This indicates that long-term holders are simply not spending their coins,” Glassnode, said, adding that long-term holders are more likely to be re-accumulating than cashing out.

Also, the most recent Digital Asset Fund Flows report by CoinShares stated that the outflows in bitcoin “cooled” last week and have totalled USD 10m, which is “significantly less” than the previous record week of USD 141m. Compared to the previous week, trading activity in bitcoin investment products went up by 43%.

When it comes to ethereum (ETH) in the same period, it recorded the largest outflows on record, totaling USD 12.7m. “Ethereum has been the stalwart relative to Bitcoin over recent months,” said the firm, but inflows over the course of last week were mixed which also suggests mixed opinions amongst investors.

At 13:25 UTC, BTC is trading at USD 40,359, and is almost unchanged in a day and is up by nearly 21% in a week. ETH trades at USD 2,596 and is up by almost 2% in a day and less than 1% in a week.

____

Learn more:

– Weeks Of Sideways Trading Ahead as Bitcoin Newbies Panic Selling to Hodlers

– Crypto Market Signals Go Bearish But Long-Term Investors Still Accumulate

– Bitcoin May Double This Year Despite Energy Concerns – Pantera CEO

-Bitcoin Needs To ‘Turn The Ship Around’ As Ethereum In Uptrend Already

Credit: Source link