As Bitcoin reclaims its position at the $28,450 mark, investors are left questioning the future direction of this prominent digital asset.

Will the bullish trend continue, enabling further rise in Bitcoin’s value, or should we brace ourselves for a possible bearish correction?

As we delve into the technical and market indicators, we aim to illuminate these inquiries in our Bitcoin price prediction today.

Digital Currencies Rally Amid US Debt Ceiling Discussions, Propelling Bitcoin Over the $28,000 Mark

Bitcoin’s (BTC) price has risen by 3%, and the rest of the cryptocurrency market is exhibiting a green hue, indicating a potential weekend upswing.

However, this capital inflow was observed only after Kevin McCarthy, the Republican leader, and US President Joe Biden reached a preliminary agreement to elevate the massive $32.4 trillion federal debt ceiling.

This consensus, reached after four consecutive days of 90-minute phone discussions, is tentative at present. Biden has expressed confidence that this deal will prevent the US from encountering a default.

Meanwhile, Kevin McCarthy has attributed the delay to Biden, accusing him of wasting time and repeatedly declining negotiations over several months.

By the agreement, spending by the US government will be restricted for the upcoming two years. Importantly, costs related to national security will be exempted.

This pact was established a month after US Treasury Secretary Janet Yellen issued a warning concerning a potential risk of default on June 1.

In the aftermath of the debt ceiling announcement, Bitcoin has witnessed an increased influx of funds, propelling BTC/USD prices upwards by more than 3% within a single day.

This rise endorses former Wall Street trader Macrojack’s assertion regarding the paramountcy of tangible assets like Bitcoin, particularly as he anticipates the dollar will be “printed into oblivion.” He has famously stated, “Bitcoin is the fastest horse in the race.”

Meyer suggests that raising the debt ceiling could compel the Federal Reserve to escalate its money-printing activities.

While this might lead to a depreciation in the value of the USD, it could be beneficial for BTC, as these two currencies typically exhibit an inverse trading relationship.

“Bitcoin Enhances Cause-Effect and Security in Cyberspace,” States Michael Saylor

In a recent interview with Kitco News, Michael Saylor, the Executive Chairman of MicroStrategy, proposed that Bitcoin could be a potent defense against cybersecurity risks such as deepfakes.

Saylor speaks of a digital “civil war” currently in progress, propelled by billions of fraudulent accounts stirring discord among genuine users of digital platforms.

Saylor boasts over 3 million followers on Twitter and gains nearly 2,000 fake followers daily.

He recounts an instance where “1500 bot accounts were removed from my account in less than an hour – all bots.”

The prevailing situation is untenable, he argued. Saylor believes that Decentralized Identities (DIDs) solve deepfakes and various other digital trust issues.

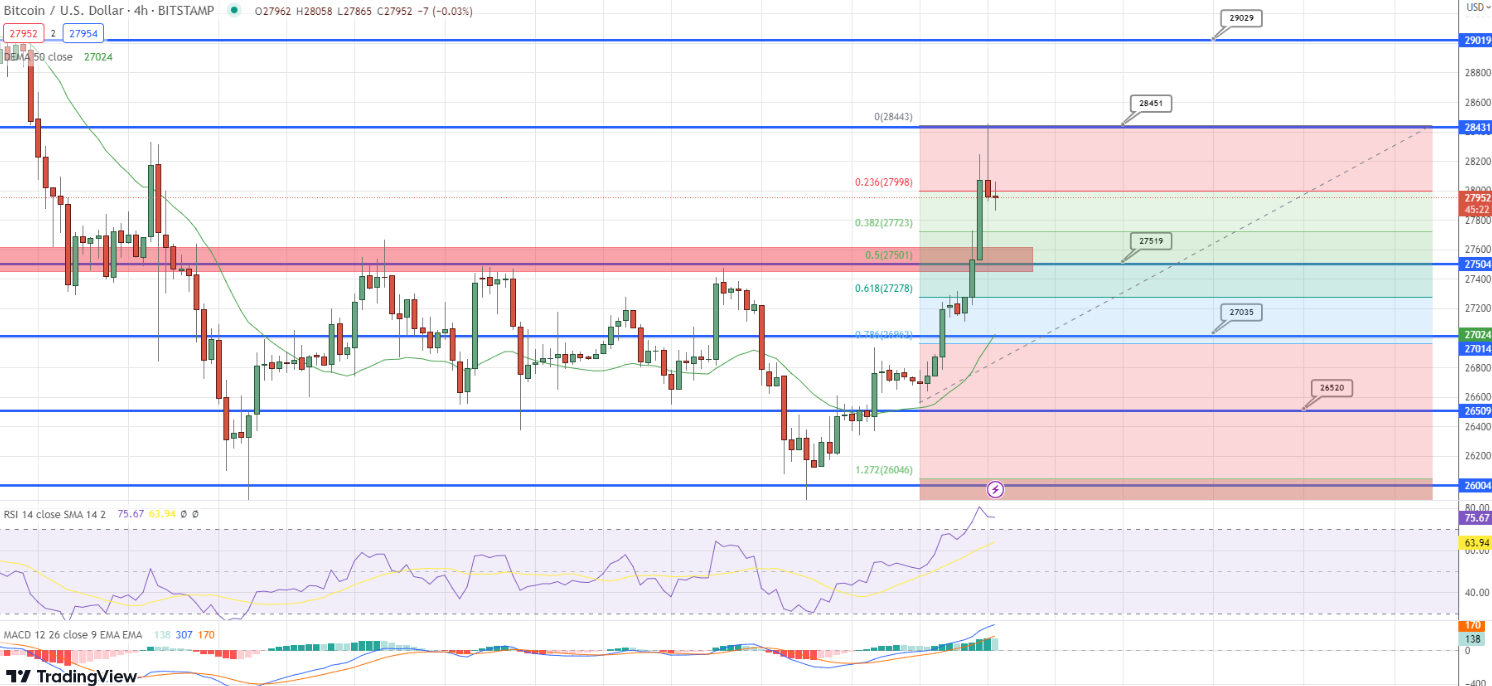

Bitcoin Price Prediction

On Monday, Bitcoin experienced a 3% surge, trading at $28,068. This marks the first time since May 10 that the world’s largest cryptocurrency has surpassed the $28,000 threshold.

Bitcoin’s upward trajectory has continued for five consecutive days, including a robust performance on Monday.

A significant obstacle for Bitcoin lies at the $28,300 level, as indicated by the four-hour chart’s ‘double tap’ pattern. The recurring closures of candles below this level might signify exhaustion among buyers, indicating a potential handover of market dominance to sellers.

Key indicators such as the RSI and MACD are currently in the overbought territory, with the RSI hovering close to 76.75 and the MACD forming long-lasting histograms near 171.

The considerable difference between the 50-day EMA, roughly $27,000, and Bitcoin’s current trading price near $28,000 indicate an overbought market, hinting at a possible adjustment in price.

If Bitcoin can’t overcome the $28,300 threshold, investors might have an opportunity to bet on a price decrease, aiming for a drop to $27,500 or even $27,000.

On the other hand, if Bitcoin successfully breaches and settles above $28,300, it may encourage investors to bet on a price increase, with an initial target of $29,000 and potentially higher at around $29,450.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

Cryptonews Industry Talk introduces a fascinating roster of cryptocurrencies set for a promising trajectory in 2023.

Brace yourself to discover the exhilarating opportunities that await these digital currencies.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

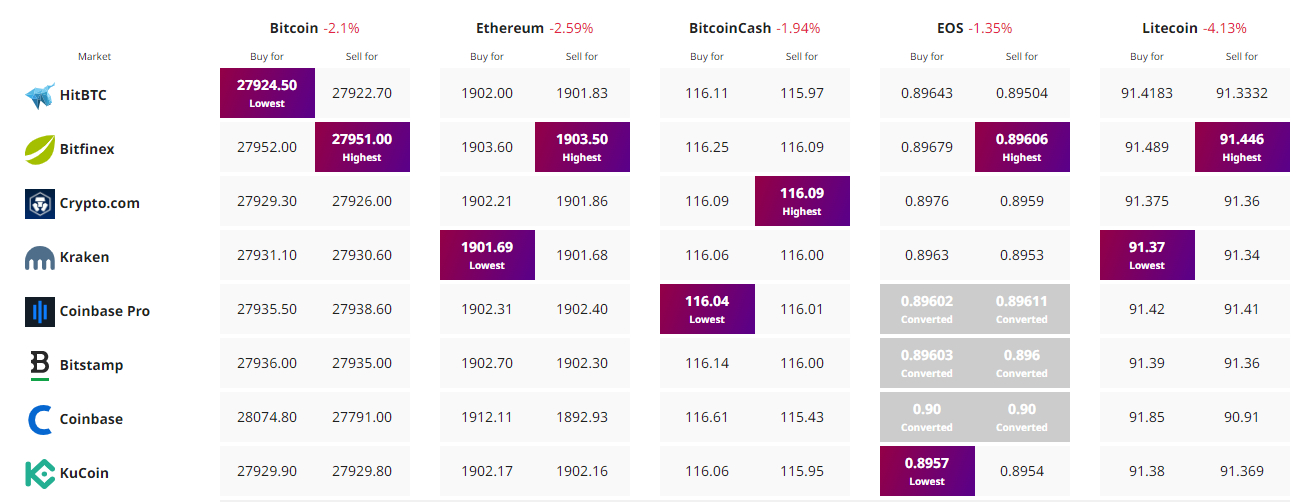

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link