In a swift turn of events, Bitcoin’s value dipped nearly 2.50% in today’s cryptocurrency market, causing a significant stir among investors and stakeholders.

This unexpected drop in Bitcoin’s price is the latest in a series of fluctuations that have been characteristic of this digital currency.

This Bitcoin price prediction provides crucial insights into the current trends and indicators in the Bitcoin market that could guide potential investors and current holders in making informed decisions.

With a comprehensive analysis of the factors influencing this decline, we seek to forecast potential trajectories that Bitcoin’s price could take in the near future.

Binance Australia Users Spotted Selling Bitcoin at a Lower Rate: A Closer Look

In comparison to the Australian dollar, the price of BTC has plummeted by a staggering 21% on the Australian branch of the Binance cryptocurrency market.

Hosam Mahmoud, a Research Analyst at CCData, conveyed to CoinDesk in an interview, “The announcement from Binance provoked traders to offload their BTC/AUD pairs, causing the price to hit a historically significant discount.”

On May 18, Binance initially informed its customers that it would suspend services involving the Australian dollar (A$) due to a decision made by the third-party payments provider, PayID.

Immediate cessation of bank transfer deposits was enforced, although PayID withdrawals were permitted until June 1 at 5 p.m. local time.

Furthermore, the exchange notified its Australian customers that any remaining AUD in their accounts as of May 31 would be promptly converted into USDT.

In the aftermath of these announcements, there has been a persistent rush to withdraw funds, significantly influencing the depreciation of Bitcoin’s (BTC) price on Binance Australia.

Binance has indicated that it is actively seeking an alternative provider to continue enabling deposits and withdrawals in Australian dollars.

Despite the currently depressed prices, it remains feasible to buy and sell cryptocurrencies using credit or debit cards at present.

Data reveals that despite the considerable discount, arbitrageurs are capitalizing on the lowered pricing, implying that the situation may normalize once the funds are transferred to USDT.

Tether to Launch Bitcoin Mining in Uruguay

Tether, the firm responsible for the most widely used stablecoin in the market, USDT, has announced its foray into the energy sector.

The company plans to focus on generating sustainable energy, specifically targeting Bitcoin mining operations, in a bid to address the cryptocurrency’s considerable energy consumption concerns.

This move forms a key component of Tether’s treasury management strategy, which includes allocating up to 15% of net income to Bitcoin investments.

Tether had previously revealed that it held $1.5 billion—or roughly 2%—of its total reserves in Bitcoin.

By harnessing renewable energy sources, Tether aims to mitigate the adverse environmental impacts of Bitcoin mining, while concurrently bolstering network security.

Bitcoin Nears $28,000 as Investors Watch US Debt Ceiling Development

Based on data from CoinDesk, Bitcoin, the largest cryptocurrency by market capitalization, was recently trading around $27,740, reflecting a marginal 0.1% increase from the previous day, though considerably lower from its peak value earlier in the day.

After a consensus was reached between House Speaker Kevin McCarthy and US President Joe Biden to defer the debt ceiling issue until January 2025, Bitcoin (BTC) rose above $28,000 on Sunday, achieving this feat for the first time in over three weeks.

The market remained volatile on Monday following reports of several Republican lawmakers intending to vote against the deal.

Bitcoin is currently facing downward pressure as market participants eagerly await further indications on the progression of the debt ceiling situation, especially in the aftermath of China’s announcement of a new web3 innovation and development plan.

Bitcoin Price Prediction

Bitcoin is facing considerable sell-offs after falling below the key $27,500 support level. The four-hour chart depicts a breach of the 50% Fibonacci level and the upward trend line, signaling a bearish sentiment.

A bearish engulfing candlestick pattern further underscores the downward momentum. Bitcoin has already hit the 61.8% Fibonacci level at $27,250 and is moving toward the next support around $26,950.

A successful surge above $27,950 could push Bitcoin’s price toward the next support at $26,500.

A significant climb above $26,500 may trigger a bullish surge for Bitcoin. We predict a possible revival of the previously broken resistance at around $27,300 and $27,500.

If the uptrend endures, Bitcoin might challenge the next $28,000 resistance level.

In short, it’s crucial to watch the $27,500 support zone and stay attentive to potential rebounds near the $26,500 mark for Bitcoin.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Cryptonews Industry Talk introduces a fascinating roster of cryptocurrencies set for a promising trajectory in 2023.

Brace yourself to discover the exhilarating opportunities that await these digital currencies.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

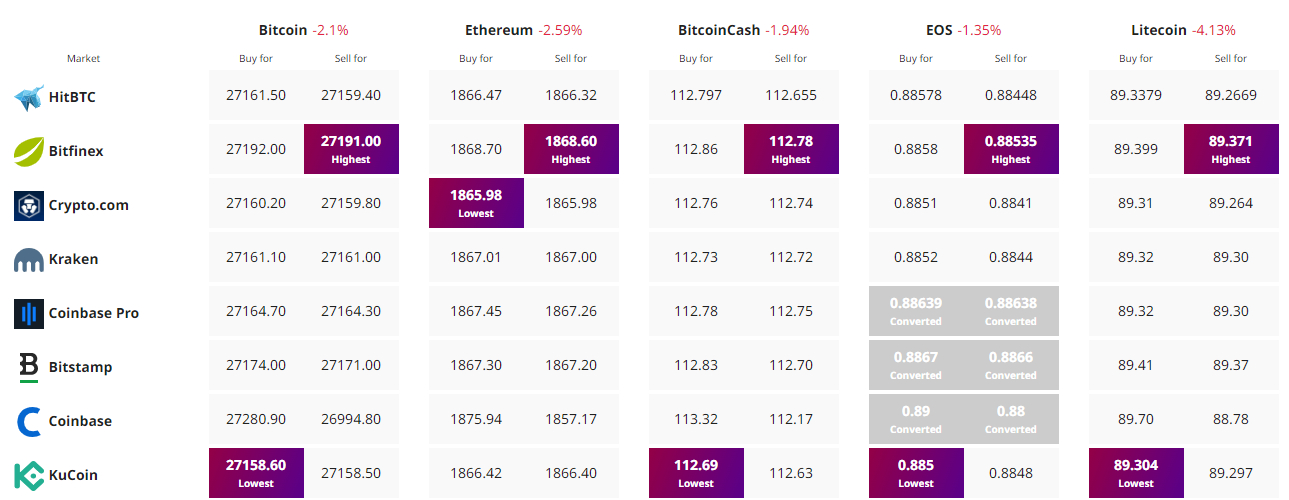

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link