Data shows the Bitcoin drop below the $27,000 level has made most investors fearful for the first time this month.

Bitcoin Fear & Greed Index Is Pointing At “Fear” Right Now

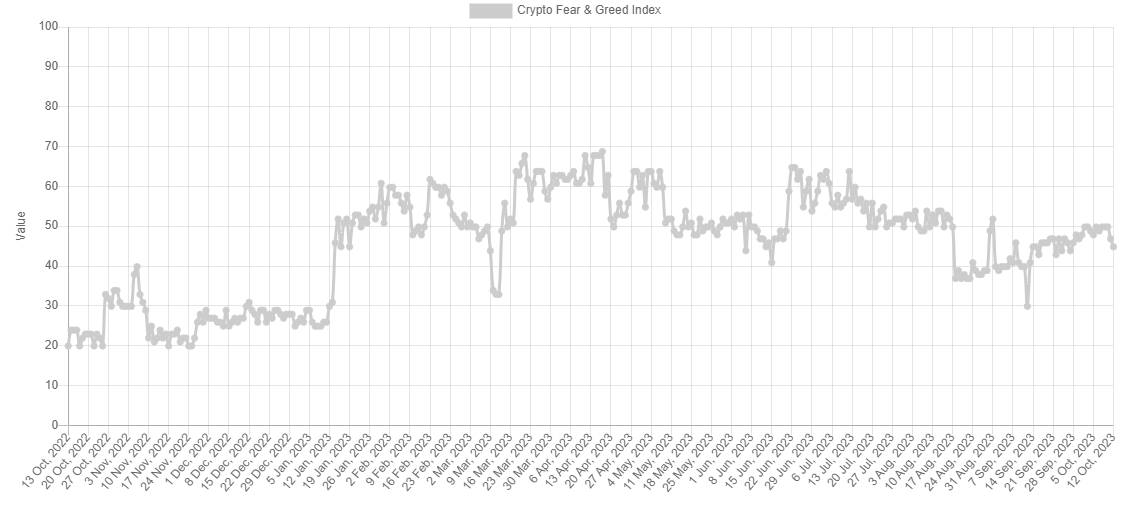

The “fear and greed index” is an indicator that tells us about the general sentiment among investors in the Bitcoin and broader cryptocurrency market. Alternative created the metric, and according to the website, it’s based on these factors: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends data.

The indicator uses a numeric scale from zero to hundred to represent the sentiment. When the index has a value greater than 54, it means that the average investor is greedy right now, while it being under 46 implies a fearful mentality is dominant.

The region between these two thresholds naturally signifies a neutral sentiment among the holders. Until today, the sector had been stuck inside this region since the last couple of days of September, as the investors had been split about the trajectory of Bitcoin.

The chart below shows that the market sentiment has worsened with the latest drop in the cryptocurrency’s price below the $27,000 level.

It looks like the value of the metric has registered some decline in recent days | Source: Alternative

After this latest drop in sentiment, the fear and greed index has hit a value of 45, meaning that investor sentiment has just entered the fear region.

The value of the metric seems to be 45 right now | Source: Alternative

Historically, the market has tended to move in a way that’s opposite to what the majority of the investors believe. The likelihood of such a contrary move happening increases as this imbalance in the sentiment rises.

While the holders are leaning towards one side (fear), the imbalance is small, as the fear and greed index is barely inside the territory. As such, the probability of a rebound would be pretty high right now (at least based on the sentiment).

Besides the core sentiments discussed before, there are also two special zones, called “extreme fear” (at or below values of 25) and “extreme greed” (at or above values of 75).

These regions are where the cryptocurrency has often turned around in the past. Naturally, bottoms have occurred in the former zone, while tops have formed in the latter area.

If the Bitcoin fear and greed index continues declining in the coming days and reaches values near the extreme fear region, a bounce could become a real possibility.

For now, one sign pointing to the chances of a rebound may be that the large investors have been buying recently, as an analyst on X pointed out.

The BTC sharks have increased their holdings recently | Source: @ali_charts on X

Since the start of October, Bitcoin investors holding between 100 and 1,000 coins have purchased a combined 20,000 BTC worth around $533.6 million at the current exchange rate.

BTC Price

At the time of writing, Bitcoin is trading at around $26,700, down almost 5% in the past week.

BTC has experienced some downtrend recently | Source: BTCUSD on TradingView

Featured image from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.net

Credit: Source link