Bitcoin (BTC), the world’s largest cryptocurrency, was able to recover some of its recent losses and attract modest bids above the $23,500 level as the crypto market started the month on a positive note. This was attributed to Abu Dhabi’s plan to create a free zone for the crypto industry, which will offer zero taxes and 100 percent foreign ownership to digital and virtual asset firms.

Additionally, France has demonstrated its willingness to implement strict licensing regulations related to anti-money laundering (AML) and know-your-customer (KYC) protocols for cryptocurrency companies to prevent money laundering and financing of terrorism. This was also considered a significant factor in reducing losses and restoring some momentum in the cryptocurrency industry.

The likelihood of interest rate hikes and a possible government crackdown on the cryptocurrency industry could deter investors in the upcoming weeks. Additionally, the current state of the crypto market and regulatory concerns have led Visa and MasterCard to delay their cryptocurrency plans, which may also limit any potential upward momentum in BTC prices.

Abu Dhabi Establishes Welcoming Regulatory Environment for Crypto Industry

As previously reported, the city of Dubai in the United Arab Emirates has been promoting the cryptocurrency industry by establishing a free zone that offers zero taxes and 100 percent foreign ownership to digital and virtual asset enterprises.

In addition, the international financial hub in the UAE’s capital, Abu Dhabi Global Market (ADGM), has introduced a new regulatory framework for digital assets. This includes the creation of a regulatory sandbox to enable developers of digital assets to test their products and services in a secure environment.

In addition, ADGM has launched “Spot,” a digital asset market that provides a secure and regulated environment for users to trade cryptocurrencies, fiat currency, and other digital assets. This move is part of Abu Dhabi’s broader goal to position itself as a major hub for fintech and digital innovation and to establish a significant presence in the global cryptocurrency market.

Abu Dhabi is striving to lure a diverse range of digital asset firms, such as cryptocurrency exchanges, digital wallets, and blockchain companies, by providing an inviting regulatory atmosphere and attractive tax benefits. This is considered a significant breakthrough for the cryptocurrency industry, which could potentially stimulate growth in the sector in the near future.

France to Enact Strict Licensing Regulations for Cryptocurrency Companies

The French National Assembly has recently passed a bill aimed at enforcing stricter licensing regulations for new cryptocurrency businesses to align with upcoming European Union (EU) regulations.

This move demonstrates France’s commitment to combating financial crime and protecting its citizens from illicit activities. By mandating that cryptocurrency companies adhere to AML/KYC requirements, France is sending a clear message that it takes financial crime seriously and is taking steps to prevent it.

It is noteworthy that the proposal received 109 yes votes, accounting for 60.5%, compared to 71 no votes, or 39.5%. After being approved by the French Senate, the measure will now be handed to President Emmanuel Macron, who has 15 days to sign it or remit it to the legislature.

It will be interesting to see how this new regulation is implemented and how it impacts the French cryptocurrency market. While some companies may struggle to comply with the new regulations, others may view it as an opportunity to demonstrate their commitment to transparency and ethical business practices.

Bitcoin Price

The price of Bitcoin is currently at $23,796, with a 24-hour trading volume of $22.5 billion. Over the past 24 hours, Bitcoin has increased by around 1.50%. Ethereum, on the other hand, has a current price of $1,650 and a 24-hour trading volume of $7.4 billion, with a gain of 1.25% in the previous 24 hours.

On the 4-hour chart, Bitcoin faced difficulty in breaking the crucial resistance level of $23,750. The failure to sustain above this level led to a bearish correction, which could push the BTC price toward the $22,800 support level. If this support level fails to hold, the next area of support could be around $22,150.

Although the BTC/USD pair is currently oversold, a rebound is possible if the oversold condition persists, allowing Bitcoin to break past the $23,500 resistance level and potentially leading to a price of $24,250.

Buy BTC Now

Bitcoin Alternatives

Investors who are interested in buying Bitcoin may want to explore other options that offer more growth potential in the short term. Cryptonews has conducted a detailed analysis of the top 15 cryptocurrencies that investors should consider for 2023. Click below to learn more.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

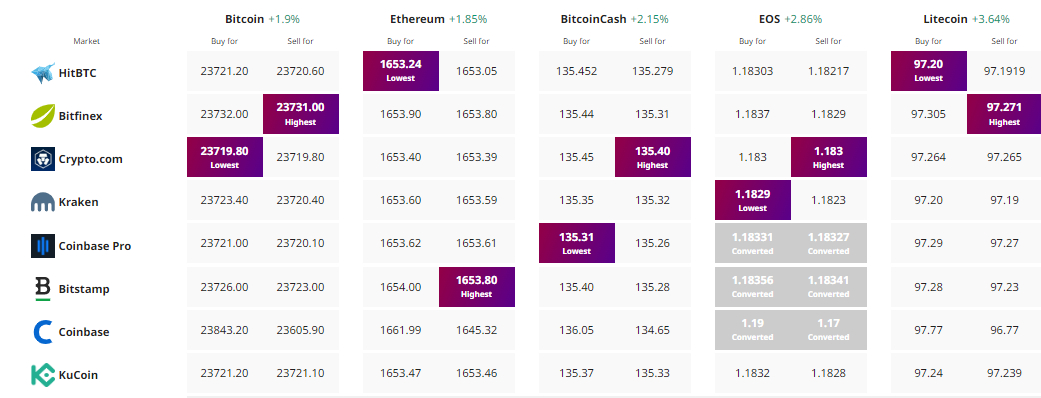

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link