On-chain data shows the number of Bitcoin sharks has continued to increase recently, but the whale count on the network has hit stagnation.

Bitcoin Sharks Have Continued To Go Up In Number Recently

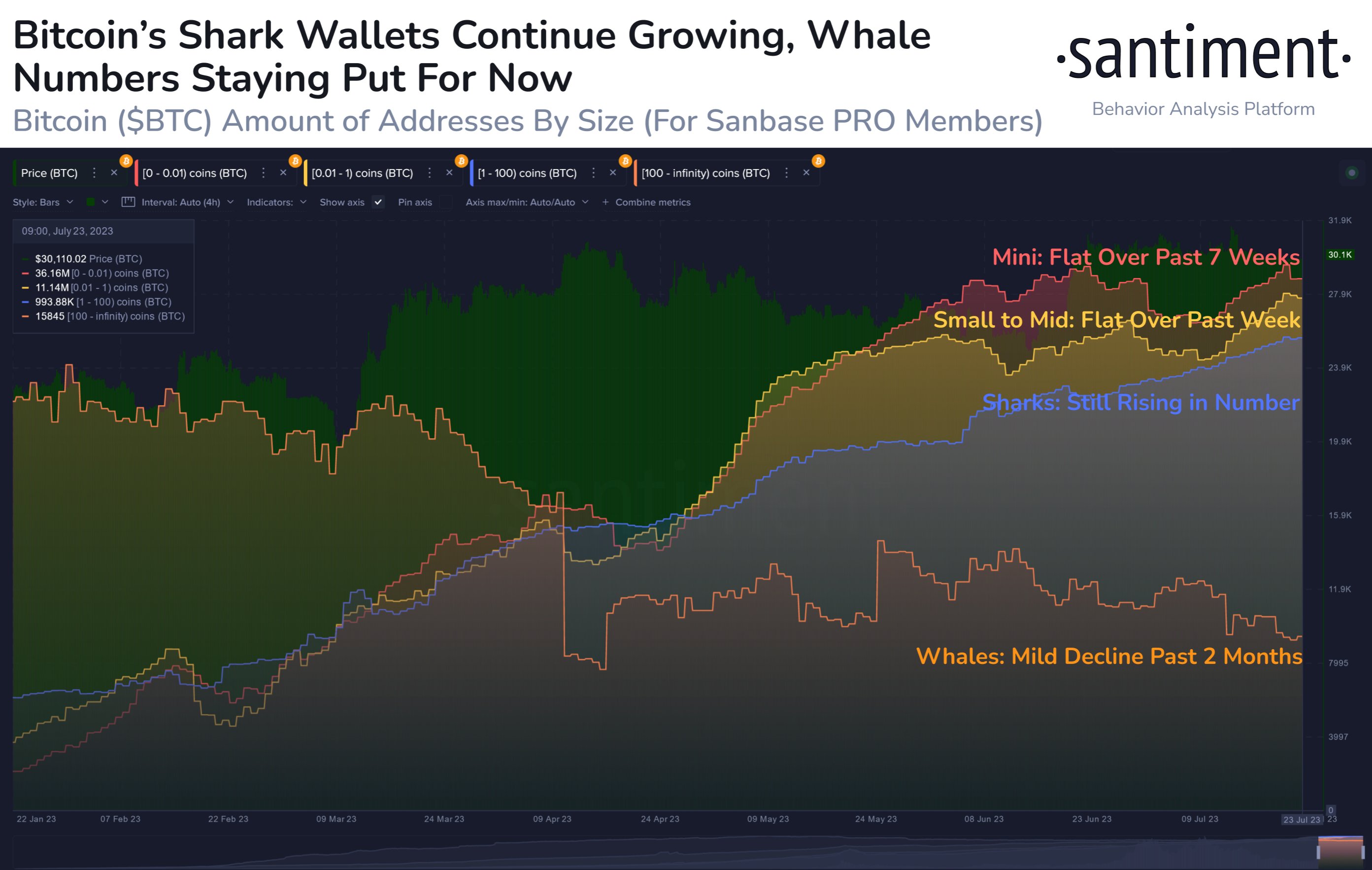

According to data from the on-chain analytics firm Santiment, the number of whales on the Bitcoin blockchain has observed a slight decline during the last couple of months.

The relevant indicator here is the “Supply Distribution,” which measures the total number of addresses that belong to each of the wallet groups on the network.

The addresses are divided into these “wallet groups” on the basis of the total amount of BTC that they are carrying in their balances right now. In the context of the current discussion, there are four such cohorts that are of interest: 0-0.01 coins, 0.01-1 coins, 1-100 coins, and 100+ coins.

Naturally, an address belonging to any of these groups would have its balance inside the range of the group in question. So if the Supply Distribution is applied to these cohorts, it would tell us (among other things) the total number of addresses on the chain that satisfy the respective conditions.

Now, here is a chart that shows the trend in the Bitcoin Supply Distribution for each of these four cohorts since the start of the year:

Looks like only one of these metrics has continued to constantly grow in recent days | Source: Santiment on Twitter

The first of these groups, the 0-0.01 coins range, signifies the small retail holders of the market. From the above graph, it’s visible that these investors haven’t changed in number much lately as their Supply Distribution curve has been moving sideways over the past seven weeks. This would suggest that adoption among small investors isn’t rising for the cryptocurrency at the moment.

The second group of relevance (0.01-1 BTC) has also been moving flat recently, showing that retail investors as a whole have hit a state of stagnation on the network.

Unlike these cohorts, though, the indicator’s value for the 1-100 coins group, which is sometimes popularly referred to as the “sharks,” has only continued to climb higher in the past few months. This would imply that these decently-sized holders are still interested in buying the cryptocurrency, which could be a positive sign for the asset’s rally.

While the sharks may hold some influence in the market due to the size of their holdings, they don’t hold nearly as much power as the largest cohort in the market: the whales.

These humongous investors with 100+ BTC can move around a large amount of coins on the network, and thus, can cause noticeable ripples in the market. Due to this reason, these holders’ behavior may be considered the most important to watch.

As displayed in the graph, the number of whales on the network has observed a decline during the last couple of months, although the degree of the downtrend hasn’t been too much. Nonetheless, one fact remains: they haven’t been accumulating recently.

What these investors do next from here may be worth keeping an eye on, as Santiment explains that if they start buying again, the possibility of a breakout would greatly increase.

BTC Price

At the time of writing, Bitcoin is trading around $29,300, down 3% in the last week.

BTC has plunged during the past day | Source: BTCUSD on TradingView

Featured image from Flavio on Unsplash.com, charts from TradingView.com, Santiment.net

Credit: Source link