After breaching US$50,000 some three weeks ago, bitcoin at face value appeared to have lost some momentum, fluctuating around the US$45,000 mark. Glassnode’s latest on-chain report, however, paints a picture of strong underlying fundamentals and a potential supply squeeze on the horizon.

Close to 80% of Supply Held by HODLers

Who is a HODLer? According to Glassnode, it refers to investors whose coins have a lifespan of around 155 days or more. For obvious reasons, they tend to have extremely high levels of conviction and are therefore seen as “buyers of last resort”, snapping up discounted coins when volatility and fear take hold.

On that basis, coins purchased after mid-April would be regarded as short-term holders and, as per the chart below, only 16.8 percent of them are currently in profit.

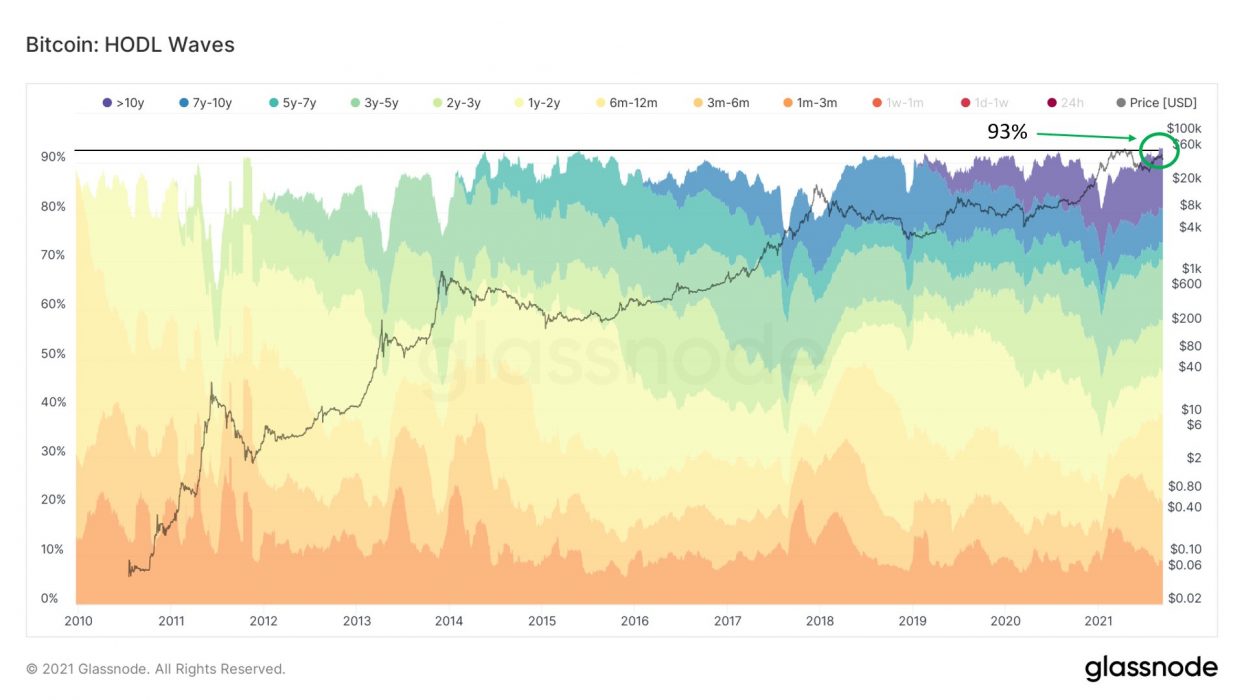

Perhaps more telling is that HODLer-owned supply reached 79.5 percent of all bitcoin supply this week. This is the same level reached in October last year, when bitcoin traded for around US$10,750. If the following three months replicated what happened in October 2020, we may be looking at a price north of US$120,000 before year end.

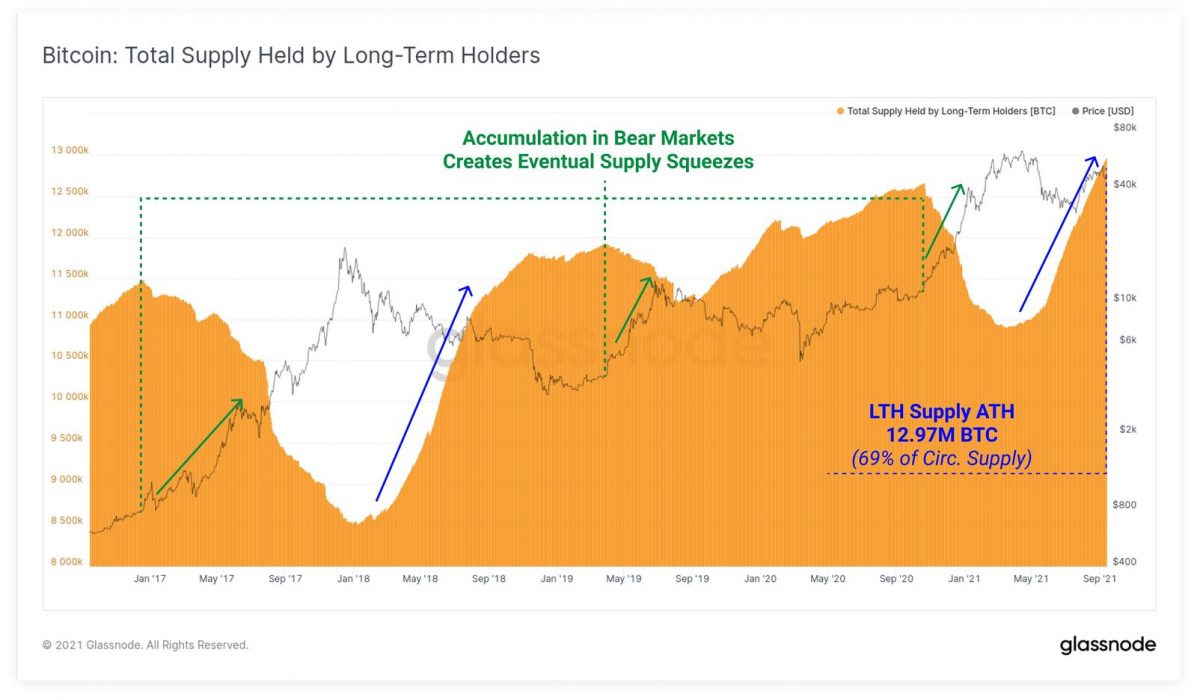

Peaks in LTH (long-term holders) owned supply typically correlate with late stage bear markets, which are historically followed by a supply squeeze and initiation of cyclical bull runs.

Checkmate, Glassnode

In absolute terms, HODLers currently own the most coins in history, hitting 12.97 million bitcoin this week. Supporting the “buyers of last resort thesis”, much of the momentum has been since the market crash in May this year.

As further evidence of the bullish supply-side dynamics, it’s also worth noting that 93 percent has not moved in a month.

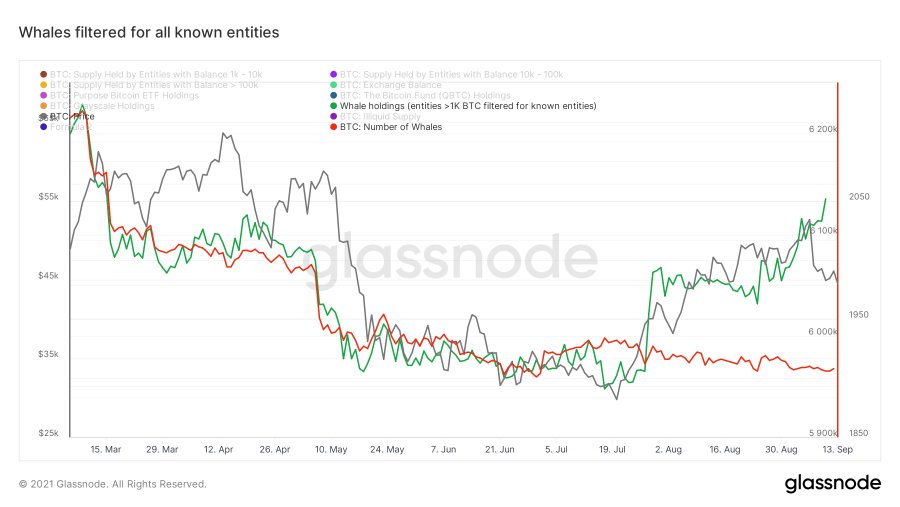

Whale Feeding Frenzy

This week, MicroStrategy, a well-known whale, has once again been at it:

While MicroStrategy may be one of the best known whales, other lesser known whales have been on the prowl, gobbling up 103,600 BTC over the past three weeks alone.

A strong case is mounting for some strong price gains into the last quarter of 2021. Don’t bet on it, however – the world of crypto never ceases to offer all sorts of surprises along the way. As Mark Yusko likes to say: “Price is a liar”. We’ll see.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link