Following the bearish breakout of the upward channel on December 12, the Bitcoin price prediction turned bearish. It was supporting Bitcoin near the $17,000 level, and now, following a bearish breakout, Bitcoin price is vulnerable to the $16,750 level.

Ark Invest’s CEO Cathie Wood recently tweeted her admiration for Bitcoin’s resiliency, noting that the flagship cryptocurrency “didn’t skip a beat” amid a recent crisis.

She goes on to say that Bitcoin’s “transparency” and “decentralization” are reasons why disgraced FTX founder Sam Bankman-Fried didn’t care for it. He was helpless, the well-known investor said.

The latest tweet from Wood is in response to Ark Invest, the investment management firm she runs.

This week, the market’s attention is focused on the high-impact economic events coming out of the United States. Let us take a look.

Upcoming FOMC on the Docket

Market participants are concerned about the next Federal Open Market Committee (FOMC) meeting and policy discussions on December 13. The above is due to Bitcoin’s price still having a strong correlation with stocks. As a result of the market’s reaction to the news, the upcoming CPI reporting event may result in increased volatility for BTC/USD.

The US Federal Reserve will raise interest rates on December 13. It follows a series of 75 basis point interest rate increases throughout the year. The interest rate hike scheduled for tomorrow is expected to be smaller than in the past.

Because the US Federal Reserve Chair has indicated that the Fed will scale back the rate hike in December, the market is anticipating a lower interest rate increase. If the news of tomorrow’s interest rate rise is less than those that came before it, the crypto market may see a relief rally.

If the interest rate rise is 50 basis points or less, the global financial and cryptocurrency markets will experience a small to moderate relief rally. However, if interest rates rise by more than 50 basis points, all prices will fall significantly more. The release of the inflation rates will also affect the price of BTC/USD.

Bitcoin Smart Contract Functionality

The non-profit DFINITY Foundation created the Internet Computer (IC), the first web-speed, internet-scale public blockchain. The IC’s mainnet announced the integration with Bitcoin, bringing cutting-edge smart contract functionality to the world’s leading cryptocurrency.

The Internet Computer can now act as a Bitcoin Layer 2 by allowing smart contracts to hold, transfer, and receive bitcoin without the use of blockchain bridges or other intermediaries. It provides a secure foundation for various DeFi and Web3 apps that want to code Bitcoin.

The integration of the Internet Computer with Bitcoin also provides threshold ECDSA bridges, a more secure alternative to centralized bridges (Elliptic Curve Digital Signature Algorithm).

The ECDSA solution enables Internet Computer’s canister smart contracts to conduct Bitcoin transactions without the need for an intermediary or bridge. It enables IC developers to write native Bitcoin code and provides a trustless foundation for Bitcoin-based DeFi applications.

The integration benefits BTC/USD because the price increased following the announcement.

Sank Bitcoin as ‘Everyone Who Could Go Bankrupt Has Gone Bankrupt’

Arthur Hayes, the former CEO of crypto derivatives platform BitMEX, believes the worst is over for Bitcoin this cycle. It’s because the “largest, most irresponsible entities” have exhausted their BTC supply.

On December 11, podcaster and cryptocurrency proponent Scott Melker stated, “looking forward, pretty much everyone who could go bankrupt has gone bankrupt.”

Hayes clarifies his position by stating that because BTC is the “reserve asset of crypto” and the “most pristine asset and the most liquid,” centralized lending companies (CELs) frequently call in loans before selling them when they are experiencing financial difficulties.

In a blog post published on December 10, Hayes made a similar argument. He stated that due to the credit crisis, massive physical bitcoin sales are still taking place on exchanges, with trading businesses and CELs attempting to avoid insolvency and liquidating their holdings.

He believes that the Fed will activate the printer bank, causing the BTC/USD and all other risky assets to rise.

Let us now look at Bitcoin’s technical aspects.

Bitcoin Price

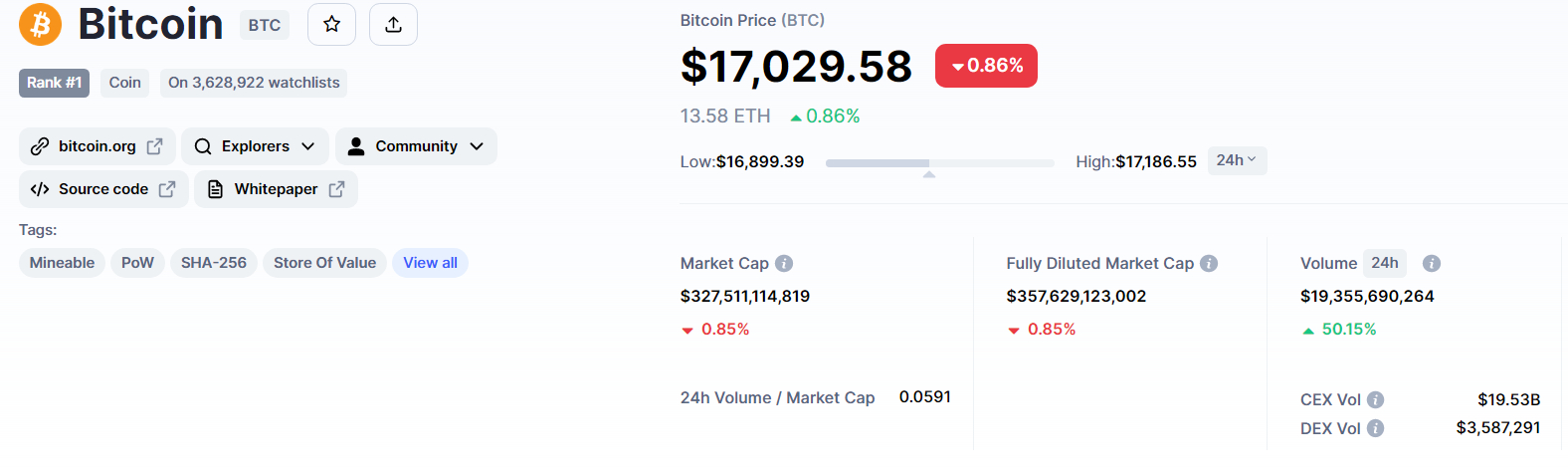

Bitcoin’s current price is $17,035, and the 24-hour trading volume is $19 billion. The BTC price has lost over 0.50% since yesterday.

On the technical front, Bitcoin has broken through an upward channel at $17,000, and candle closings below this level suggest that the selling trend may continue.

On the downside, BTC may fall until it reaches the next support area of $16,750, and below that, the next support is at $16,365.

A bearish crossover below the 50-day simple moving average (SMA) reinforces the bearish bias, suggesting that BTC may move toward $16,750.

Dash 2 Trade (D2T) – Presale in the final stage

Dash 2 Trade is a trading intelligence platform based on Ethereum that provides investors with real-time analytics and social trading data to help them make better trading decisions. It will go live in early 2023, and its D2T token will be used to pay monthly platform subscription fees (there are two subscription tiers).

The presale for Dash 2 Trade, which is now in its fourth and final stage, has already raised more than $9.5 million. It has also announced listings on Uniswap, BitMart, and LBANK Exchange for early next year, implying that early investors will soon be able to lock in some profits.

Visit Dash 2 Trade Now

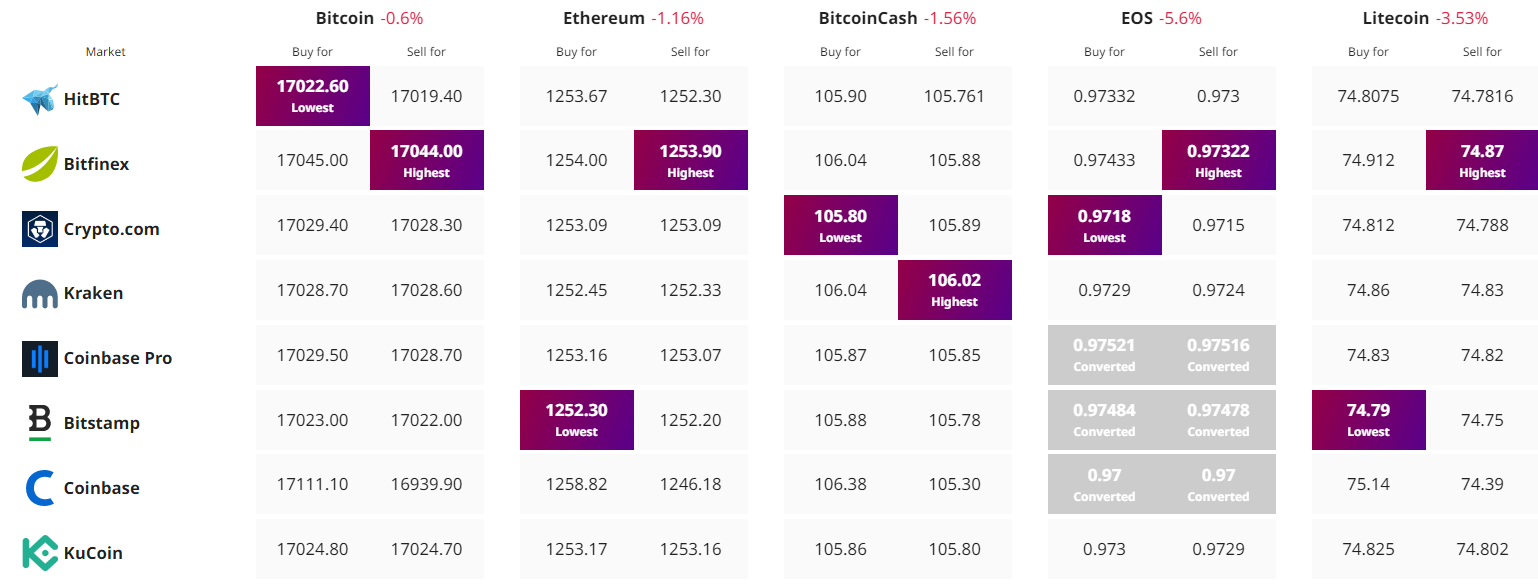

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link