Amidst the turbulent cryptocurrency market, Bitcoin now trades at $25,900, reflecting a 1.75% decline on Saturday.

As bears drag BTC below the pivotal $26,000 threshold, speculations arise: is another tumble to the $20,000 level on the horizon?

Adding to the complexity of the crypto landscape, the state of Texas has recently granted Riot a substantial $31.7 million to halt Bitcoin mining operations amidst looming energy concerns.

Texas Allocates $31.7 Million to Riot to Cease Bitcoin Mining Amid Energy Concerns

Bitcoin miners in Texas are currently facing a significant challenge due to an ongoing power crisis, necessitating the suspension of their mining operations.

Texas has historically been an attractive hub for Bitcoin mining, owing to its cost-effective energy resources and permissive regulatory environment. Prominent Bitcoin mining companies like Riot and Marathon Digital have established substantial operations within the state.

The power crisis has escalated in severity due to adverse weather conditions, prompting the Biden Administration to declare a state of emergency regarding power supply in Texas.

Lee Bratcher, the president of the Texas Blockchain Council, reported that Bitcoin mining activities have been drastically curtailed by over 90%, with only essential systems remaining operational due to constrained power availability.

As a result, large-scale Bitcoin miners are diligently adhering to these restrictions.

This situation compounds the existing challenges faced by miners, including low Bitcoin prices, intensified competition, and diminishing rewards following the most recent halving event.

In a bid to address the ongoing energy crisis, the state of Texas has allocated $31.7 million in energy credits, effectively putting a halt to the operations of Riot Platforms and other Bitcoin miners.

This move comes as a response to the severe power shortage exacerbated by adverse weather conditions.

The allocation of these energy credits is spearheaded by the Electric Reliability Council of Texas (ERCOT), with the primary aim of relieving stress on the state’s power grid.

Simultaneously, it serves as a means to reduce the operational costs incurred by Riot Platforms and other mining entities.

Despite having reported losses exceeding $500 million in 2022, Riot Platforms perceives these energy credits as a critical financial lifeline.

In conclusion, the ongoing power crisis in Texas poses a significant challenge for Bitcoin miners, forcing them to halt their operations, and this situation is keeping BTC lower today.

Bitcoin Price Prediction

Bitcoin is cautiously advancing, presently lingering just over $26,000. Although it hints at possible resurgence, the $26,500 resistance remains an obstacle.

Recently, BTC’s movement has broken past a significant bearish trend, actively engaging with resistance territories, especially crucial points at $26,400 and $26,500.

Maintaining a steady position above this latter mark might trigger a notable rise, aiming for thresholds close to $28,000.

On the flip side, should the cryptocurrency falter at $26,500, it might face a decline, with immediate defensive lines set at $26,100 and $26,000.

Dipping below these might ramp up selling momentum, potentially driving Bitcoin’s value down to $25,500 or possibly as low as $25,350.

Top 15 Cryptocurrencies to Watch in 2023

Stay at the forefront of the digital asset realm by exploring our meticulously chosen top 15 alternative cryptocurrencies and ICO endeavors set to make waves in 2023.

This compilation is a collaboration between seasoned professionals from Industry Talk and Cryptonews, ensuring you receive expert advice and profound perspectives on your cryptocurrency ventures.

Keep abreast of the latest and understand the promise these digital currencies hold.

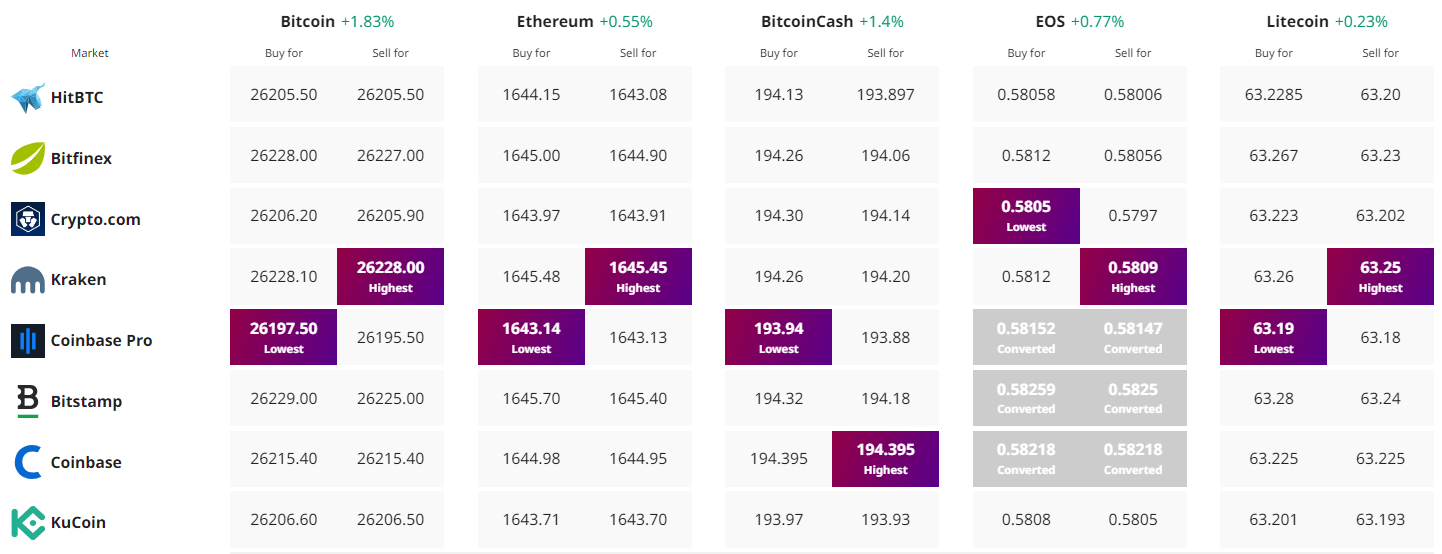

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link