Allan Flynn, a trader and owner of local exchange BitcoinCanberra, is claiming A$250,000 from two of Australia’s biggest banks after they terminated banking services with him on the basis that he operated a crypto trading platform.

Banking a Human Right? Perhaps …

According to the Sydney Morning Herald, Flynn will now have his day in court so to speak. His matter has been scheduled for next month before the ACT Civil and Administration Tribunal’s Discrimination Tribunal where he will argue that both ANZ and Westpac breached his human rights and discriminated against him on the basis that he was a crypto trader and offered trading services to his clients.

Flynn, as the applicant, seeks compensation from the respondent (the banks) for discrimination by reason of his occupation or profession, contrary to the Act, and claims that the respondent(s) refused to provide banking services to him because he is a cryptocurrency dealer or exchanger, in direct violation of his human rights

The applicant holds a ‘protected attribute’ within the meaning of …the Act because he is a cryptocurrency trader; and cryptocurrency trading is a ‘profession, trade, occupation or calling’.

Richard McGilvray, Flynn’s solicitor, from law firm Lexmerca

A successful claim is likely to have implications not only for the crypto sector, but also those that have routinely suffered debanking, specifically those in the adult entertainment industry.

Regulatory Clarity Needed

The timing of Flynn’s case is opportune, considering the recent hearings before the Select Committee on Australia as a Technology and Financial Centre where it was revealed that Australian crypto businesses were being ‘debanked’ by written notice without the ability to appeal.

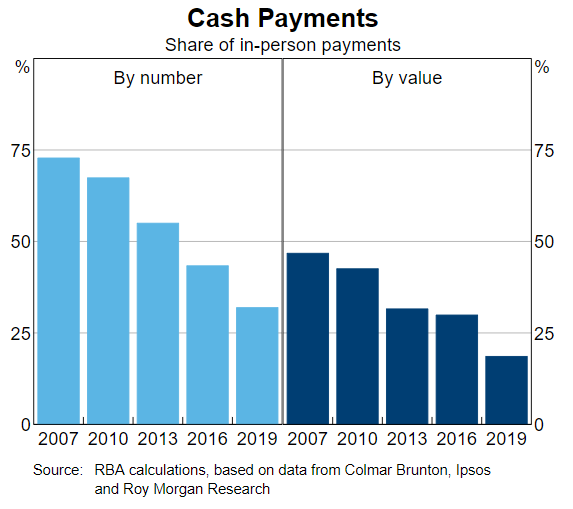

As Australia increasingly moves towards becoming a cashless society, there may be growing arguments in favour of including banking as a human right. While this may appear counter-intuitive at face value, how does one expect citizens to operate within an economy if they are denied access to banking or cash?

Some would say crypto is the solution. However, as long as digital assets are considered by the ATO as property (and not cash), the punitive tax consequences, accounting administration and inconvenience of using crypto far outweigh any potential transactional benefits.

Much like the experiences of crypto brokerage businesses such as Bitcoin Babe, Flynn says he has been debanked more than 60 times. Remarkably, the banks have gone as far as terminating financial services of his relatives:

Another bank closed my brother’s term deposit account without warning only for the fact that I was a signatory, for family oversight purposes.

Allan Flynn

While banks have a legitimate interest in complying with their statutory anti-money laundering (AML) and counter-terrorism financing (CTF) obligations, there is a growing sense that alternative forces such as hindering competition may be in play.

Flynn’s case is scheduled to be heard in late October. The Senate Committee’s final report is also due around that time. Hopefully, by the end of 2021, we’ll have a coherent and sensible regulatory framework.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link