After showing signs last month, the holy grail of technical analysis is finally upon us – bitcoin has reached a “Golden Cross”, which typically is viewed as an indicator of bullish price action on the horizon.

What is a Golden Cross?

In the world of technical analysis (TA), the golden cross is a chart pattern where a shorter-term moving average (MA) crosses above a longer-term moving average. This is typically considered to be a bullish signal.

When considering a golden cross, the most commonly used moving averages are the 50- and 200-day periods. Once the crossover happens, the longer-term moving average is typically considered to be a strong area of support.

The opposite of a golden cross is a death cross, where a shorter-term moving average crosses below a longer-term moving average. This is typically considered to be a bearish signal.

What Happened with Previous Golden Crosses?

Since inception, there have been six Golden Crosses and in four cases it has resulted in massive price action. In the past two instances, it has resulted in values increasing by five and three times respectively.

Let’s examine how bitcoin has fared in each of the previous six Golden Crosses.

May 2020: + 600 percent

February 2020: +5 percent

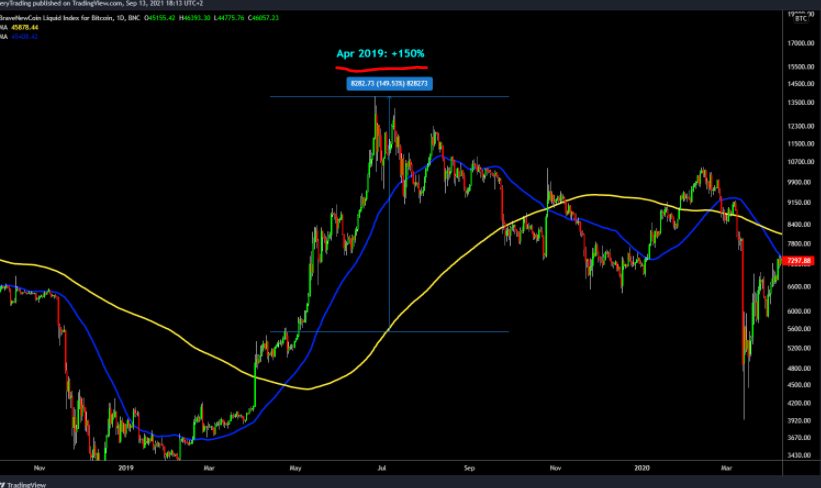

April 2019: +150 percent

November 2015: +7,000 percent

July 2014: +0.5 percent

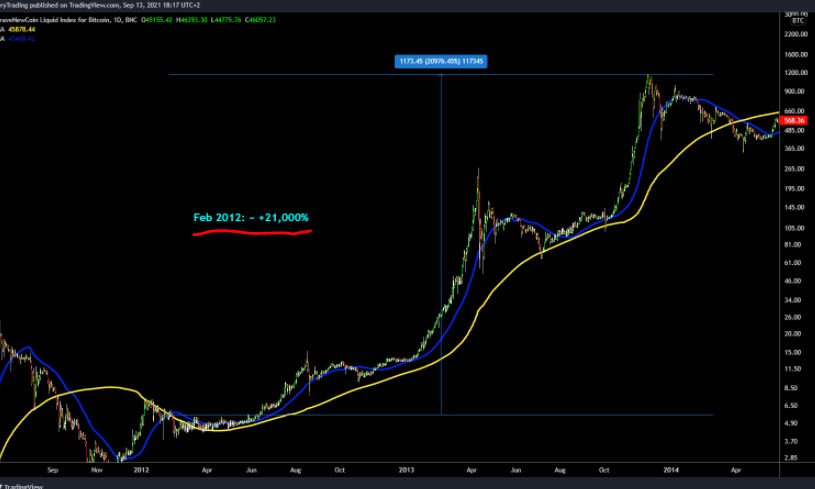

February 2012: +21,000 percent

What’s the TLDR?

It’s clear that in general, golden crosses tend to result in rather bullish price action, but not always. Given that the market is more mature, diminishing returns ought to be expected.

Importantly, one shouldn’t overly rely on any single indicator – a multiplicity of variables have an impact on the price, none of which is predictable. Experienced investors know this and are no doubt taking it into account going forward. Just recently, bitcoin looked unstoppable as it crossed US$50,000, before declining sharply shortly thereafter to US$44,500.

If you’re interested in upping your technical analysis game, be sure to consult Crypto News Australia‘s guide to bear and bull markets.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link