A literal interpretation of “cryptocurrency” necessarily implies a willingness on the part of the holder to exchange it for goods and services. However, according to BitPay, a company that provides BTC and BCH payment processing services for merchants, not all holders wish to part with their coins and, of late, Bitcoin spending is on the decline.

A Treasury and Marketing Strategy Wrapped in One

Around the globe, consumers and businesses are increasingly embracing crypto payments. While consumers may wish to spend some of their gains, many businesses have jumped on the bandwagon, driven by both financial and publicity reasons. It worked on both fronts for MicroStrategy:

That has increased the power of the brand by a factor of 100. We just had our best software quarter over the last 10 years. The Bitcoin business is driving shareholder returns. I think the employees are happy. The shareholders are happy.

Michael Saylor, chief executive and founder of MicroStrategy

From a company’s perspective, and when it comes to payments, there’s little downside to giving customers additional choices. Provided you aren’t hamstrung by shareholder environmental and social governance (ESG) activism (see Tesla), it makes commercial sense to accept some crypto assets – particularly since they can always be exchanged for fiat if the company doesn’t have a bullish outlook on the digital asset concerned.

From a customer’s perspective, the main downside to using one’s crypto for payment is that in most countries (including Australia), it constitutes a taxable event, meaning you will be obliged to pay capital gains tax.

Bitcoin’s Digital Gold Narrative Reducing Payments?

Given its inbuilt scarcity and trusted monetary policy, Bitcoin was always likely to be the long-term investor’s digital asset of choice. If billionaires like Bill Miller and Peter Thiel recommend HODLing Bitcoin, then it’s probably advice worth thinking about.

As the digital gold narrative became firmly entrenched in mainstream consciousness, together with growing institutional adoption, it’s no surprise that the level of Bitcoin spent is on the decline.

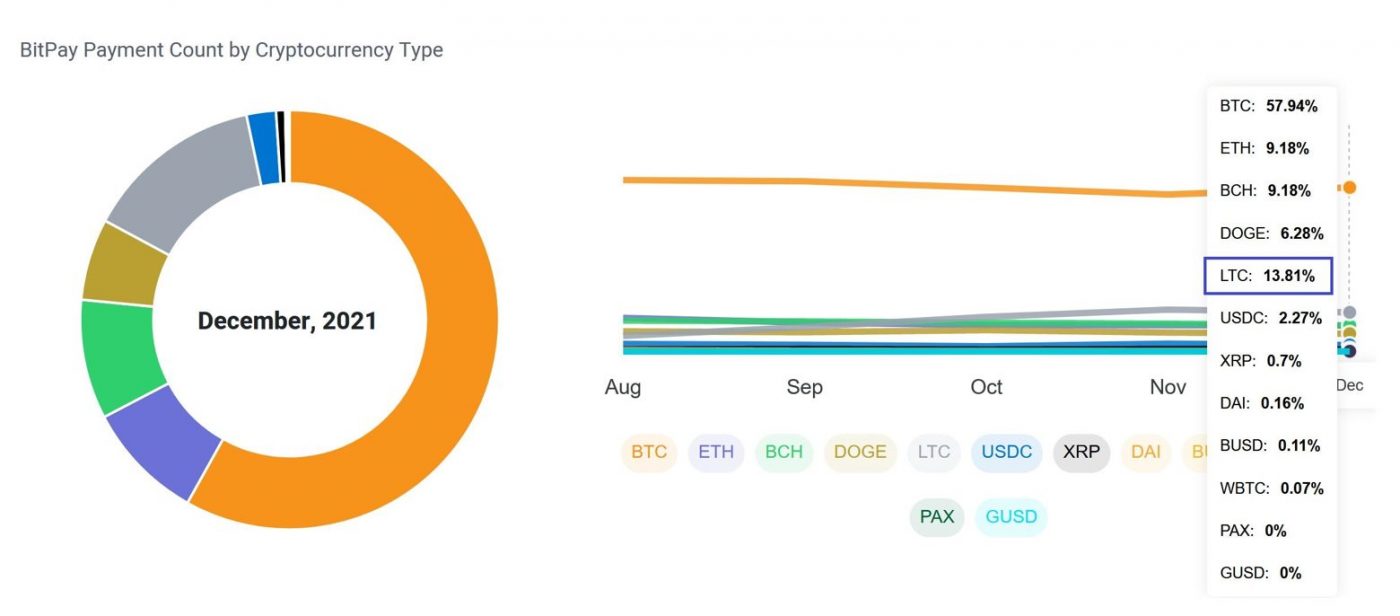

Last year, Bitcoin’s use at merchants that use BitPay dropped to about 65 percent of processed payments, down from 92 percent in 2020.

Disclaimer:

The content and views expressed in the articles are those of the original authors own and are not necessarily the views of Crypto News. We do actively check all our content for accuracy to help protect our readers. This article content and links to external third-parties is included for information and entertainment purposes. It is not financial advice. Please do your own research before participating.

Credit: Source link