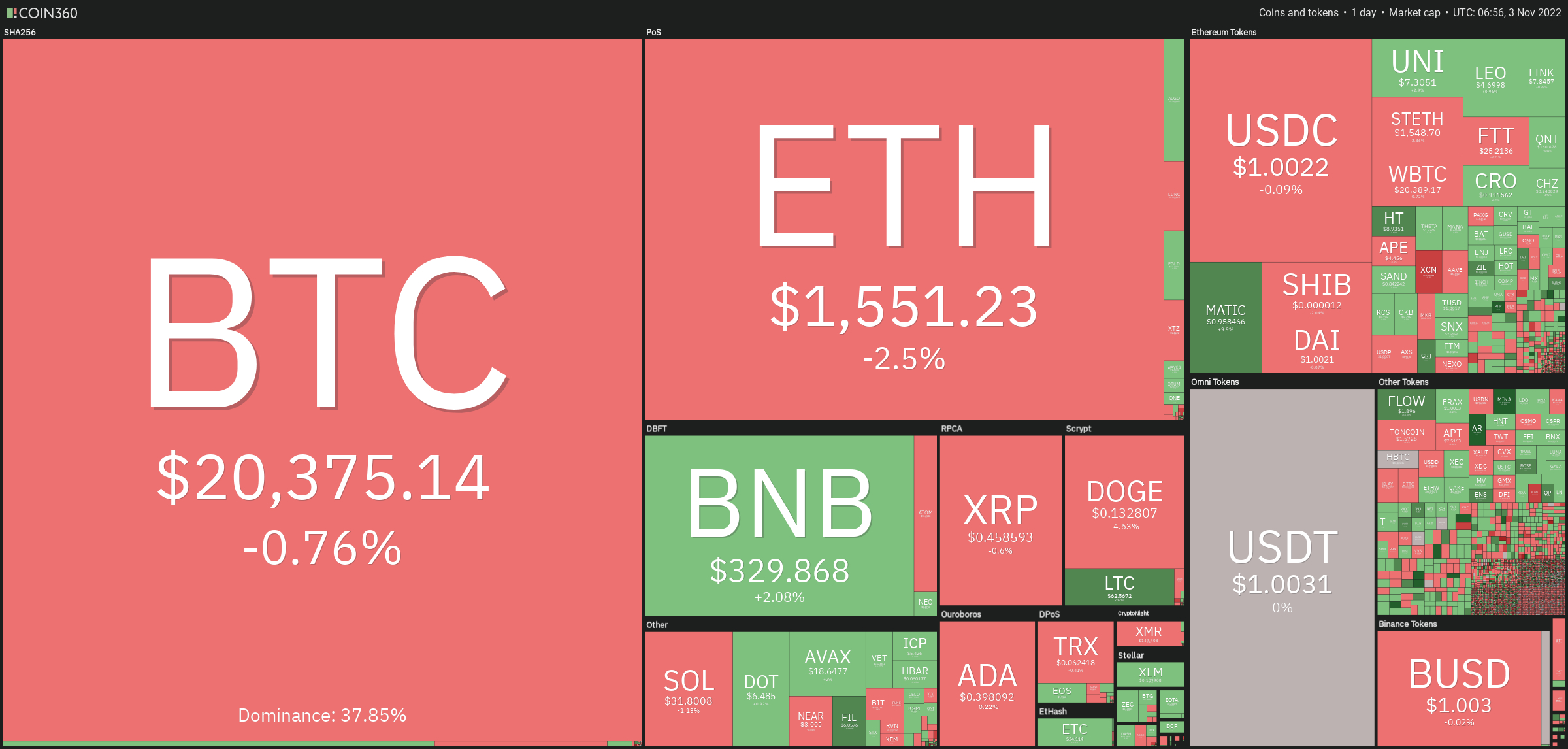

On November 3, the Bitcoin price fell sharply following the Fed’s interest rate hike decision, but the losses were short-lived as BTC reclaimed pre-FOMC trading levels. The Fed was widely expected to raise interest rates by 75 basis points, and the majority of that was already factored in, limiting the crypto market’s losses.

Likewise, Ethereum has dropped more than 2% in the last 24 hours to trade at $1,547 as the Fed raises interest rates. The global crypto market cap fell less than 1% to $1.01 trillion the previous day, sending major cryptocurrencies into the red early on November 3. On the other hand, the total crypto market volume increased by 37% in the last 24 hours to $102 billion.

The total volume in DeFi was $4.34 billion, accounting for 4.25% of the total 24-hour volume in the crypto market. The total volume of stablecoins was $92.91 billion, accounting for 90% of the total 24-hour volume of the crypto market.

For the time being, the market will be anticipating the release of US nonfarm payroll figures on November 4.

Top Altcoin Gainers and Losers

Arweave (AR), Flow (FLOW), and The Graph (GRT) were the top performers in the last 24 hours. AR’s price has increased by more than 65% to $16.85, while FLOW’s price is up by nearly 14% to $1.89. At the same time, GRT has gained less than 2% to trade at $0.091.

Chain (XCN) has dropped more than 10% to $0.055 in the last 24 hours. Dogecoin (DOGE) is down over 4% to around $0.1324, and Aptos (APT) is down about 4% to $7.50.

Fed Raises Rates Again, Suggests Smaller Increases

On Wednesday, the Federal Reserve tightened monetary policy by the most in 40 years, increasing interest rates by another 75 percentage points. The Fed explained that future increases in borrowing costs are necessary for its fight against inflation.

The two-sided message gave policymakers leeway to keep raising rates if inflation does not begin to decrease while allowing for future rate hikes in smaller increments. This could suggest that the Fed will cease its series of three-quarter-point raises as early as December in favor of more gradual increases of possibly half a percentage point.

The central bank increased its short-term borrowing rate by 0.75 percentage points to 3.75%-4%, the highest level since January 2008. For weeks, the markets had been anticipating this action.

Monetary policy hasn’t been tightened this much since the early 1980s when inflation was last this high. Markets had anticipated the rate hike and were hoping to hear that it would be the final 0.75-point (or 75 basis point) increase.

Bitcoin Price

The current Bitcoin price is $20,334, and the 24-hour trading volume is $55 billion. Bitcoin lost less than 0.50% during the Asian session. CoinMarketCap currently ranks first, with a live market cap of $390 billion, down from $393 billion yesterday.

After breaching a key support level of $20,330, the BTC/USD pair is currently trading negative. Closing candles below this level very probably indicate a significant selling trend in BTC. Furthermore, the ascending trendline that had been supporting BTC near $20,300 has been breached.

For the time being, Bitcoin is expected to continue falling until it reaches the $19,984 mark. Investors can look for sell trades below $20,330 since the MACD and RSI have now entered the selling zone.

A bullish breakout of $20,330, on the other hand, might expose the BTC price to levels as low as $20,800 or as high as $21,270.

On the plus side, a rise in Bitcoin demand might push it beyond the $20,800 resistance zone and into the $21,000 range. BTC might reach $21,450 if a strong breakout occurs over the $21,000 barrier.

Ethereum Price

Ethereum’s current price is $1,552, with a 24-hour trading volume of $24 billion. In the last seven days, Ethereum has given up all gains, and now it’s down over 1%. Ethereum is now ranked second on CoinMarketCap, with a live market capitalization of $190 billion, down from $194 billion yesterday.

Following the Fed rate hike, the ETH/USD pair broke through the upward channel that had been supporting it near $1,550. For the time being, the same level is acting as a barrier, keeping ETH bearish.

The 50-day moving average is also extending resistance at the same level, and the RSI and MACD indicators are both indicating a bearish bias.

A bullish breakout above $1,550 may push ETH toward the $1,660 resistance level. Moreover, a bullish crossover above $1,660, on the other hand, could propel ETH to $1,720 or $1,805.

On the bearish side, closing candles below $1,550 have the potential to push ETH to $1,480 or $1,404 today.

New Crypto Presales

With the announcement that the Dash 2 Trade presale raised more than $4 million, the company has also confirmed that LBANK Exchange will be the first CEX to sell the D2T token. It reached these milestones less than two weeks after launching its public token sale, indicating growing investor interest in its trading intelligence platform.

Dash 2 Trade (D2T) will be listed on LBANK Exchange once the second of nine presale phases are completed. This is expected to happen in the first quarter of 2023, with the release of Dash 2 Trade, a cutting-edge dashboard, and intelligence platform.

D2T has captivated cryptocurrency investors worldwide, raising more than $4.3 million in its presale. Furthermore, presales have been brisk recently, and D2T is well-positioned to capitalize on the trend.

Visit Dash 2 Trade now

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link