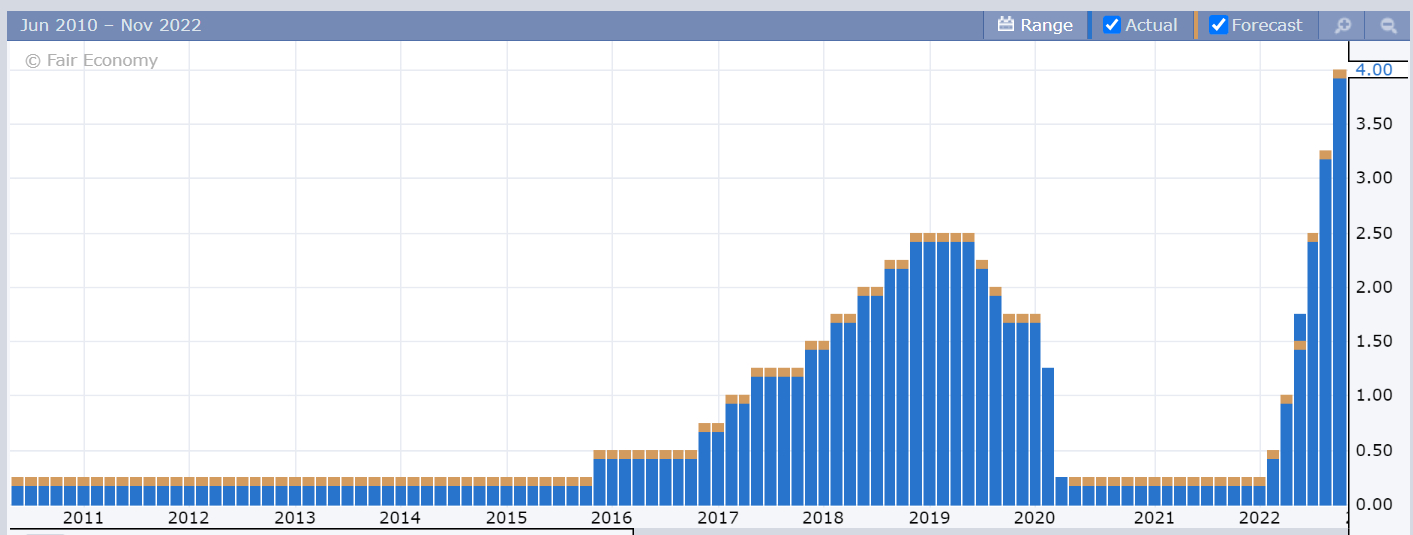

During the European session, the Bitcoin price prediction remains bullish following the Federal Reserve’s interest rate decision. After three consecutive “jumbo” rate hikes of 0.75 percentage points each, the Federal Reserve finally announced another rate increase on Wednesday, this one a full 0.75 percentage points higher in an effort to slow inflation.

While a rise in interest rates can reduce inflation by discouraging consumers from taking on new debt, it will also increase the debt service payments of Americans who are already struggling to keep up with the rising cost of living, which includes food, clothing, and shelter.

Fed’s Powell: There’s No Indication That Inflation Is Decreasing

The Federal Reserve has increased interest rates by 0.75 percentage points in its ongoing fight against inflation.

The markets reacted negatively when Fed Chair Jerome Powell indicated a rationale for halting the increases by saying it was “extremely premature” to discuss a pause.

Consumer Price Index numbers show that year-over-year inflation has remained persistently high, falling from a June high of 9.1% to 8.2% as of September. That’s far more than the 2% inflation target set by the government.

Important things to remember:

At its December 2022 meeting, the Fed could decide to make lesser interest rate hikes than the quick three-quarter point moves. However, it’s likely to increase rates more than expected.

Moreover, Mr. Powell has made it clear that as inflation has proven surprisingly persistent, the route toward an economic soft landing has become narrower.

The market’s takeaway from his statement was clear: “I would like folks to realize our commitment to getting this done.”

Bitcoin Price Prediction – BTC to Go After $19,850

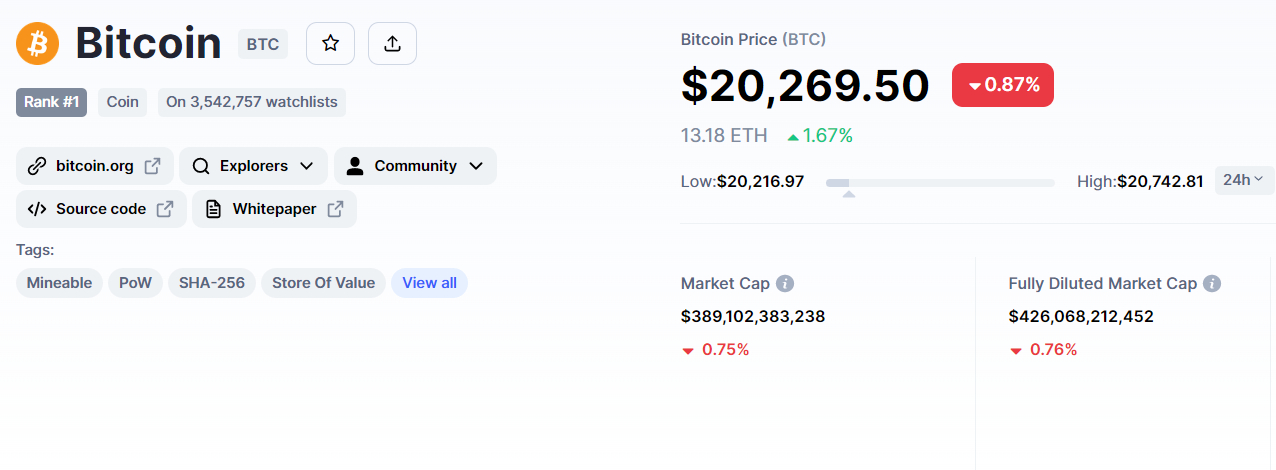

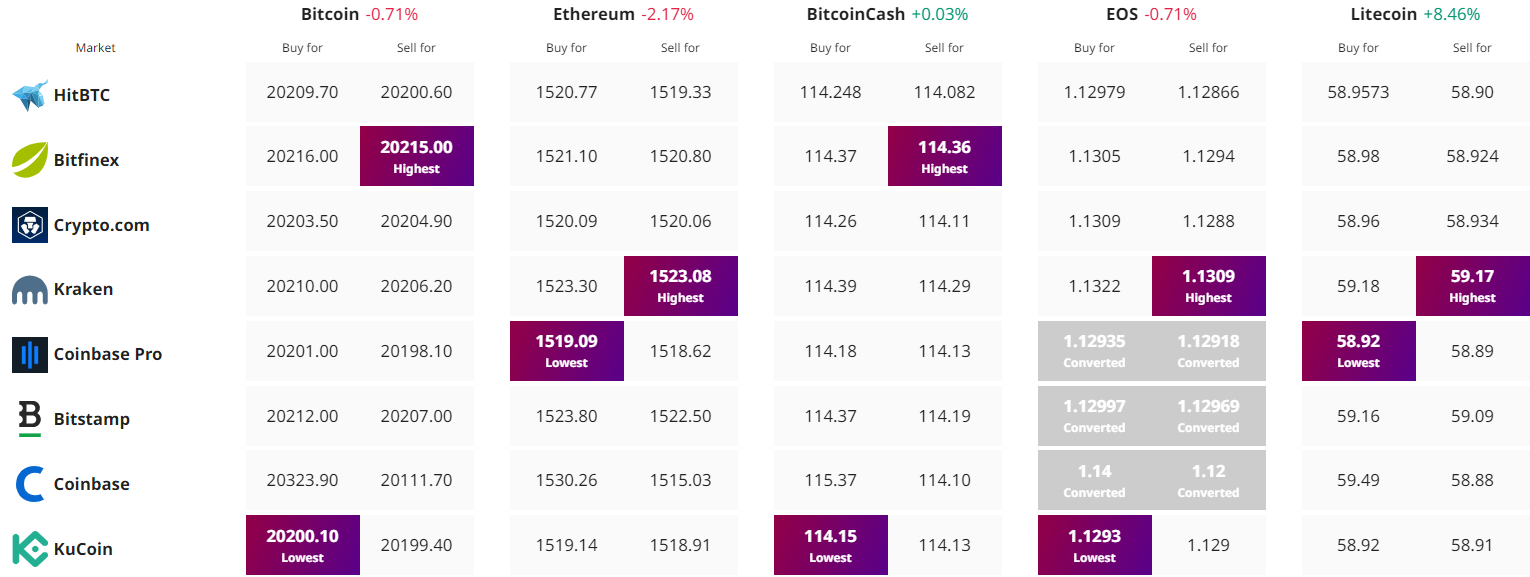

Bitcoin’s reaction to the rate hike has been quite mixed, with BTC surging to test a strong resistance level of $20,800 but failing to break above this level. It eventually fell to trade at $20,200. CoinMarketCap is currently first, with a $389 billion live market capitalization.

The BTC/USD pair is currently trading bearish after breaching a strong support level of $20,330. Closing candles below this level will almost certainly result in a strong selling trend in BTC. In addition, the upward trendline that was supporting BTC near $20,300 has been broken.

For the time being, Bitcoin is likely to continue its downward trend until it reaches the $19,984 level.

The MACD and RSI have also entered the selling zone, so investors should look for sell trades below $20,330. A bullish breakout of $20,330, on the other hand, could expose the BTC price to the $20,800 or $21,270 level.

Top Coin Alternative – Dash 2 Trade

With the news that more than $4 million was raised in the Dash 2 Trade presale, the company has also confirmed that LBANK Exchange would be the first CEX to sell the D2T token.

Less than two weeks after launching its public token sale, it has reached these benchmarks, indicating growing interest from investors in its trading intelligence platform.

Upon completion of the second of nine presale phases, Dash 2 Trade (D2T) will be listed on LBANK Exchange. It is anticipated that this will occur in the first quarter of 2023 upon the release of Dash 2 Trade, a cutting-edge dashboard, and intelligence platform.

D2T has captured the attention of cryptocurrency investors all over the world, raising more than $4.2 million in a week during its presale. Furthermore, presales have recently been brisk, and D2T is well-positioned to capitalize on the trend.

Visit Dash 2 Trade now

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link